- Welcome to Traders & Investors Paradise.

Recent posts

#81

Our Current Trades / Re: Week ended 30th December: ...

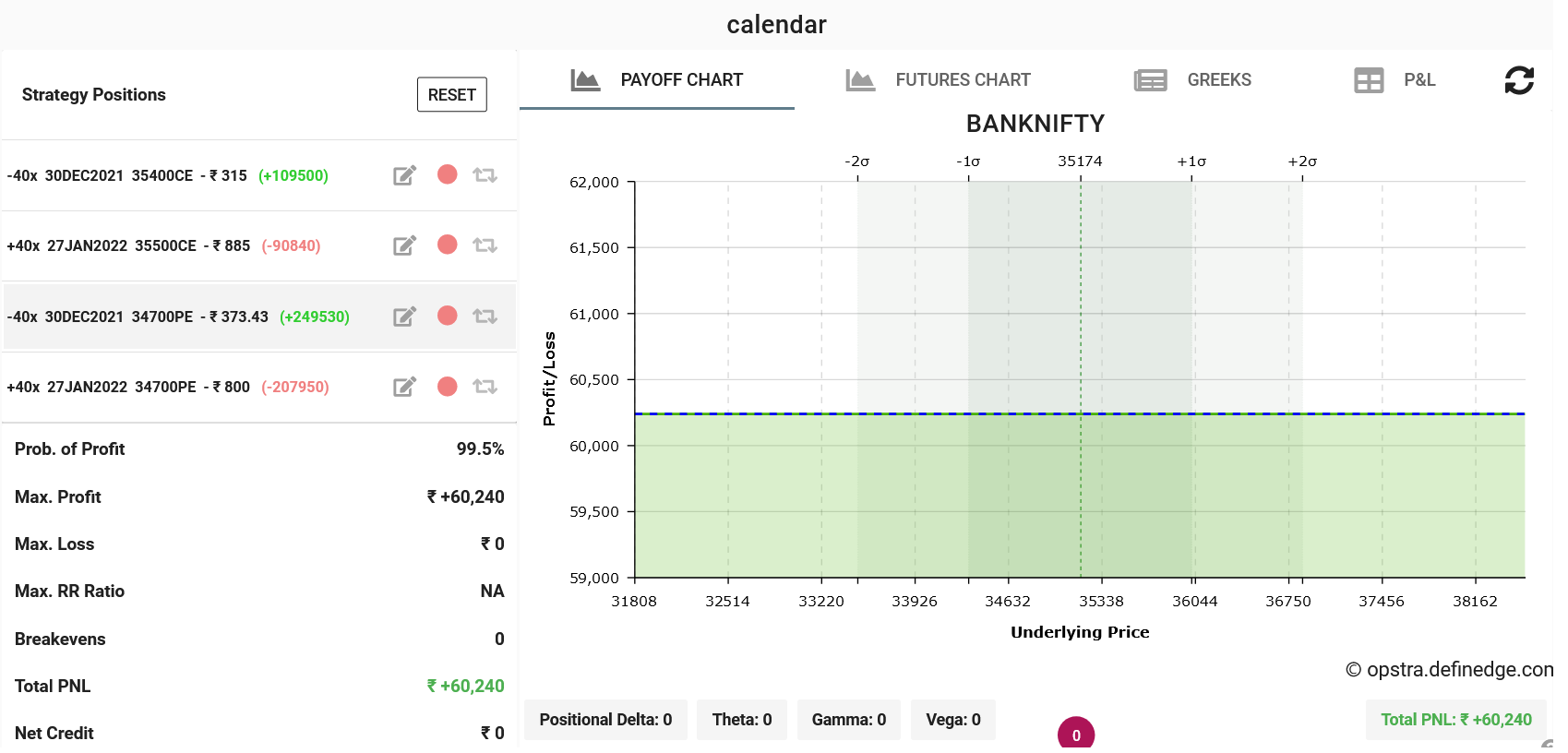

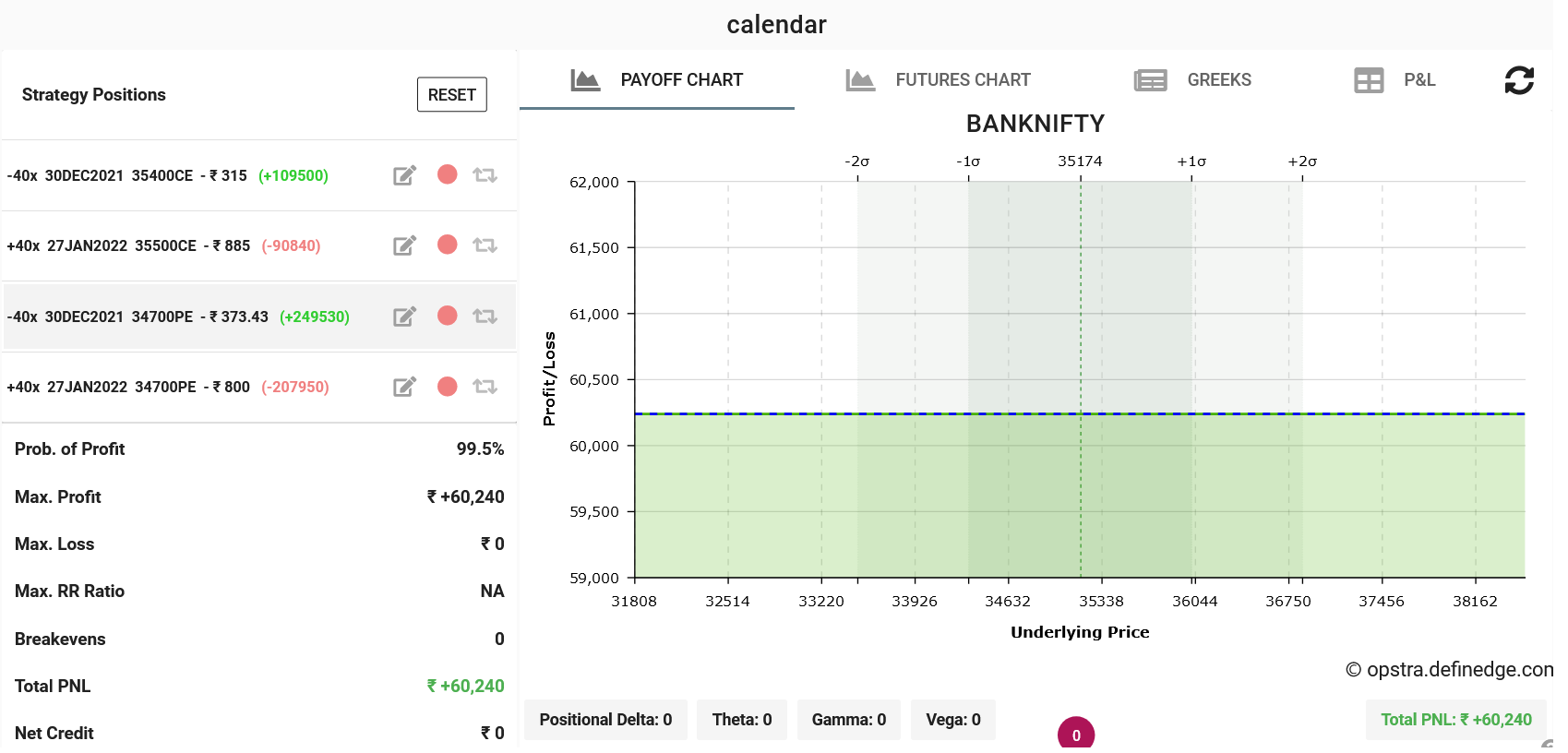

Last post by Michael Gonsalves - Dec 28, 2021, 10:28 AMI closed the Calendar for a handsome profit of Rs. 60,000. Though there was a lot of juice left in the Calendar, I decided that a more optimum situation would be to come closer to the spot.

#82

Our Current Trades / Re: Week ended 30th December: ...

Last post by Michael Gonsalves - Dec 27, 2021, 03:56 PMThe steep plunge of 500+ points by the Bank Nifty in the morning and the dramatic recovery thereafter caused the ViX to spike up 6%. This benefited the Calendar and caused a MTM gain of about 1.5% of the capital. However, if the ViX cools down, the gains may evaporate into thin air.

#83

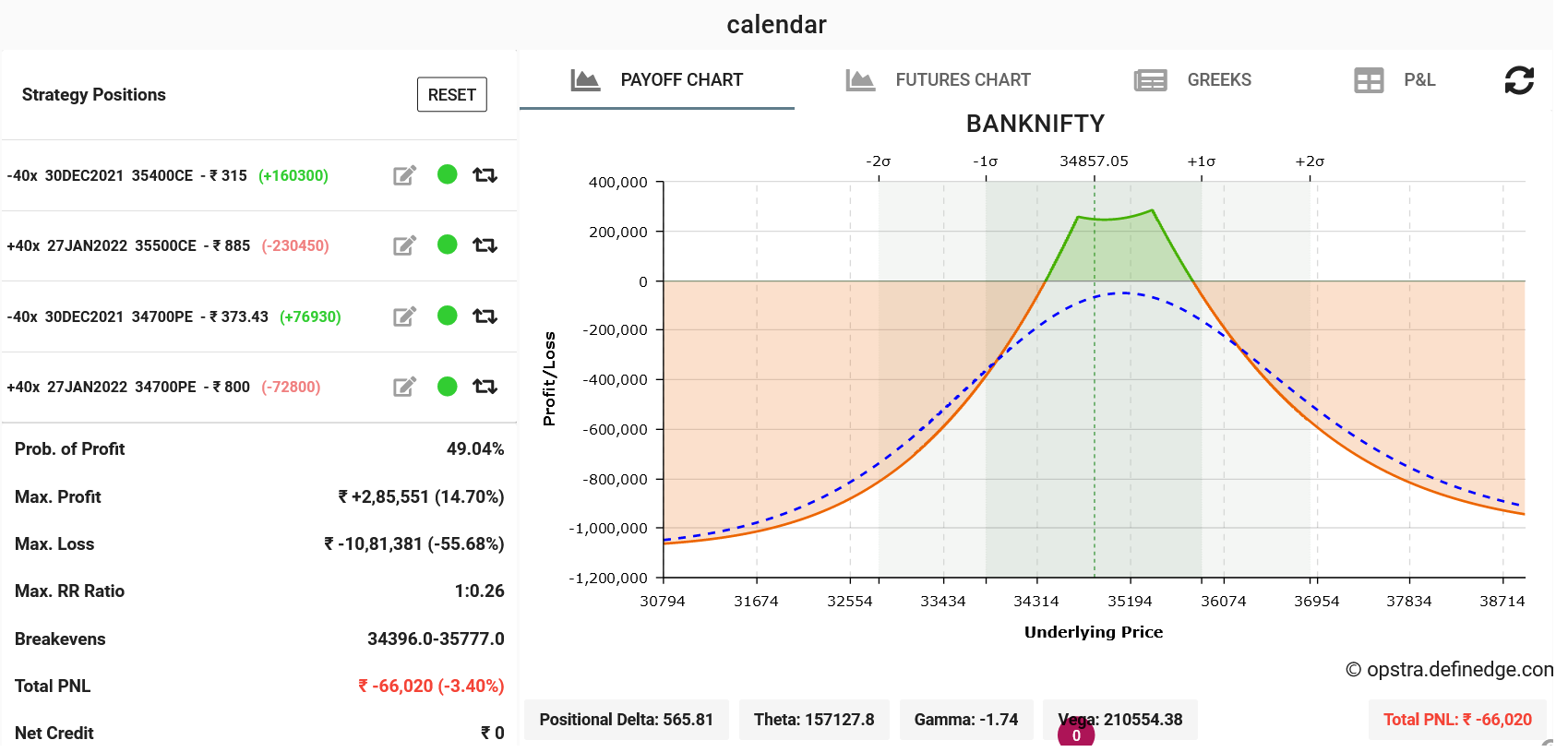

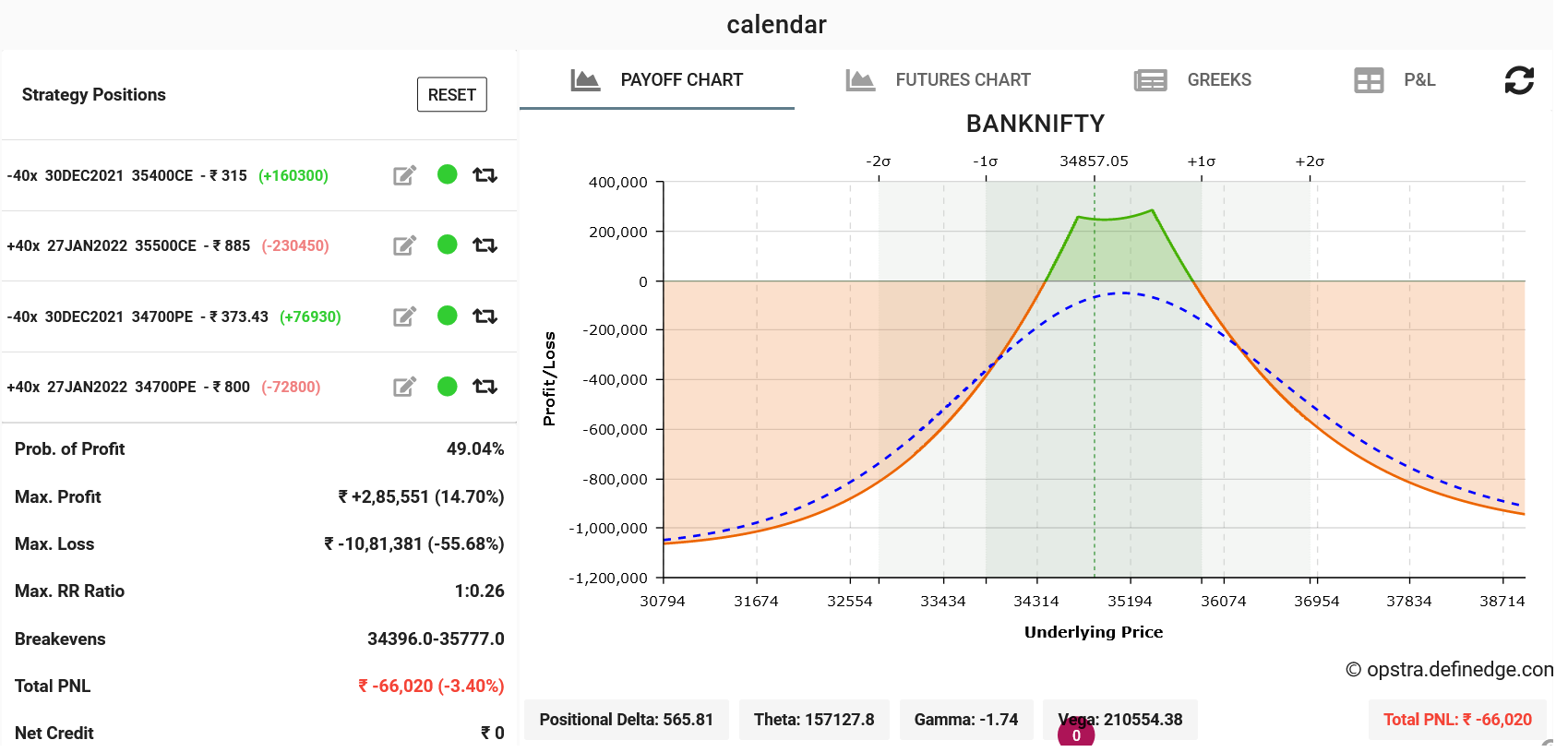

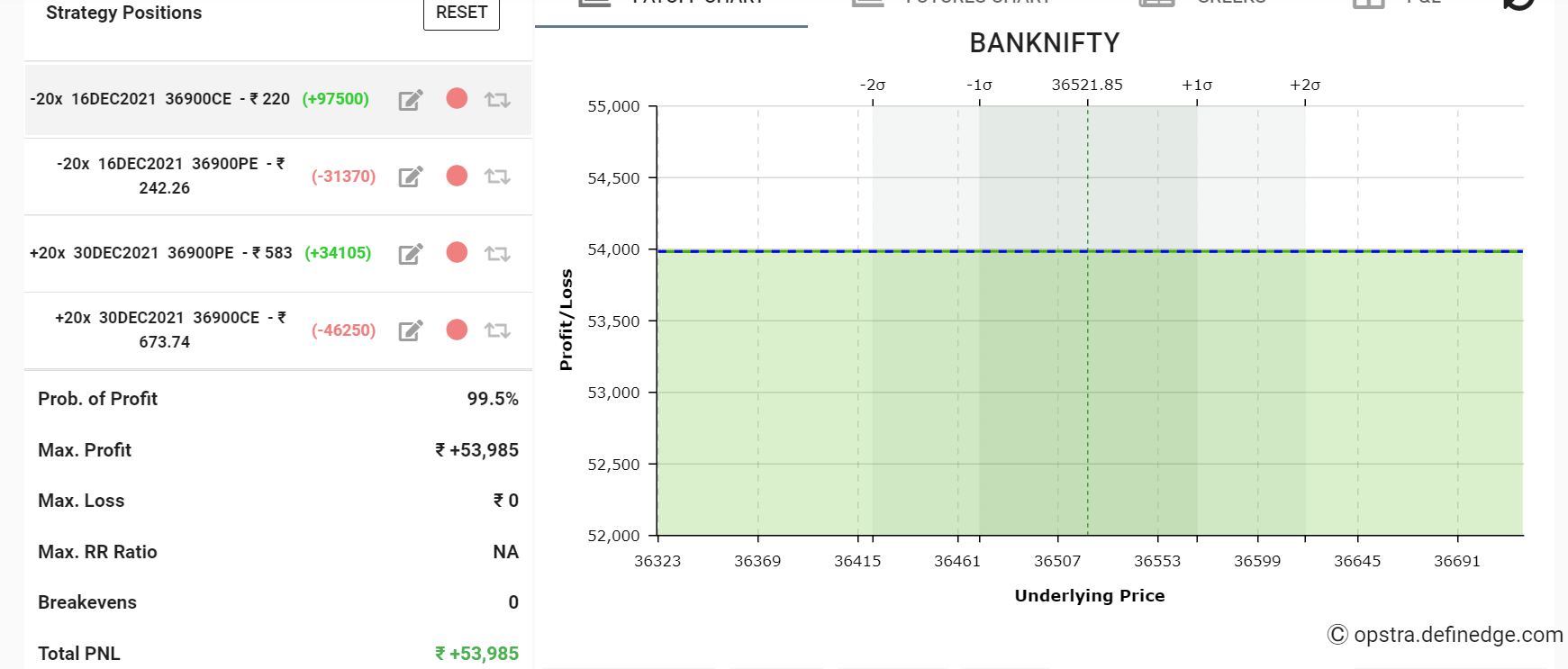

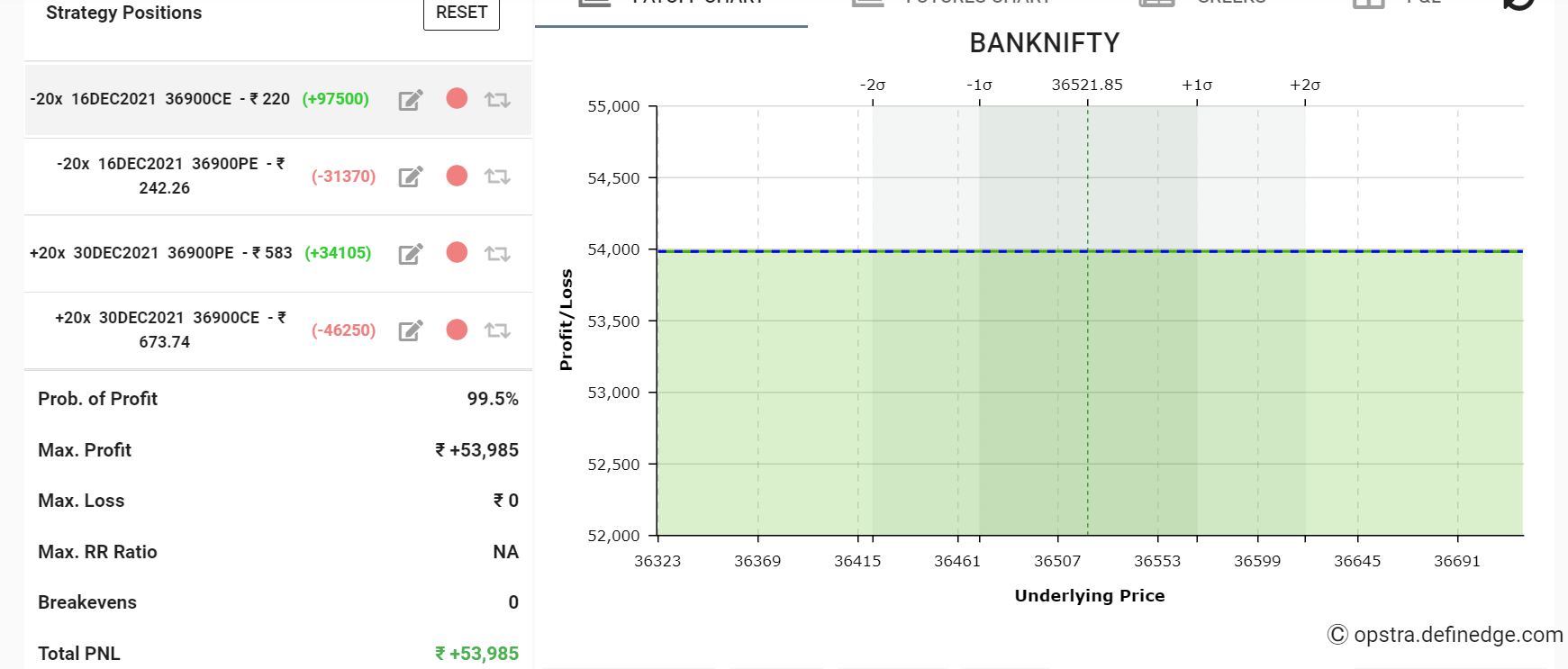

Our Current Trades / Week ended 30th December: Cale...

Last post by Michael Gonsalves - Dec 25, 2021, 12:00 PMThe fall in the ViX is a major problem with Calendars. My Bank Nifty Calendar is already bleeding because the ViX plunged immediately after I set it up. However, the position is safe because it is right in the middle of the tent. If it remains within the tent on expiry, I will get a positive outcome from the trade.

#84

Our Current Trades / Re: Week ended 23rd December: ...

Last post by Michael Gonsalves - Dec 20, 2021, 10:00 PMI made multiple adjustments to salvage the Bank Nifty Calendar. However, the savage nature of the fall made it difficult, if not impossible, to manage. I also ran out of money because I had to salvage some other positions as well. Ultimately, I threw the towel and booked a big loss of nearly Rs. 2 Lakh.

#85

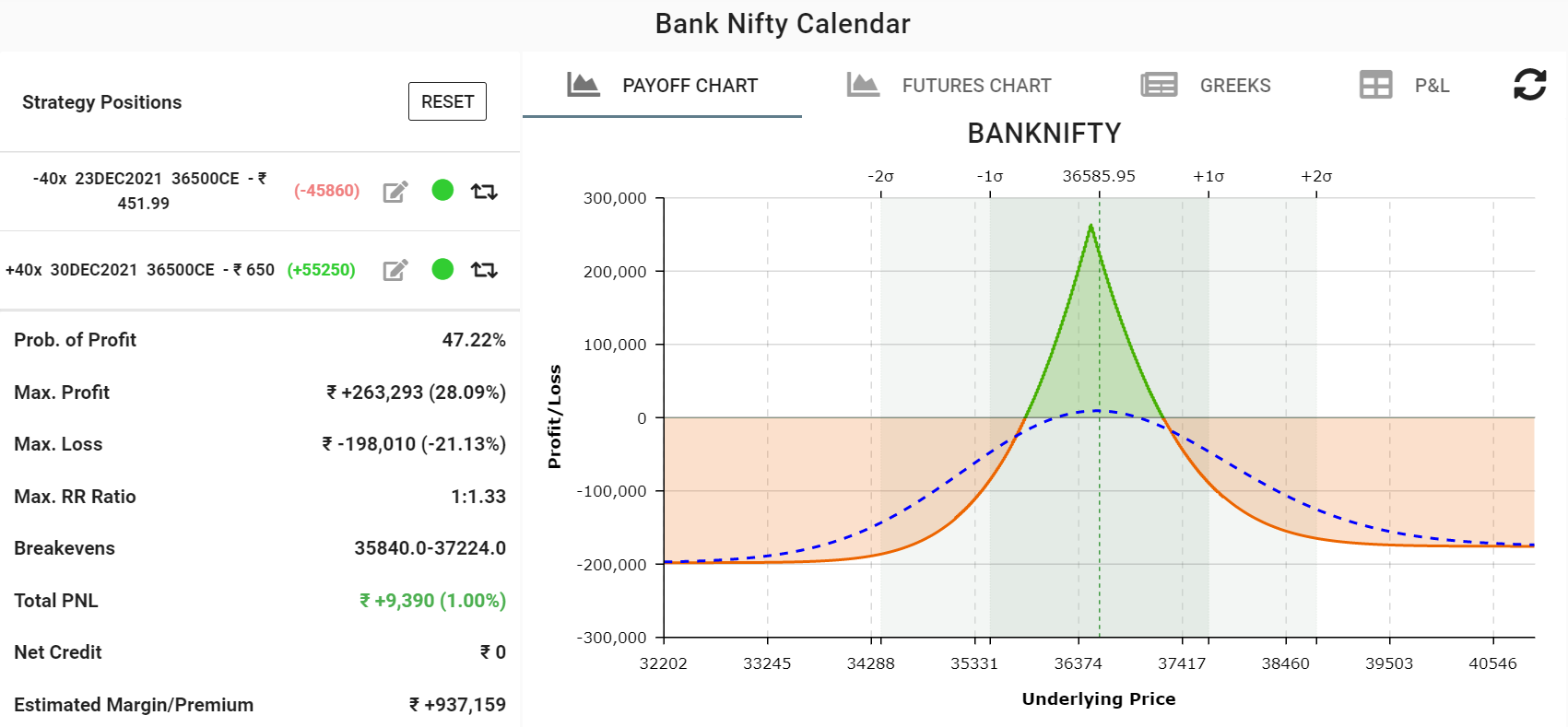

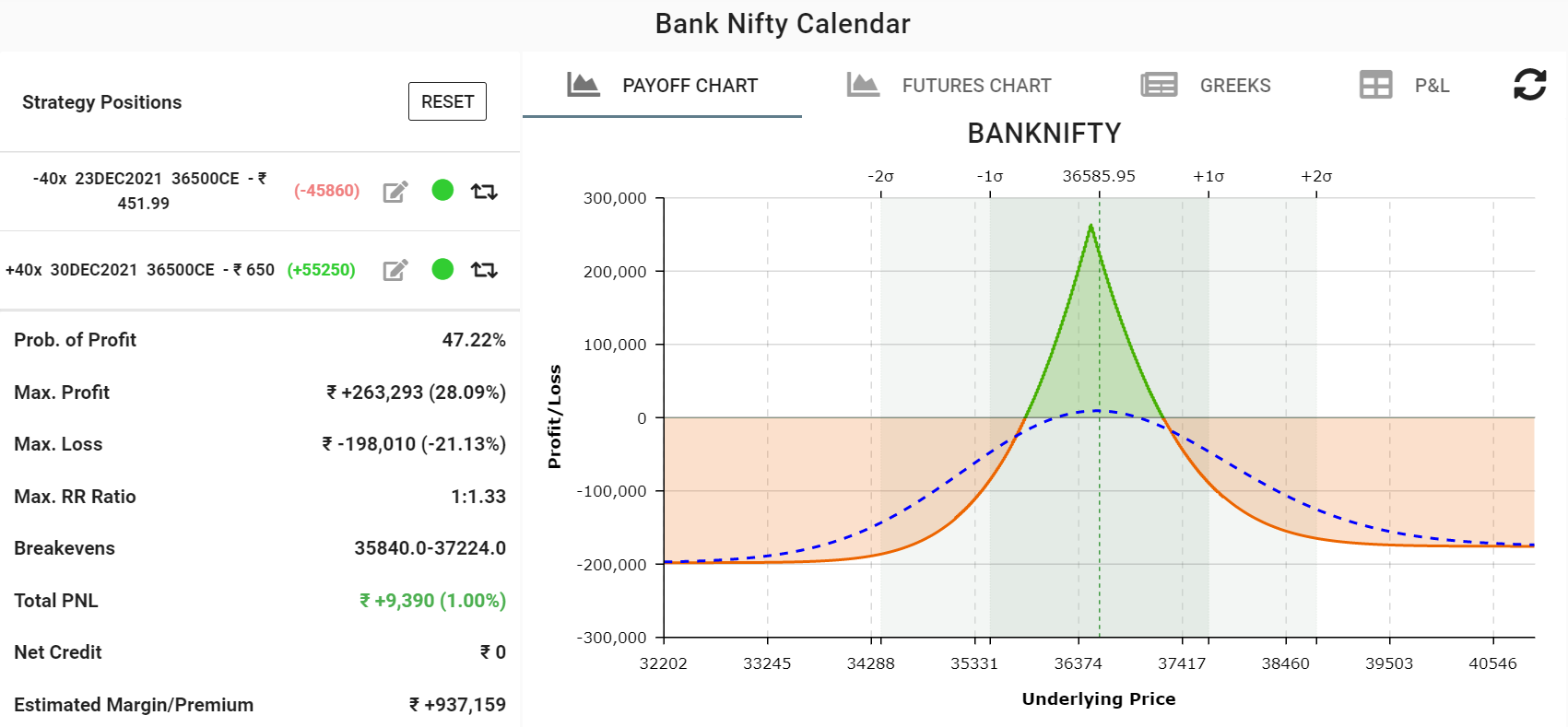

Our Current Trades / Week ended 23rd December: Cale...

Last post by Michael Gonsalves - Dec 16, 2021, 04:32 PMThis week I had tried the ATM Straddle Calendar. I realized that it requires more adjustment and so decided to implement the ATM Call Calendar for the coming week.

#86

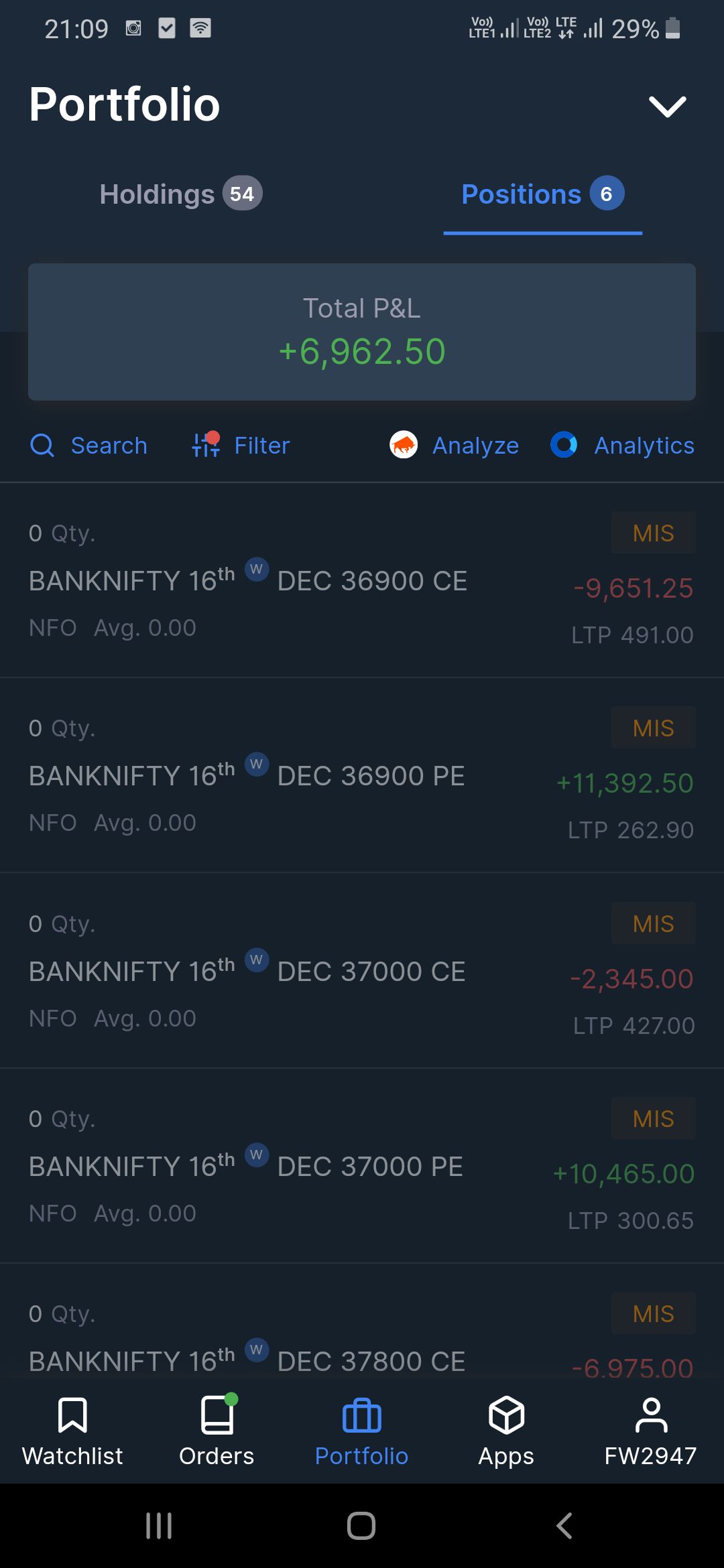

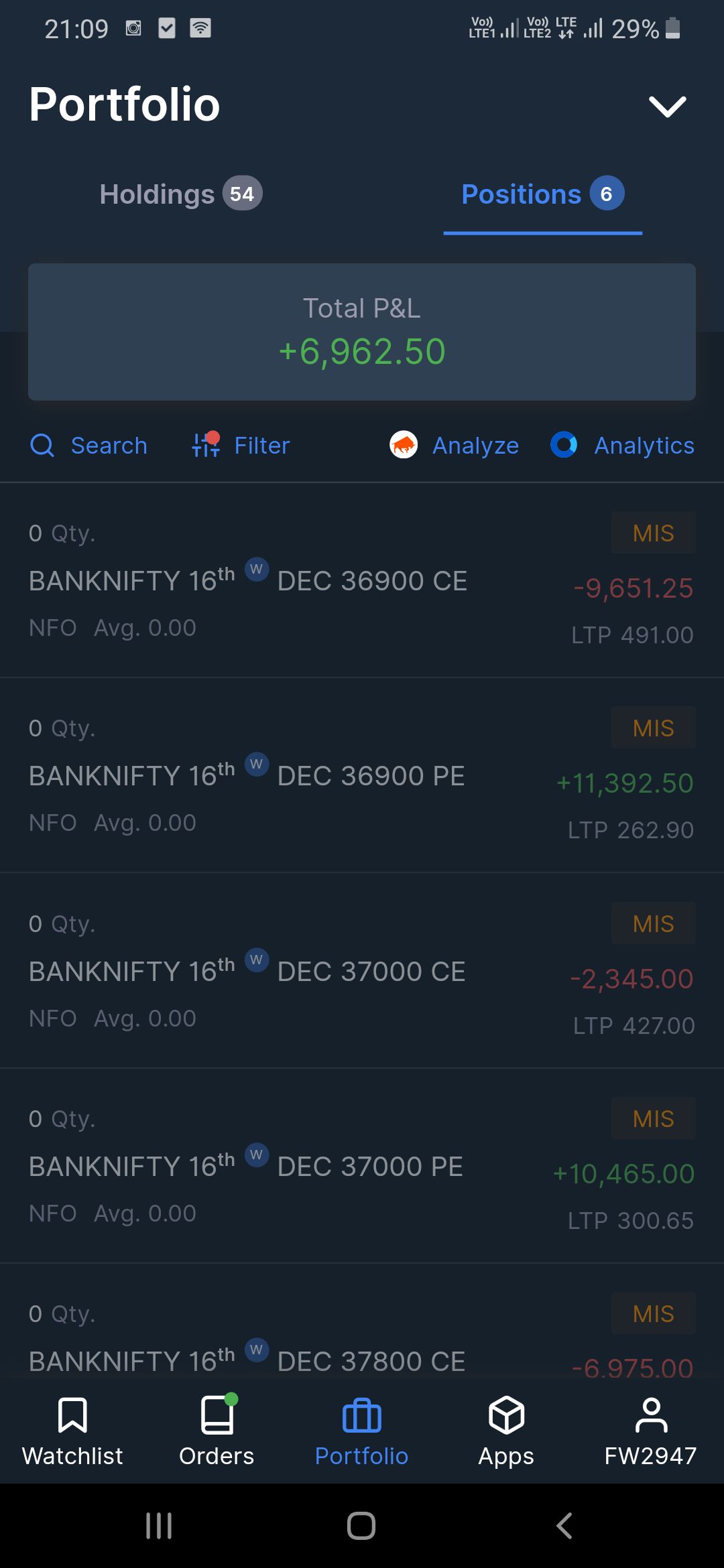

Our Current Trades / Re: Week ended 16th December: ...

Last post by Michael Gonsalves - Dec 16, 2021, 04:27 PMI exited from this position for a minor gain of about Rs. 10000 and implemented an 'ATM Straddle Calendar". I closed this Calendar for a gain of about Rs. 53000.

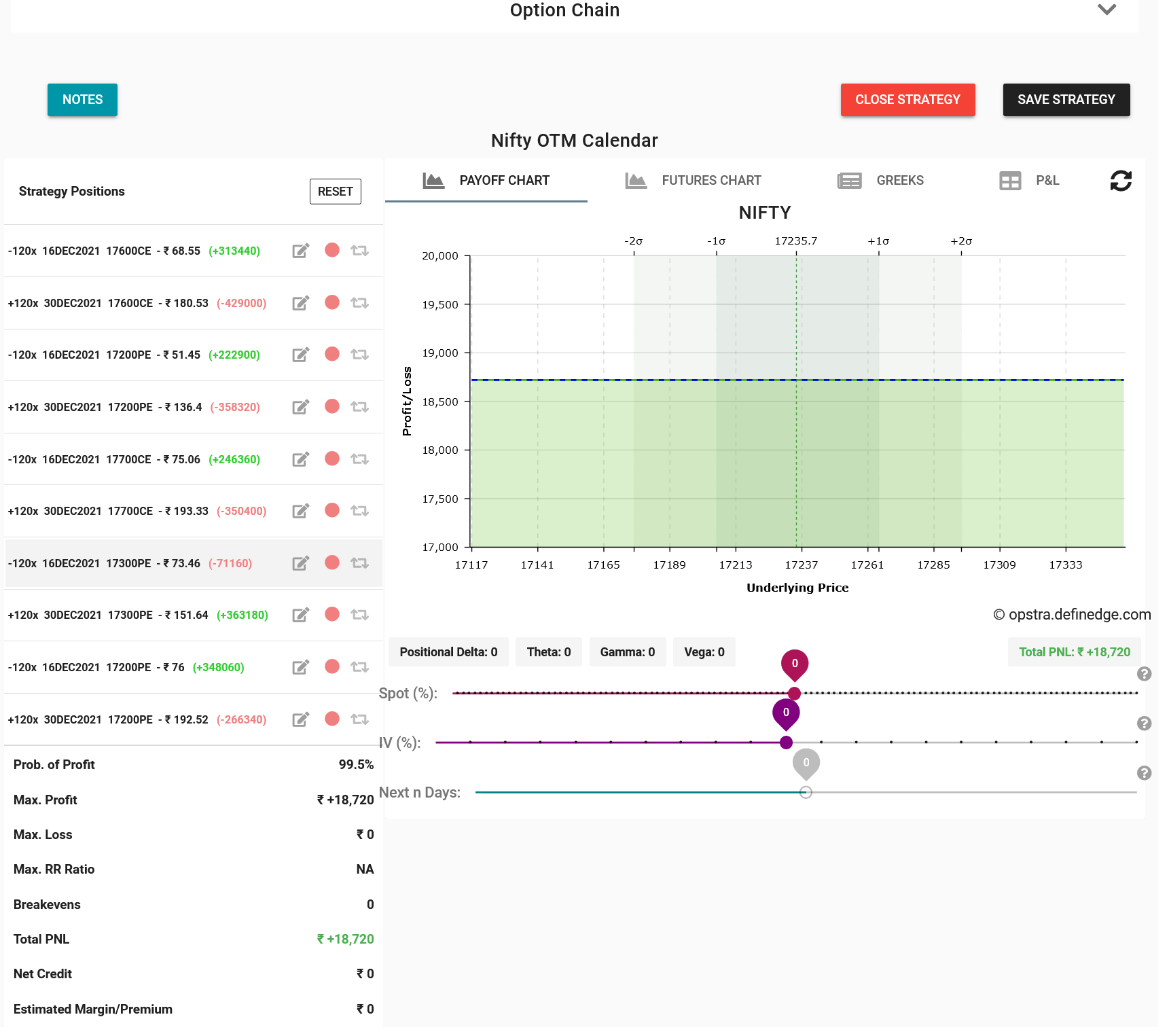

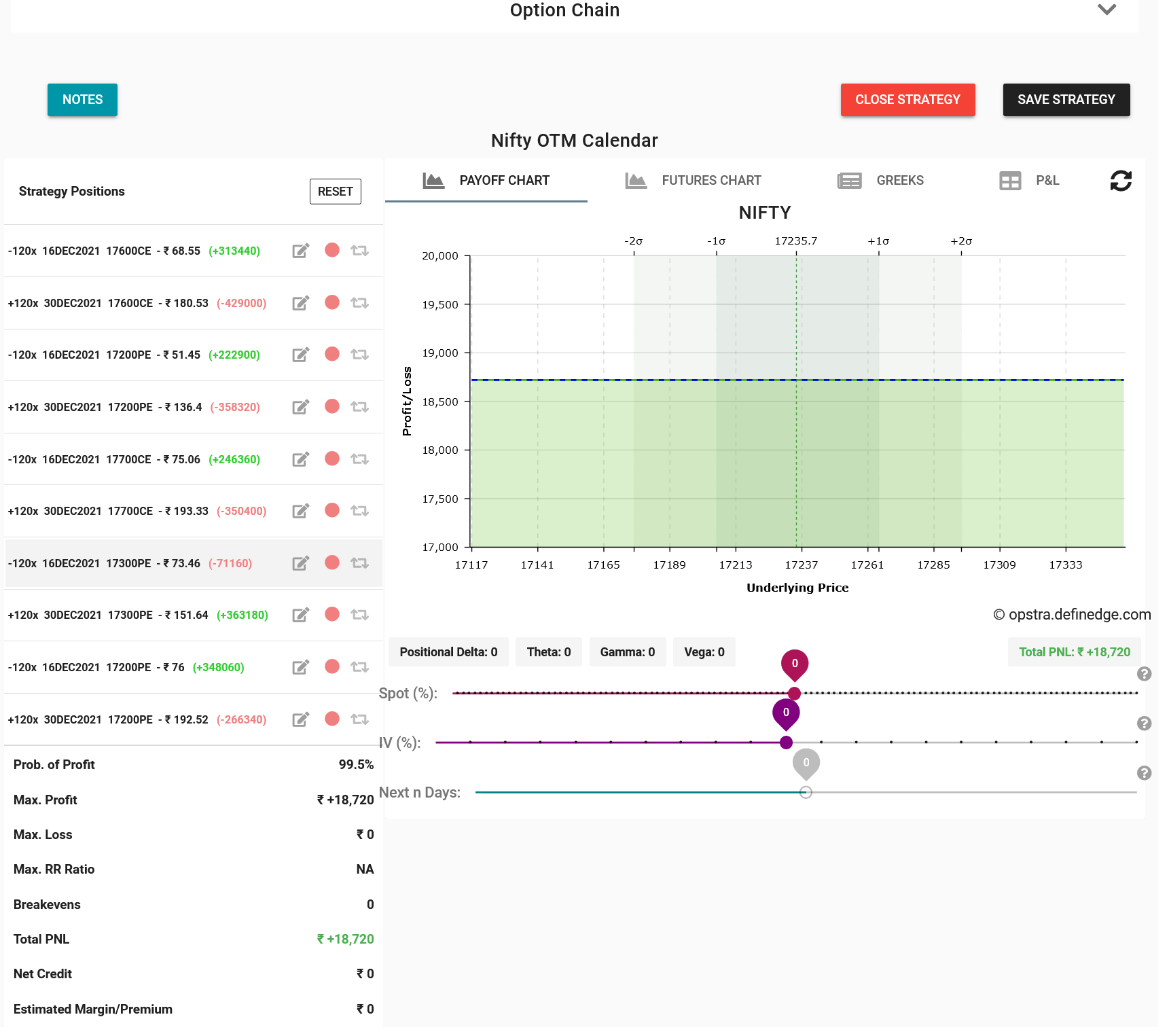

#87

Our Current Trades / Re: Week ended 16th December: ...

Last post by Michael Gonsalves - Dec 16, 2021, 04:23 PMThe Nifty OTM Calendar was basking in gains of nearly Rs. 1.5 Lakh till today morning. However, the severe plunge in the ViX of nearly 7% took a steep toll on the long options. I barely managed to exit with a breakeven profit.

#88

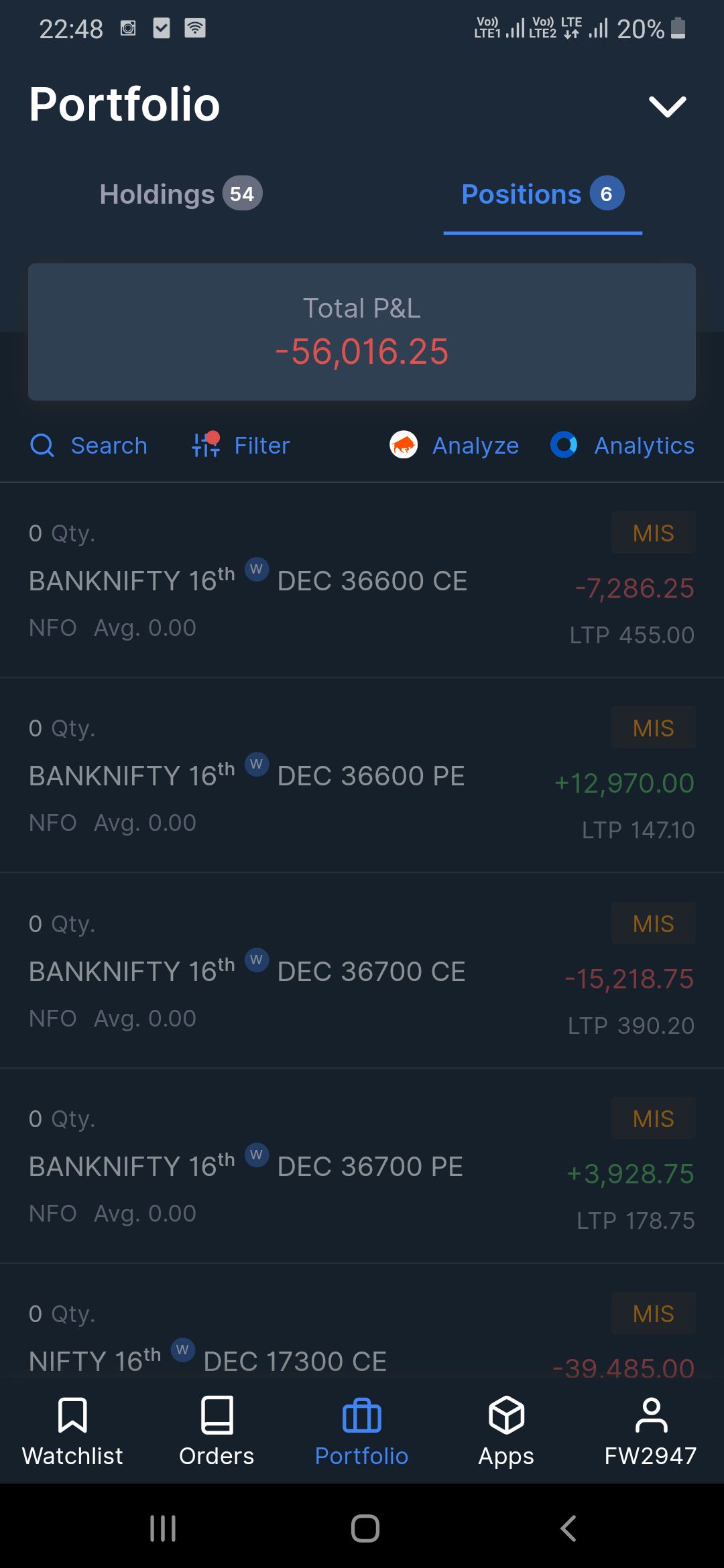

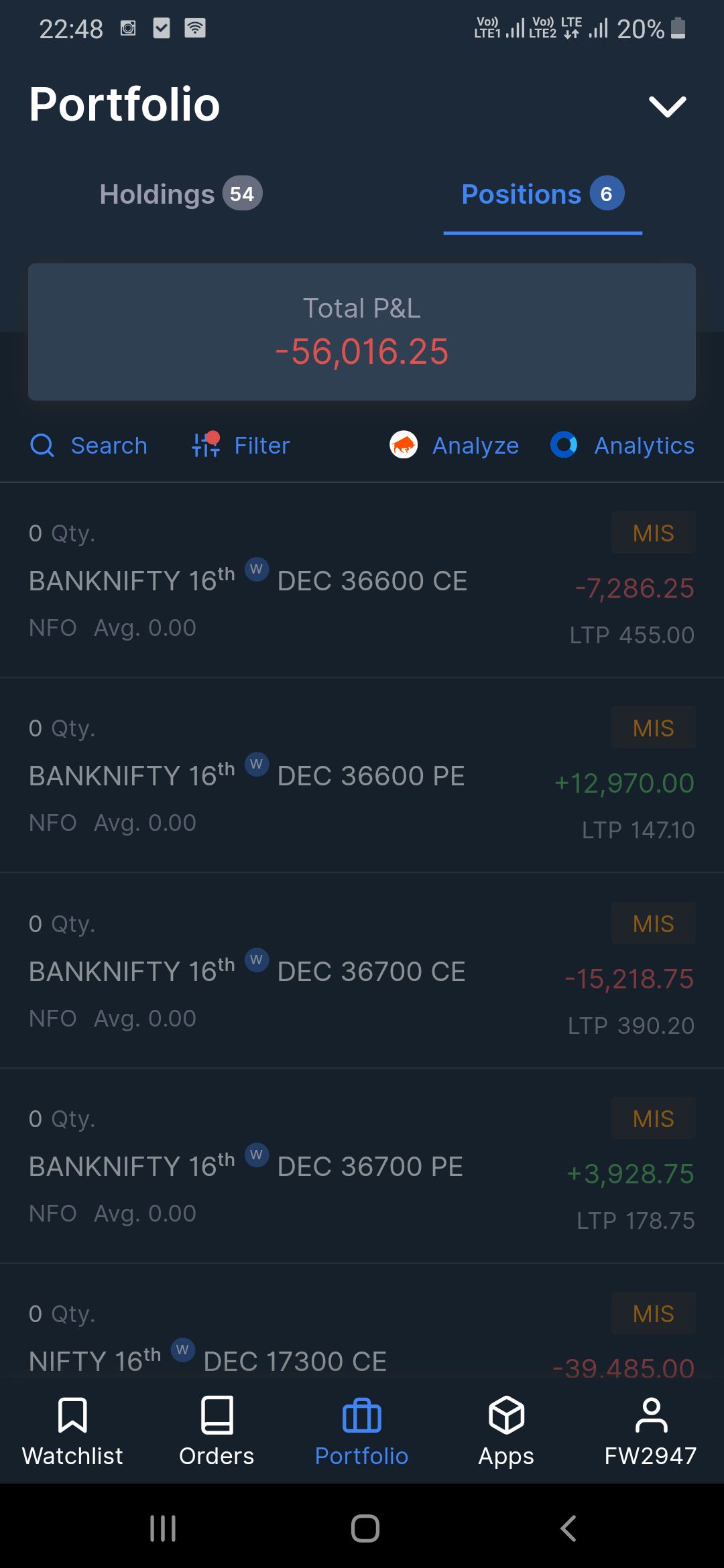

Our Current Trades / Re: Dumb straddle (9.20 am) st...

Last post by Michael Gonsalves - Dec 14, 2021, 10:50 PMToday's volatility was too rough to handle. After the PE SLs were hit, the CE SLs were also hit, causing me to lose a big chunk of Rs. 56000.

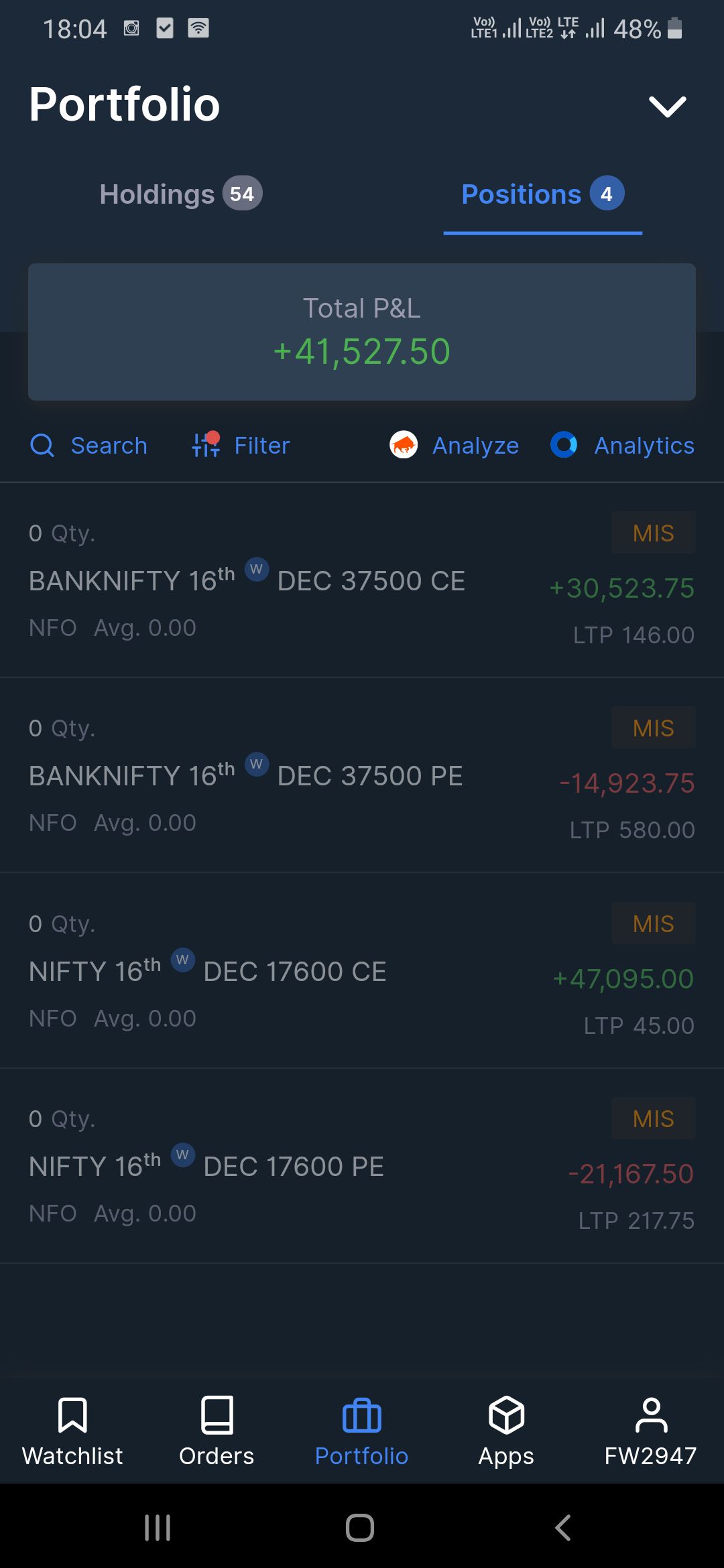

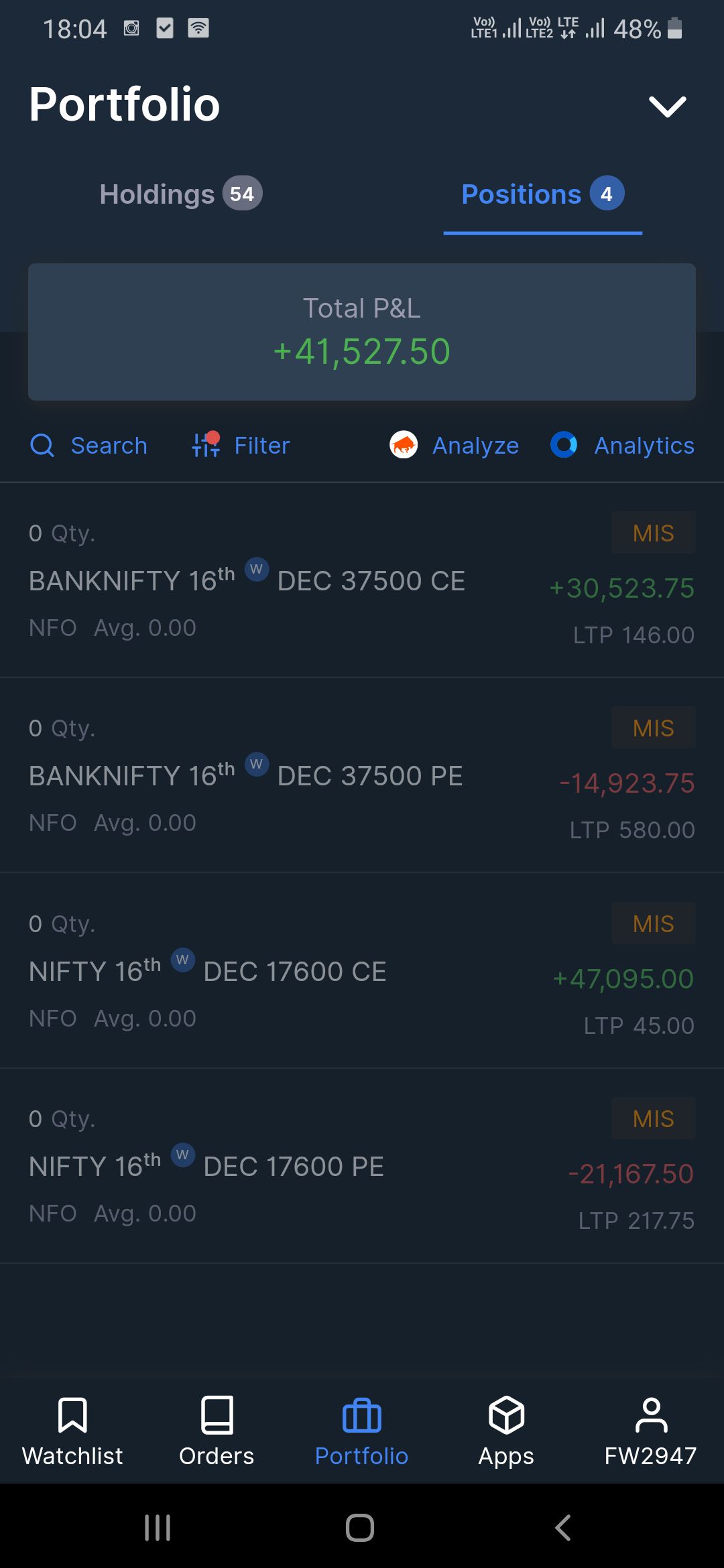

#89

Our Current Trades / Re: Dumb straddle (9.20 am) st...

Last post by Michael Gonsalves - Dec 13, 2021, 06:09 PMToday, I treated the Dumb straddle as a dumb straddle and did not make any adjustments. The market was trending downwards. After the short PE SL was triggered, I trailed the SL on the short CEs. This enabled me to take home a gain of Rs 41500. Unfortunately, I had curtailed my position to only 200 units in view of the past losses and this reduced my gains.

#90

Our Current Trades / Re: Dumb straddle (9.20 am) st...

Last post by Michael Gonsalves - Dec 10, 2021, 09:10 PMI was coasting on profits of Rs. 17,000. However, a sudden move in the Nifty and the Bank Nifty spoiled the show. I exited the Dumb Straddle in a hurry and salvaged a gain of Rs. 6900.