- Welcome to Traders & Investors Paradise.

Recent posts

#71

Our Current Trades / Re: Week ended 20th January 20...

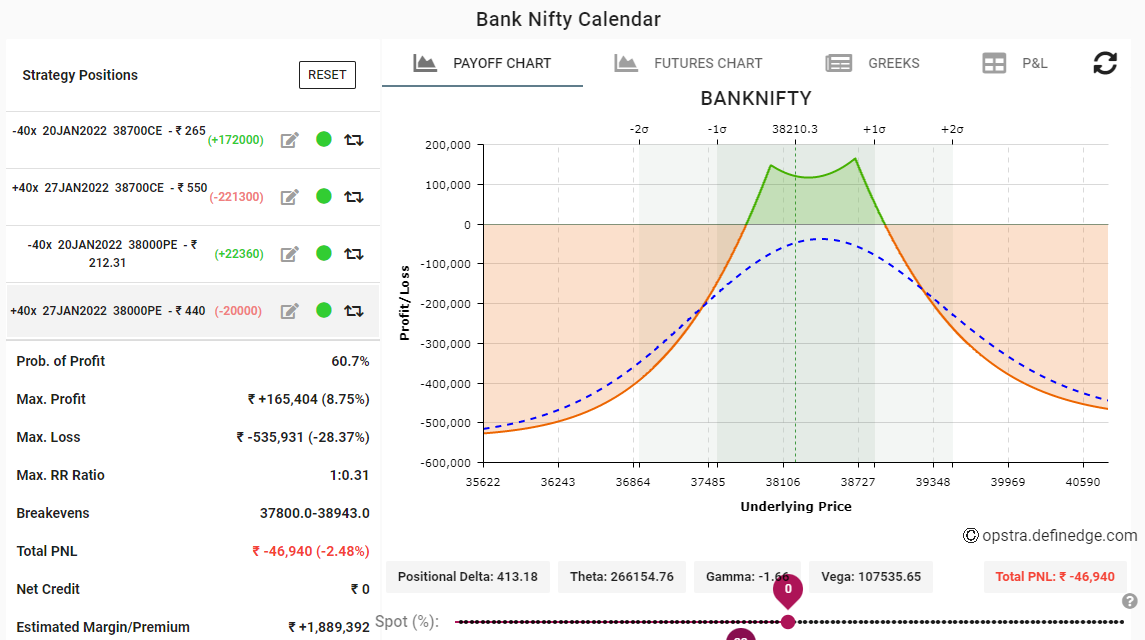

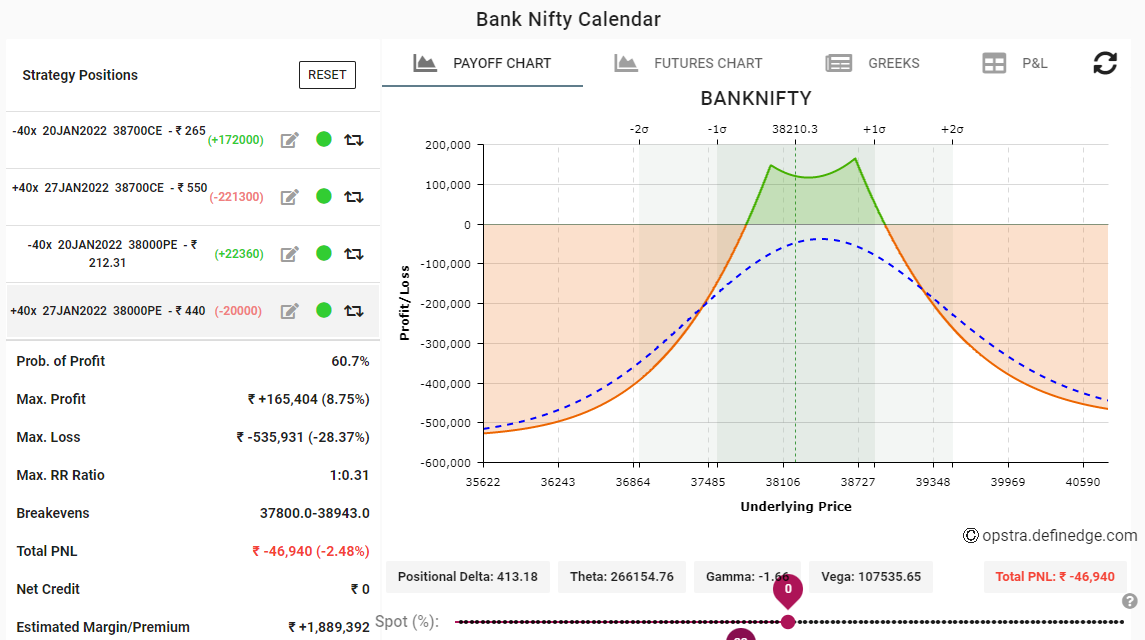

Last post by Michael Gonsalves - Jan 18, 2022, 07:59 PMI opened a Call Calendar at 38700CE. However, the Bank Nifty immediately plunged and breached my BEP of 38300. This forced me to open a Put Calendar at 38000PE. The Calendar is bleeding and I have already lost 2.48% MTM. However, if the Bank Nifty expires within the range and the ViX does not plunge much, I can take home a tidy profit.

#72

Our Current Trades / Re: Week ended 20th January 20...

Last post by Michael Gonsalves - Jan 18, 2022, 07:55 PMThe extreme volatility today, where the Indices went from one extreme to the other spooked me. I decided to close the Calendar for a minor profit of Rs. 5000 and to open a new one.

#73

Our Current Trades / Re: Week ended 20th January 20...

Last post by Michael Gonsalves - Jan 15, 2022, 10:22 PMThe slight plunge in the Nifty helped to recover most of the losses in the Calendar. If the Nifty and the ViX stay stable, there will be a chance to make some money.

#74

Our Current Trades / Week ended 20th January 2022: ...

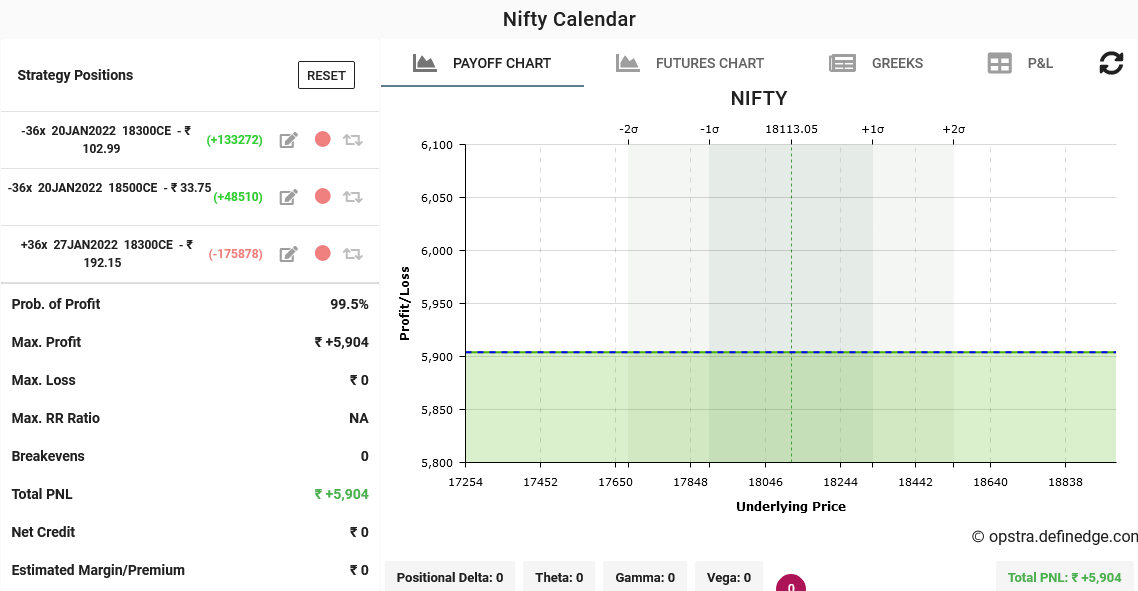

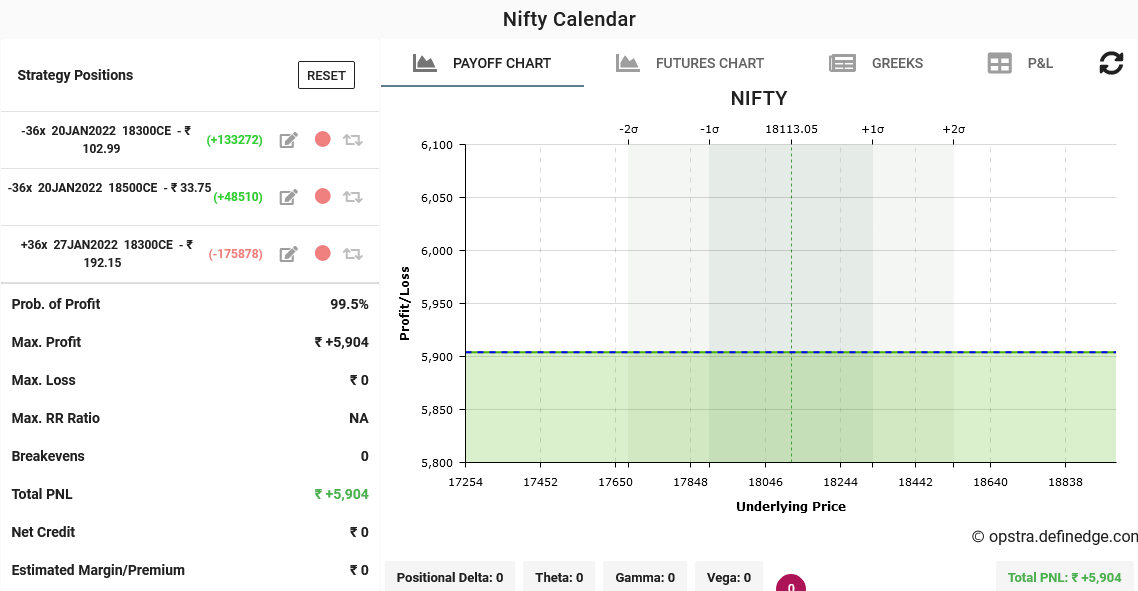

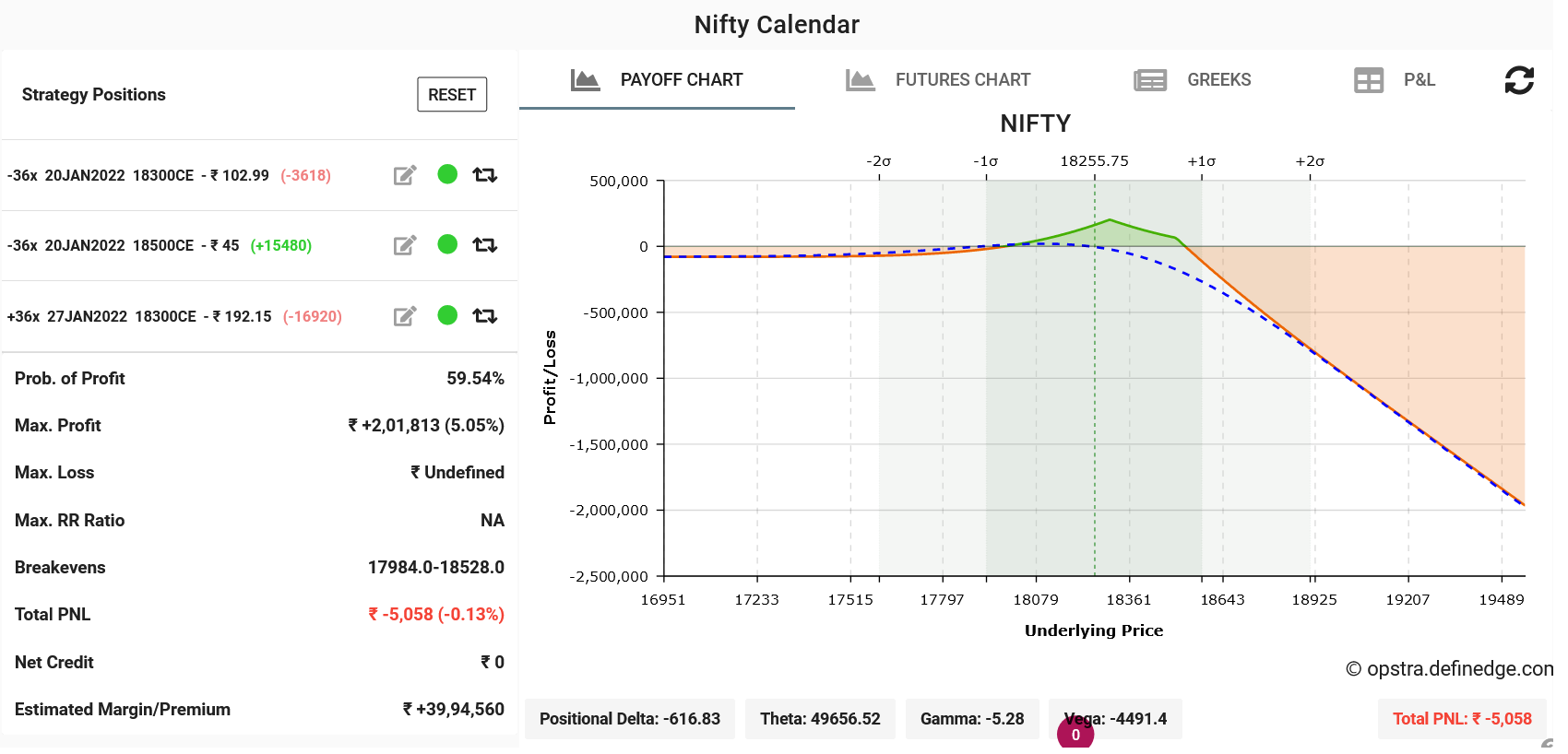

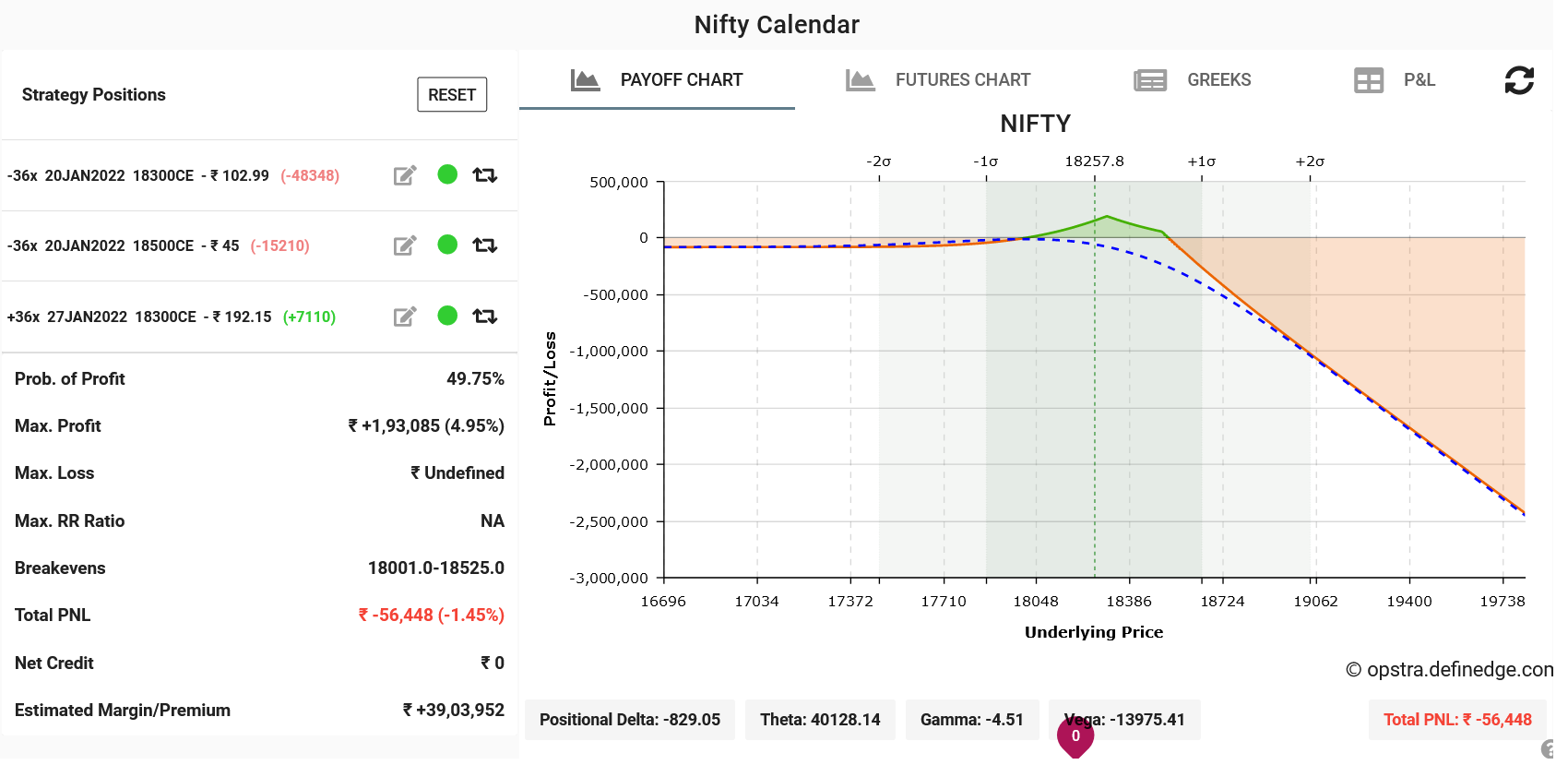

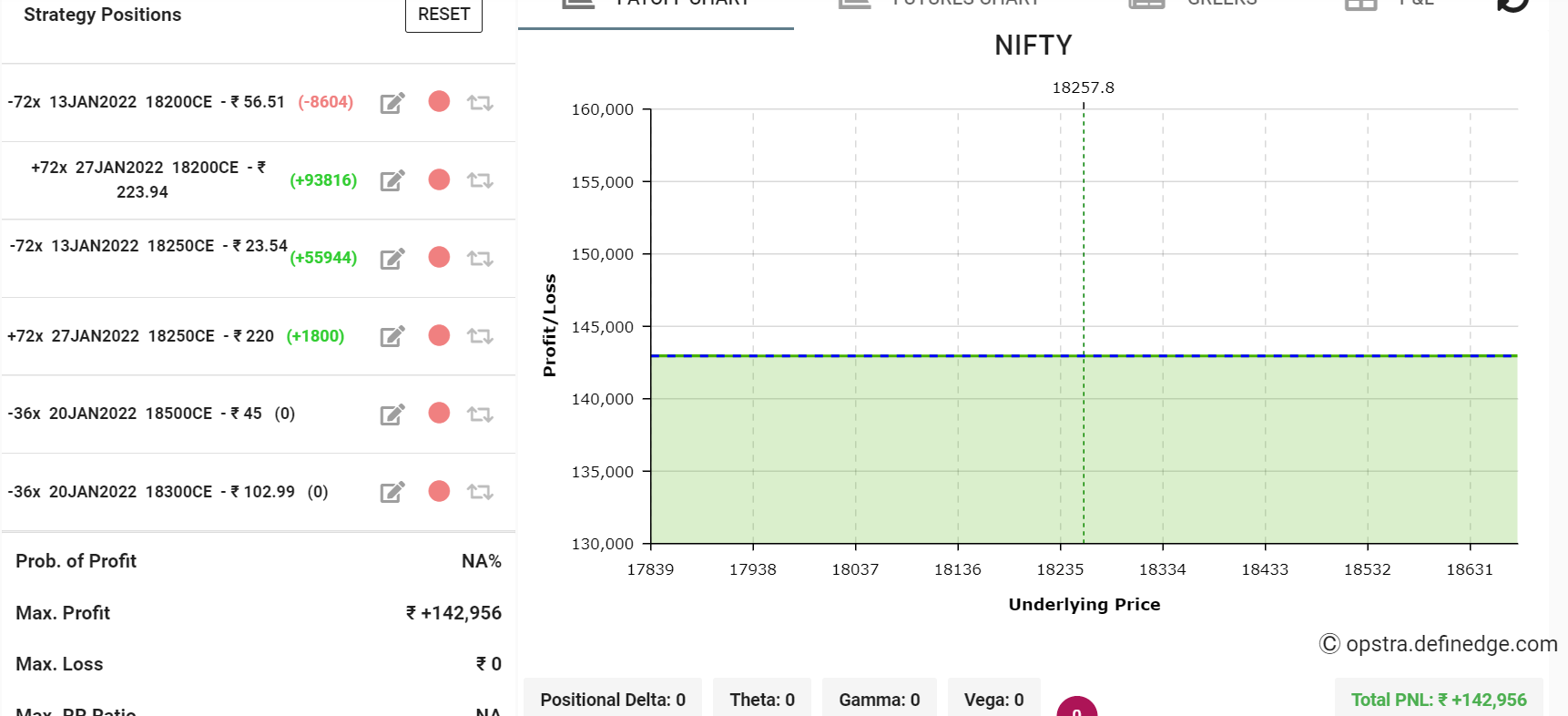

Last post by Michael Gonsalves - Jan 13, 2022, 05:31 PMAs my Calendar of 13th January was sinking, I had sold the 18300CE and 18500CE of 20th January to salvage the situation. However, as the Nifty recovered, I converted the extra sold positions into a Calendar by buying the 18300CE of 27th January.

#75

Our Current Trades / Re: Week ended 13th January 20...

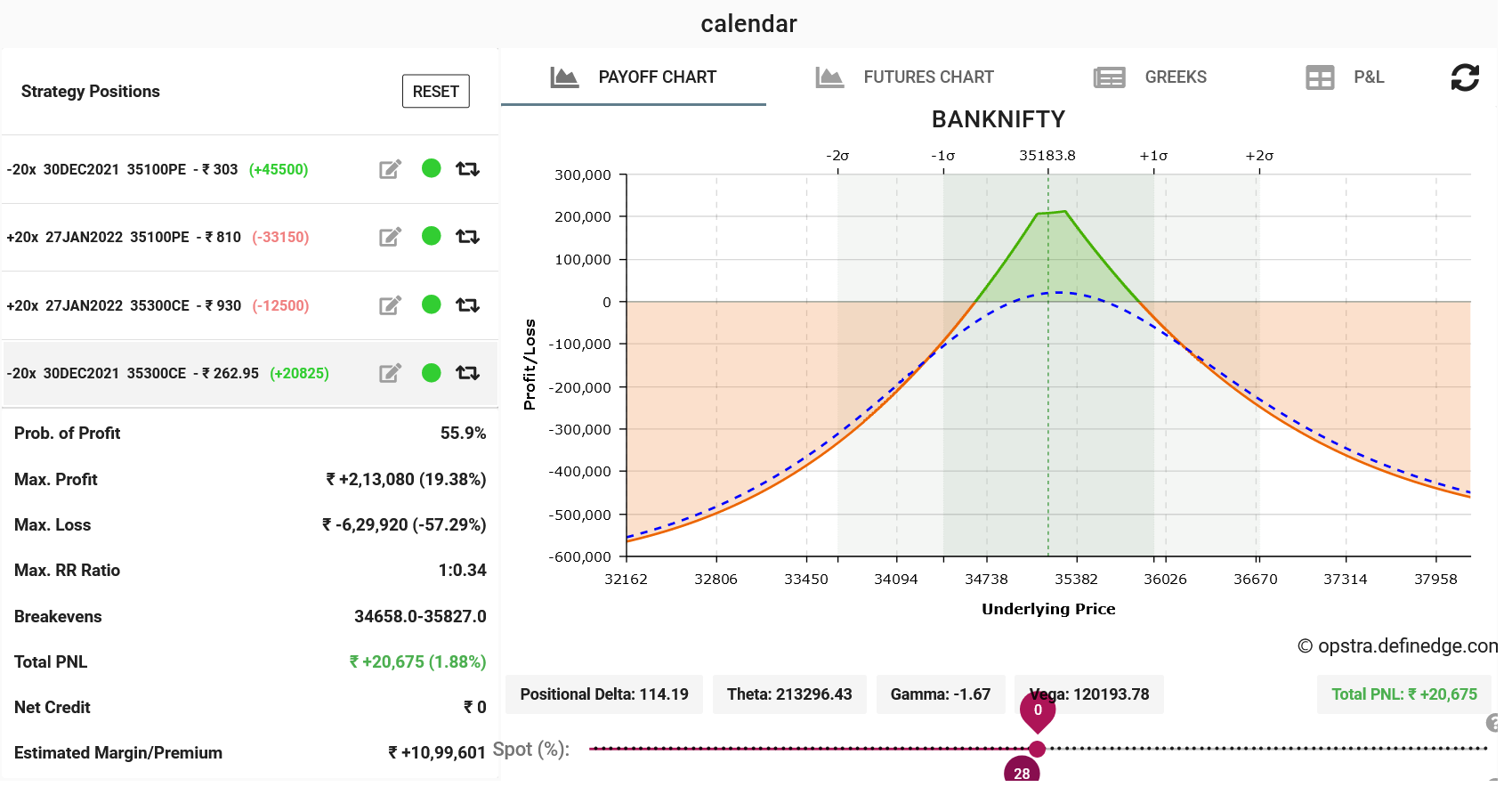

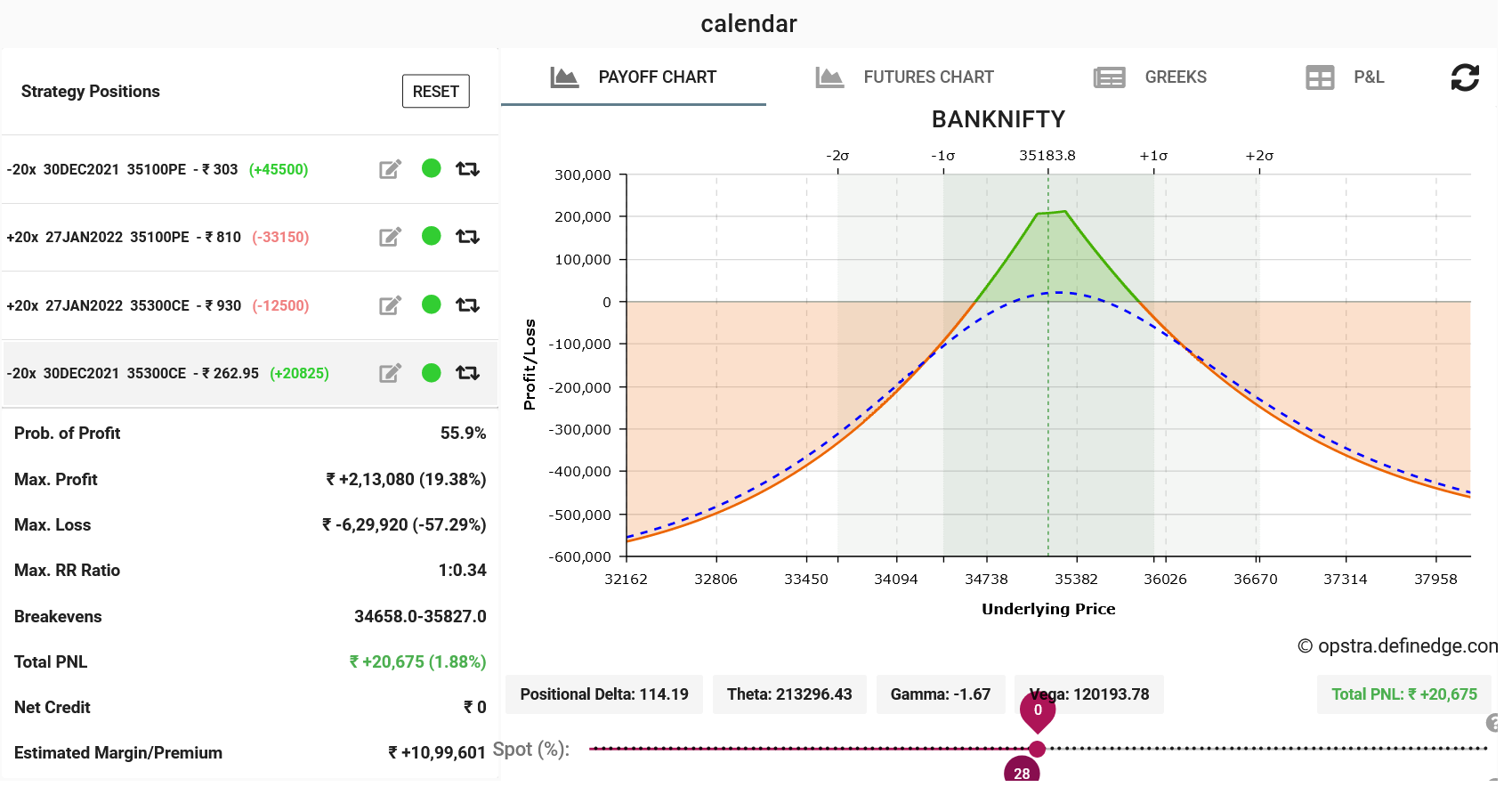

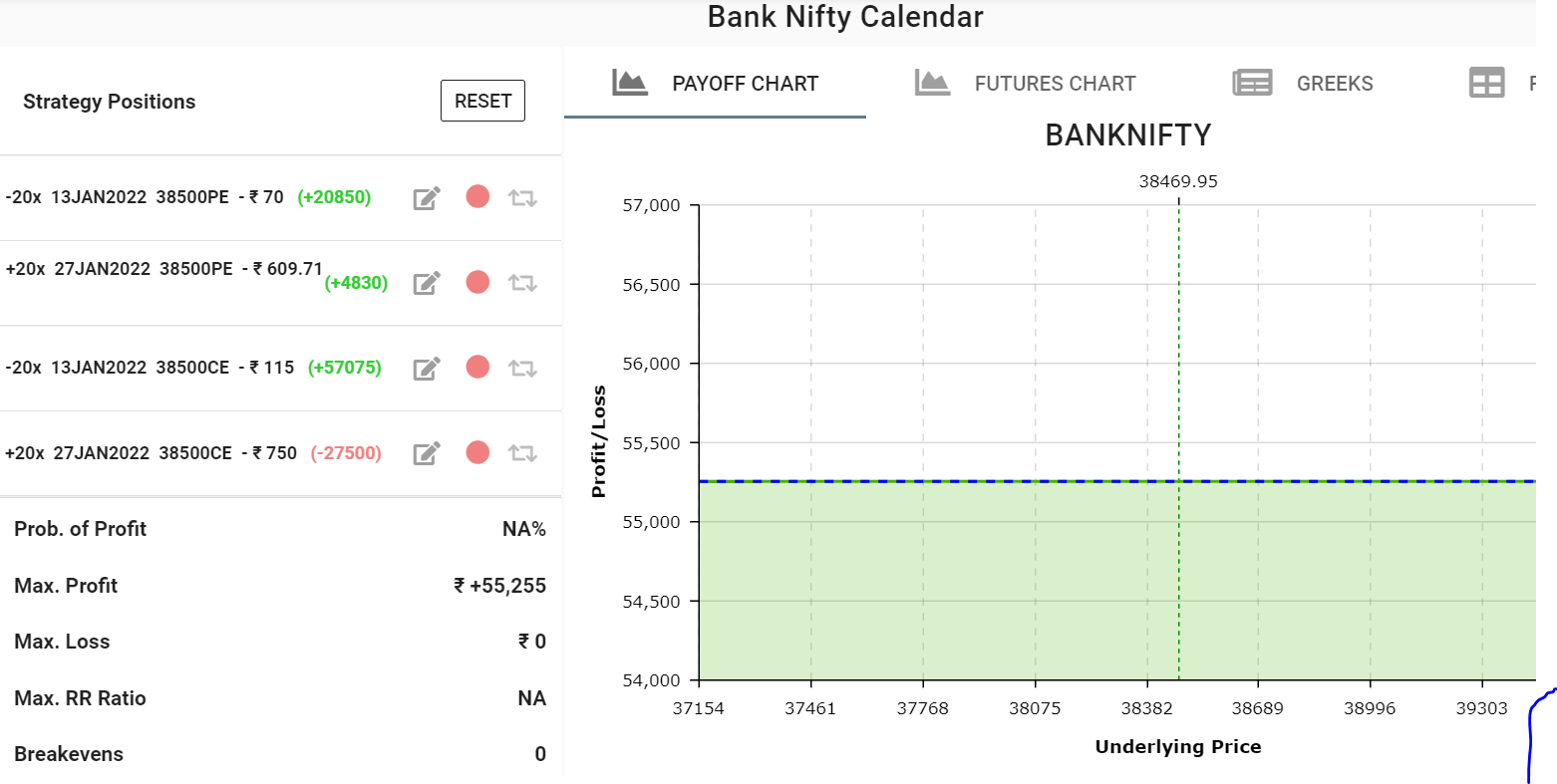

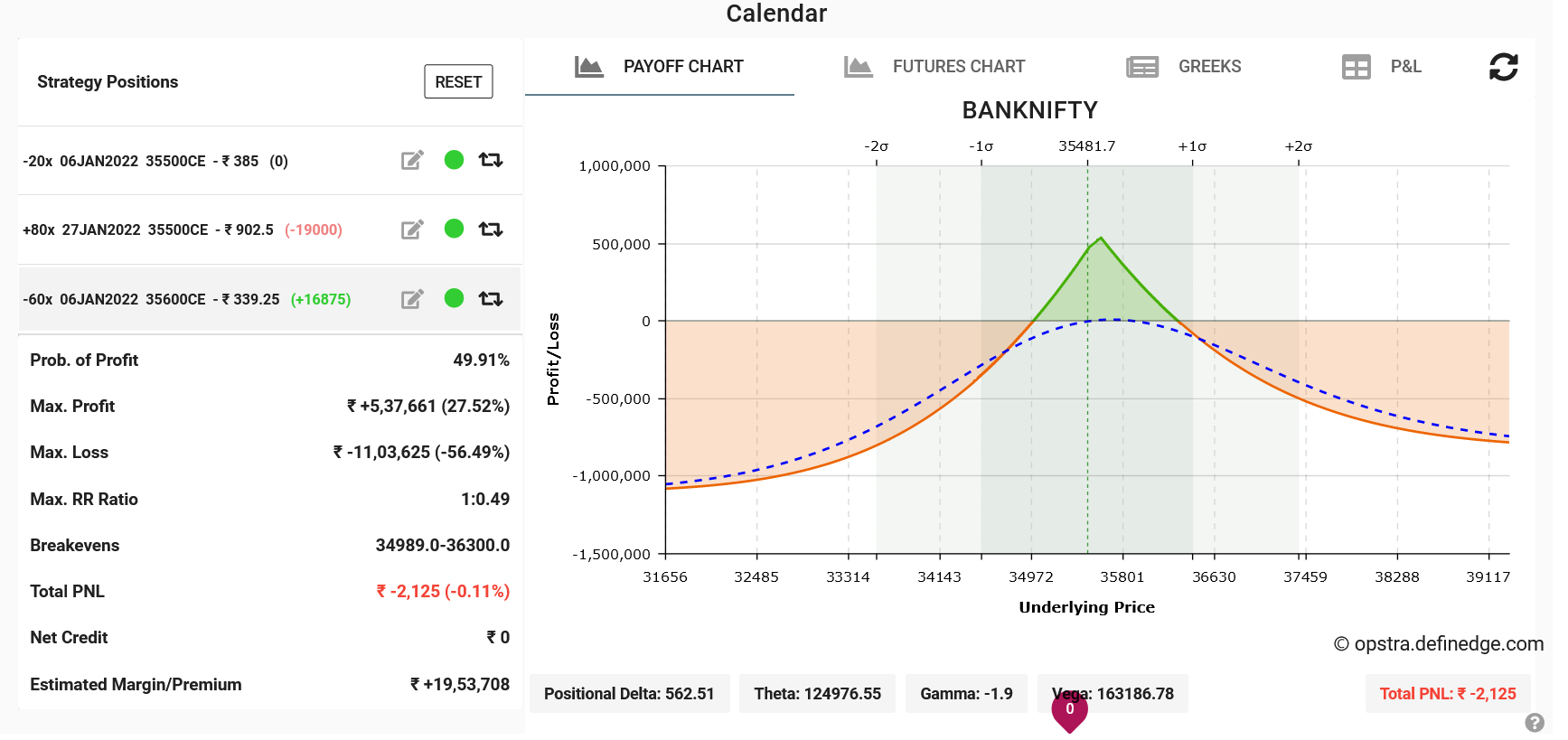

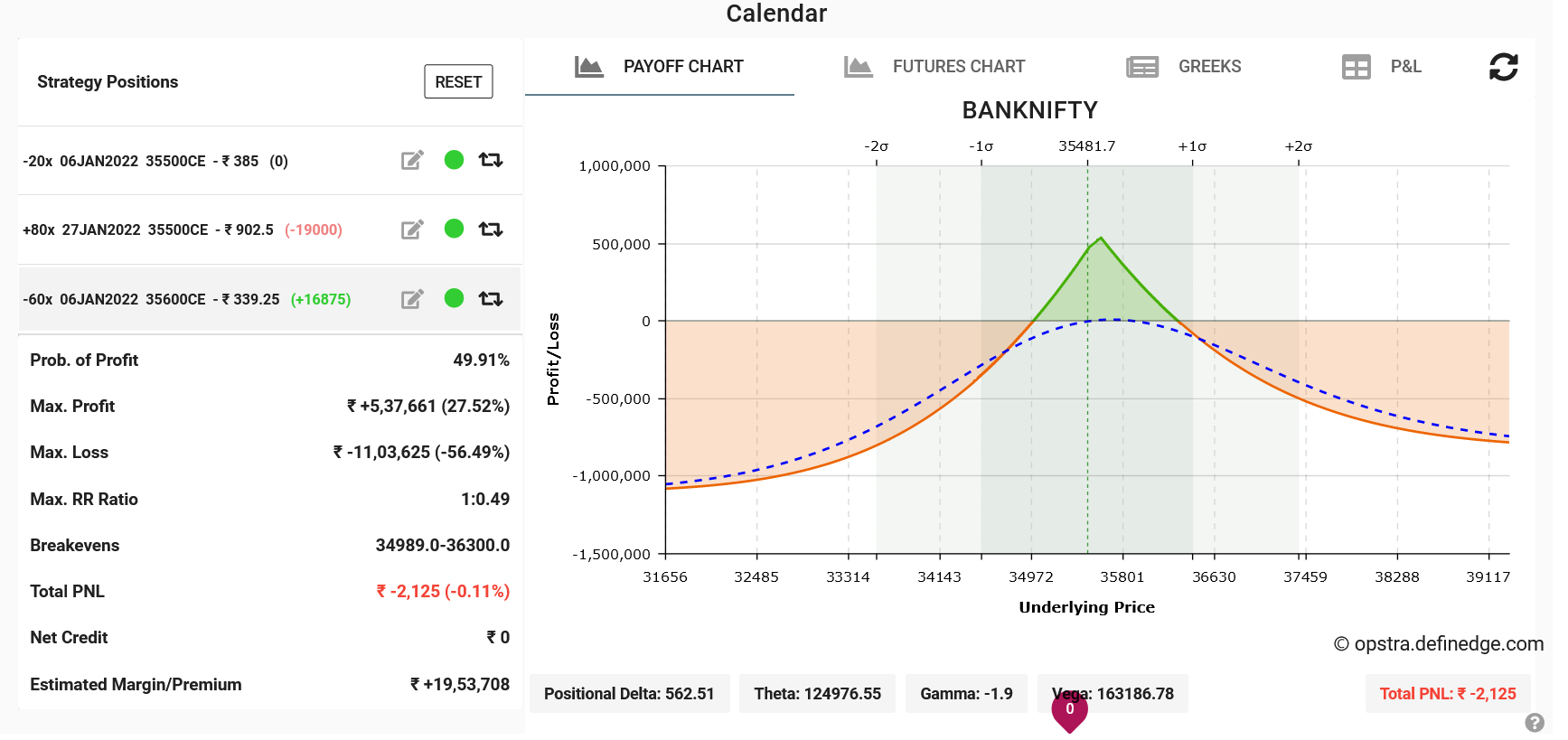

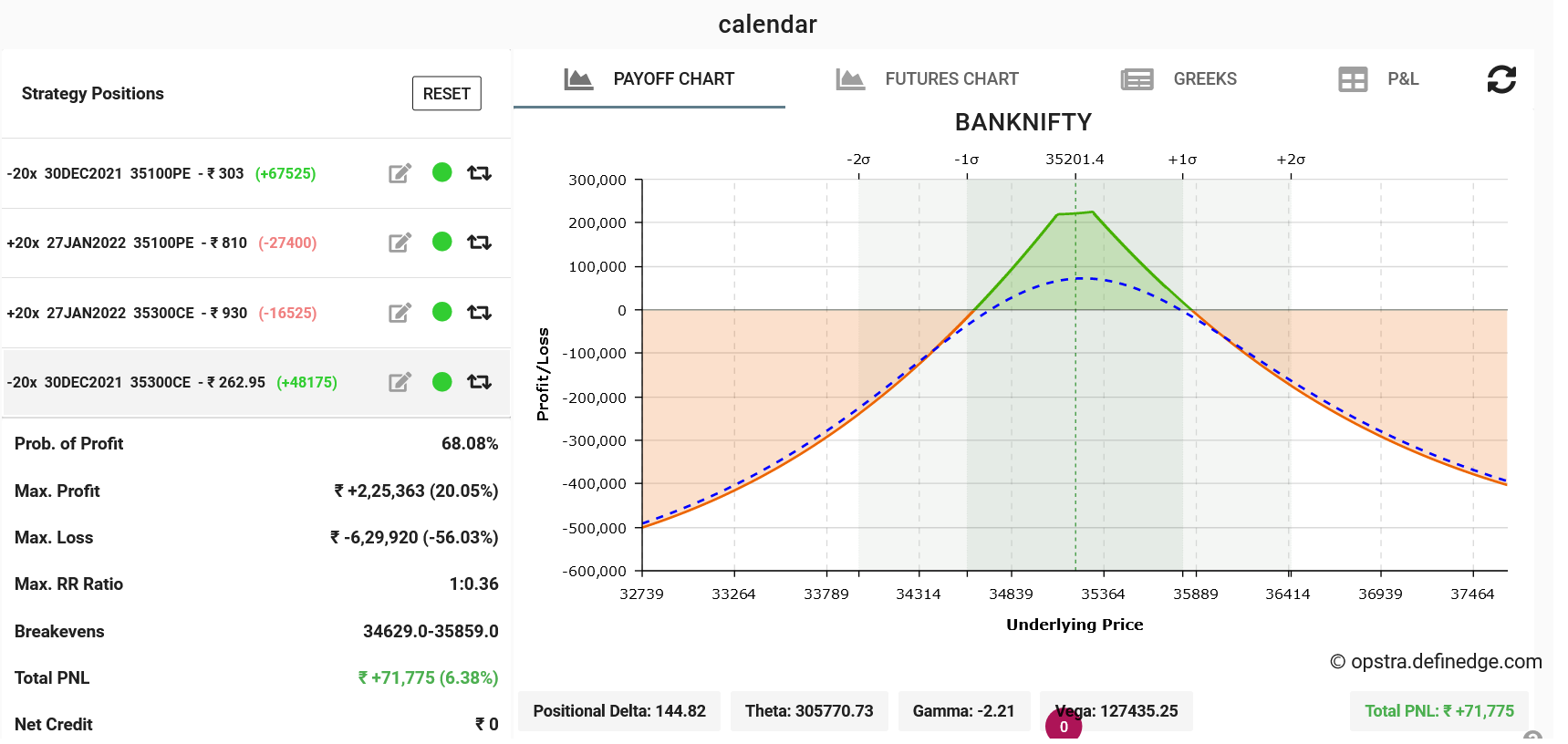

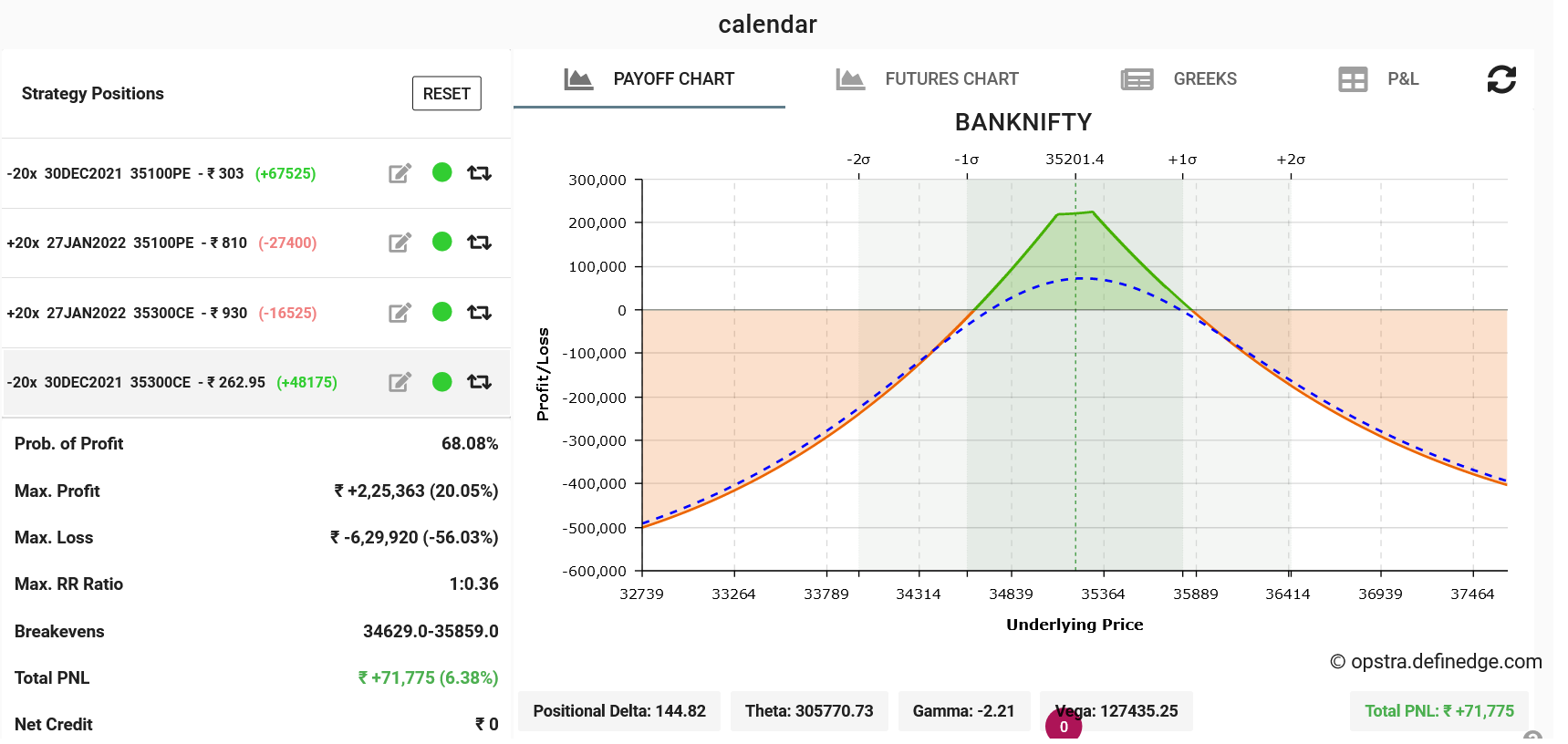

Last post by Michael Gonsalves - Jan 13, 2022, 04:15 PMYesterday, at about 1400 hours, I set up a Calendar in the Nifty with 72 lots (3600 units). Also, today morning, at about 1000 hours, I set up a Calendar in the Bank Nifty with 20 lots (500 units).

While the Nifty Calendar yielded a gain of Rs. 1.42 Lakh, the Bank Nifty Calendar yielded a gain of Rs. 55000.

While the Nifty Calendar yielded a gain of Rs. 1.42 Lakh, the Bank Nifty Calendar yielded a gain of Rs. 55000.

#76

Our Current Trades / Re: Week ended 13th January 20...

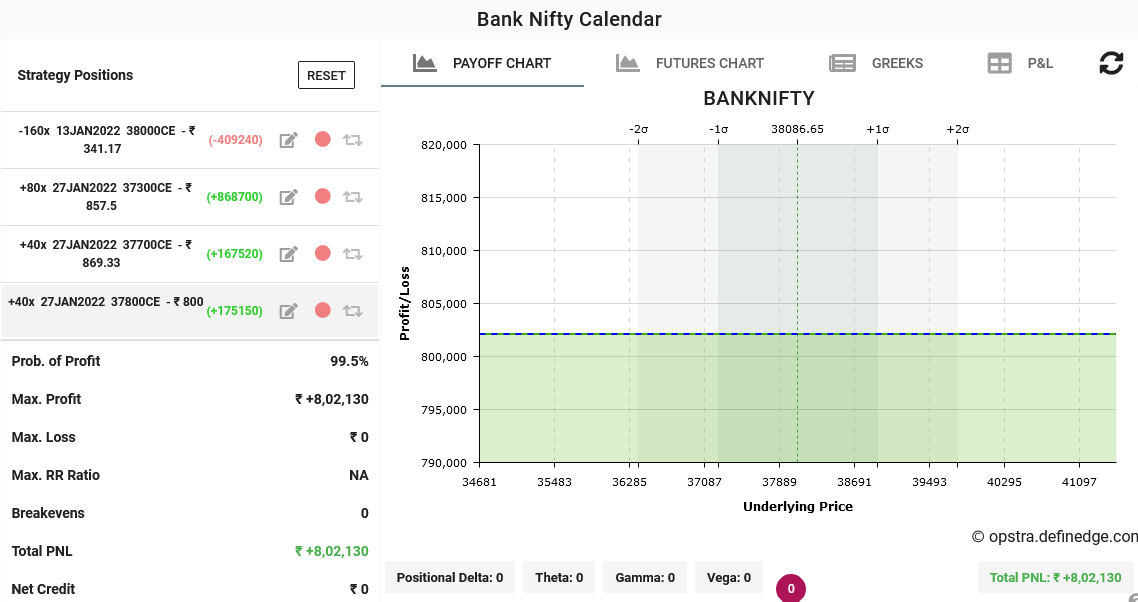

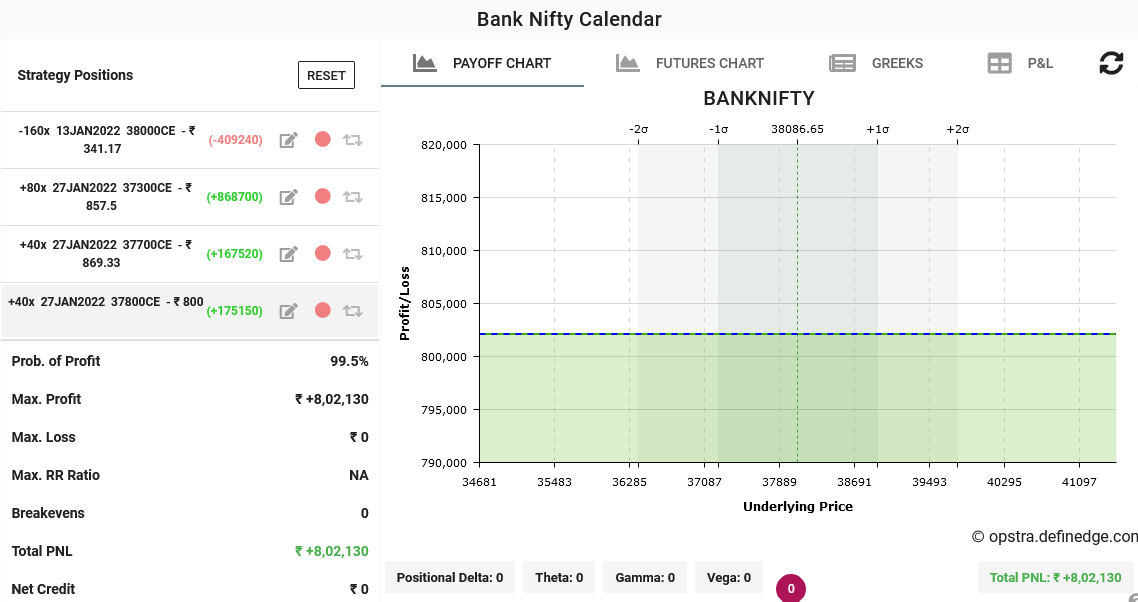

Last post by Michael Gonsalves - Jan 10, 2022, 09:33 AMA surge of 400 points in the Bank Nifty coupled with a surge in the Vix led my Calendar to sparkle. I booked out of the position for a profit of Rs. 8 Lakh.

#77

Our Current Trades / Week ended 13th January 2022: ...

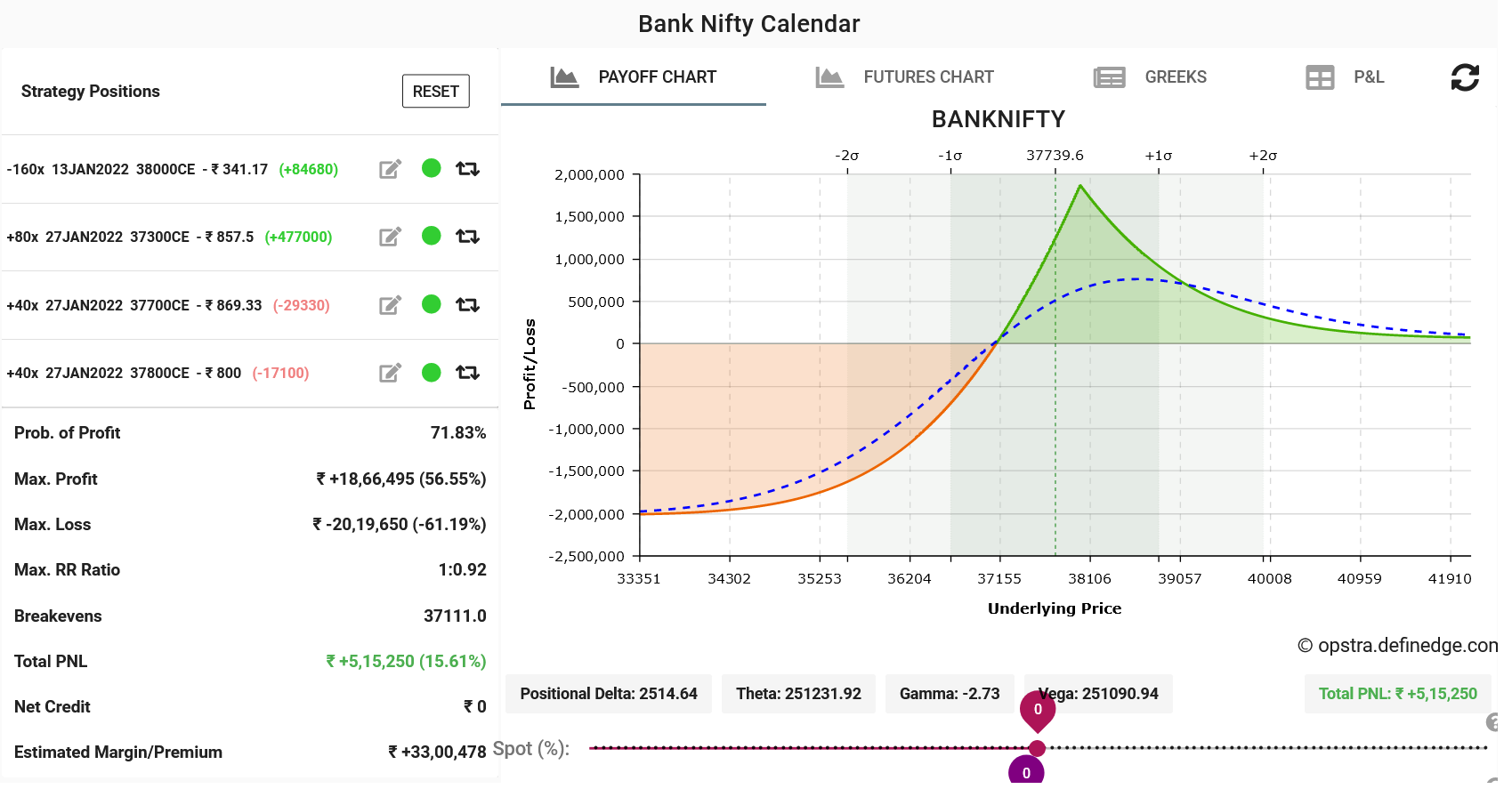

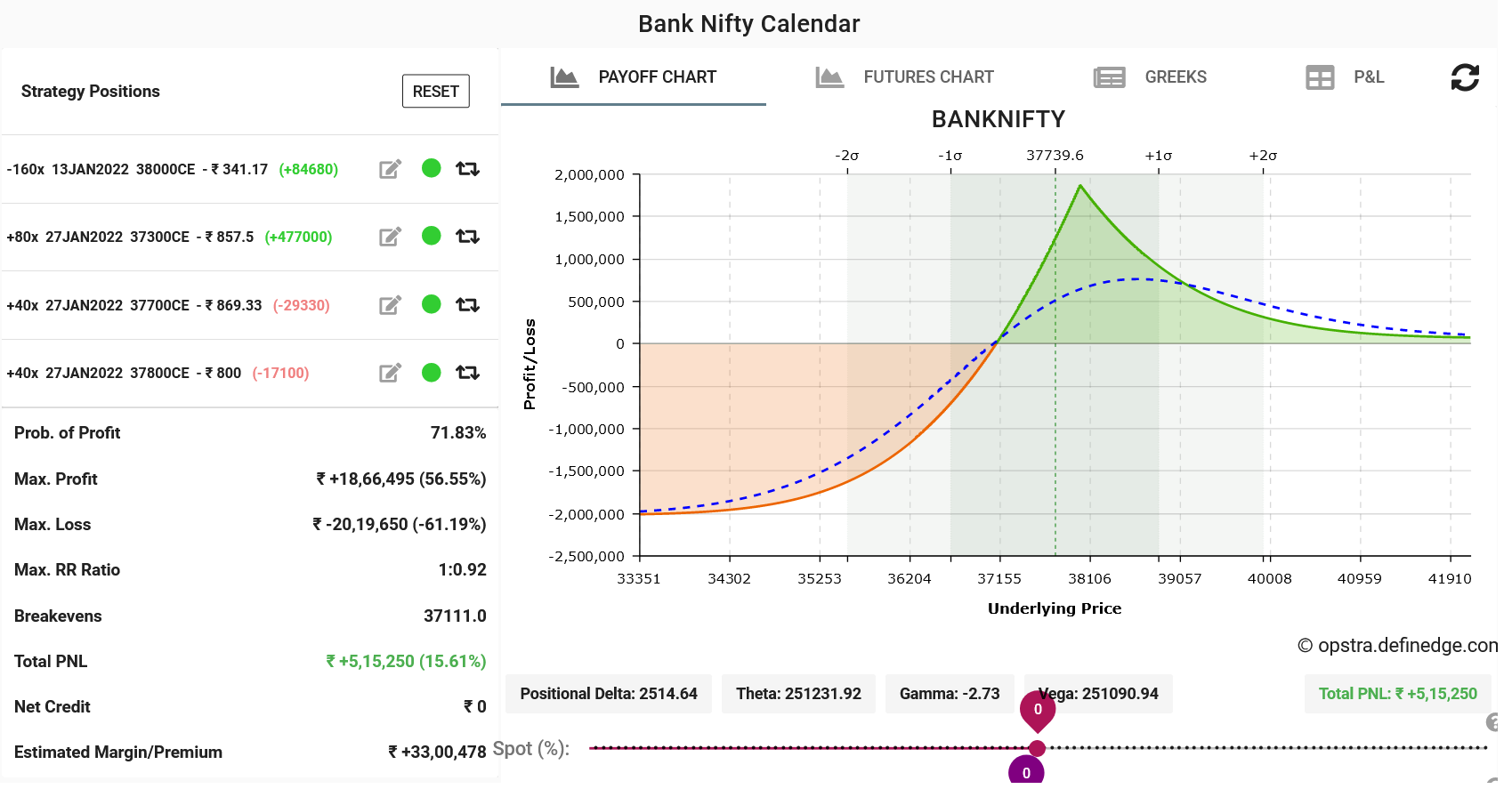

Last post by Michael Gonsalves - Jan 07, 2022, 05:50 PMLast week's Bank Nifty Calendar did not go well because of the extreme turbulence in the market. I made aggressive adjustments when the market plunged. These backfired badly when the market surged. If I would have just left it alone, I would have made a packet.

Anyway, I salvaged the long positions and sold the 38000CE of the week ended 13th January.

This is paying off well. The position is currently in hefty profits of Rs. 5.15 Lakh.

Anyway, I salvaged the long positions and sold the 38000CE of the week ended 13th January.

This is paying off well. The position is currently in hefty profits of Rs. 5.15 Lakh.

#78

Our Current Trades / Week ended 6th January 2022: C...

Last post by Michael Gonsalves - Dec 31, 2021, 04:25 PMLast week's Calendar yielded handsome gains because the Bank Nifty stayed in a narrow range. Today, there was a surge of nearly 500 points in the morning. I set up the Calendar when the market stabilized.

#79

Our Current Trades / Re: Week ended 30th December: ...

Last post by Michael Gonsalves - Dec 29, 2021, 12:02 PMThe market has remained in a very tight range. The ViX has also remained stable. The result is that the Calendar is sparkling with hefty MTM gains of Rs. 71000.

#80

Our Current Trades / Re: Week ended 30th December: ...

Last post by Michael Gonsalves - Dec 28, 2021, 05:28 PMI created a new Calendar with strike prices closer to the spot. To my good luck, that is also showing a good MTM profit at the EOD.