- Welcome to Traders & Investors Paradise.

Recent posts

#21

Our Current Trades / covered call in 1100 shares of...

Last post by Shobha Nagrani - Sep 30, 2022, 04:52 PMI am doing a covered call in 1100 shares of HDFC Bank and 400 shares of Ultratech Cement. 200 shares of Ultra devolved on me in the Sept session. My average purchase price is 6700 or so and I sold calls at 6800.

#22

Our Current Trades / Week ended 6th October: Call C...

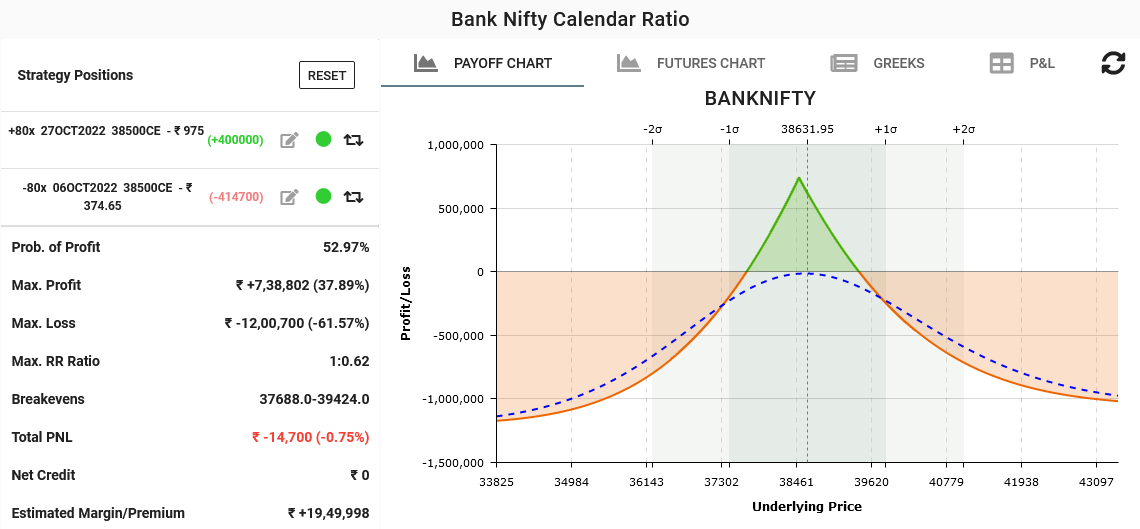

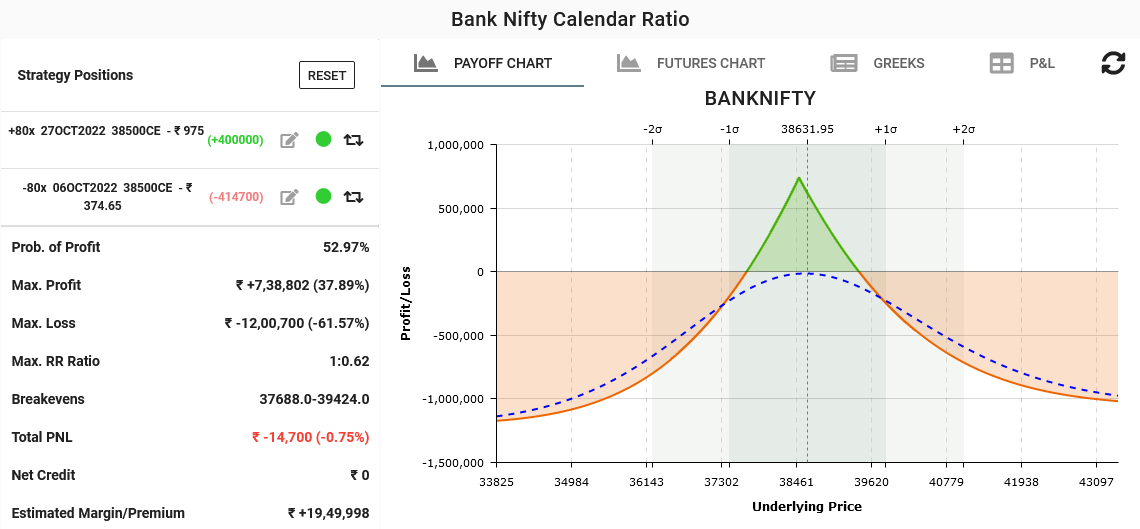

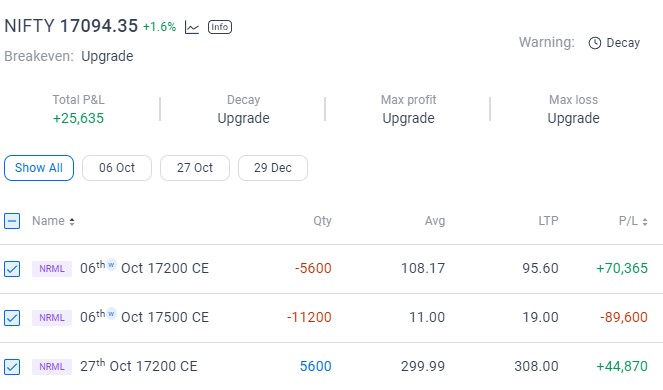

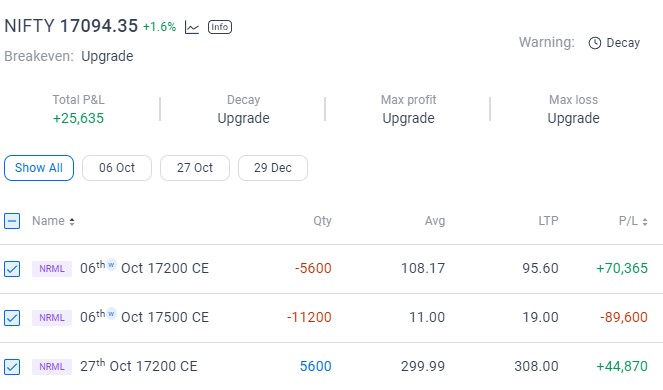

Last post by Michael Gonsalves - Sep 30, 2022, 04:47 PMMy original thinking was that I would do a Call Calendar in the Bank Nifty and a naked trade in the Nifty. However, the trade in the Nifty went wrong and I was forced to buy a Call Calendar to salvage it.

I also bought a Call Calendar in the Bank Nifty at 38500 when the Index was at 38300. However, immediately thereafter the Bank Nifty surged all the way to 38800. Thankfully, it cooled down a little bit and closed at 38600.

I also bought a Call Calendar in the Bank Nifty at 38500 when the Index was at 38300. However, immediately thereafter the Bank Nifty surged all the way to 38800. Thankfully, it cooled down a little bit and closed at 38600.

#23

Our Current Trades / Week ended 6th October: Call C...

Last post by Michael Gonsalves - Sep 30, 2022, 04:42 PMI committed a blunder today by selling 11200 nos of the Nifty 17500CE. The Nifty was below 17000 and was looking very sluggish. However, immediately thereafter the Indices surged, putting my short position in a deep loss. To salvage the situation, I bought a 17200 Call Calendar. The combined BEP is 17500. I will add more Calendars if it looks like the Nifty will sustain beyond that.

Fortunately, towards the EOD, the Indices cooled down a bit and my huge loss turned into a small profit.

Fortunately, towards the EOD, the Indices cooled down a bit and my huge loss turned into a small profit.

#24

Our Current Trades / Re: I lost Rs. 23.71 lakh due ...

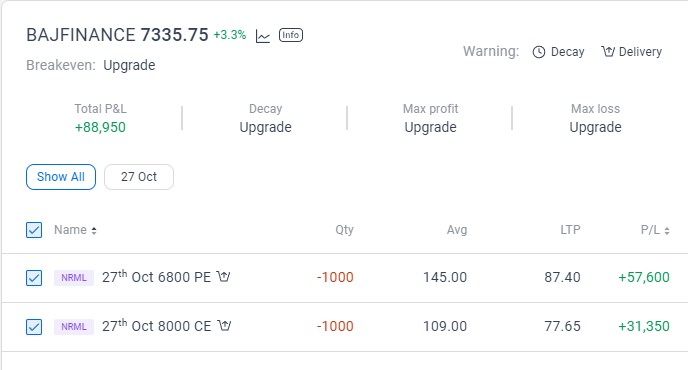

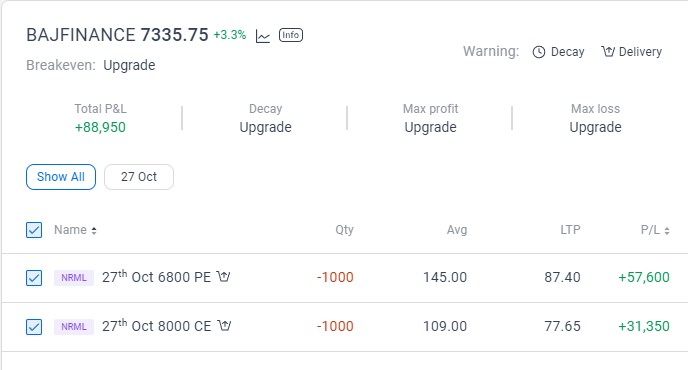

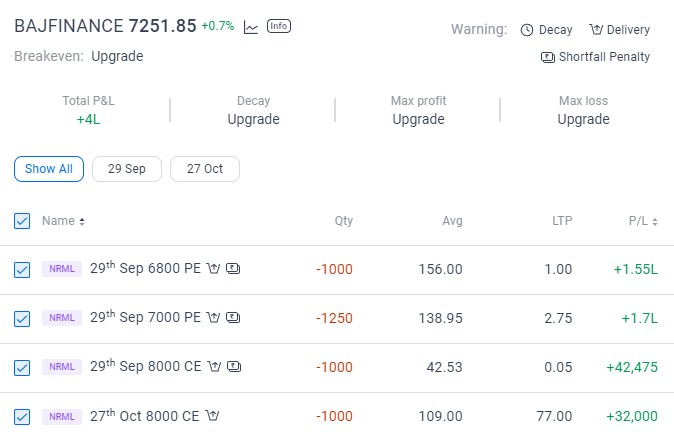

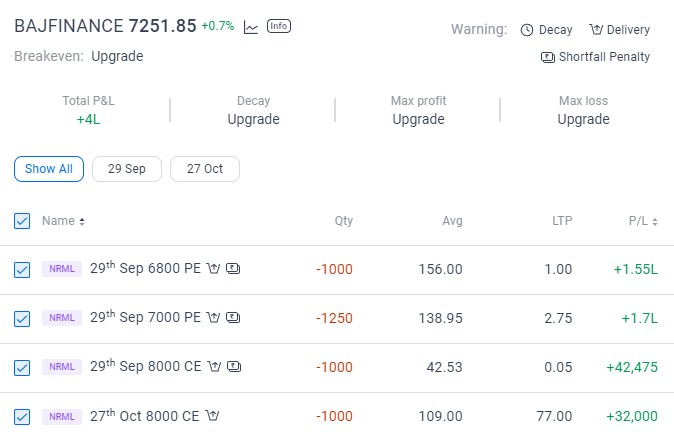

Last post by Michael Gonsalves - Sep 30, 2022, 04:34 PMI want to sell 2000 Puts of Bajaj Finance. However, after I sold 1000 nos, the stock shot up. I will try to sell the other 1000 when the stock is down. I got a good price because the stock was down in the morning session and also the ViX was high due to the speech of the RBI Governor.

#25

Our Current Trades / Re: I lost Rs. 23.71 lakh due ...

Last post by Michael Gonsalves - Sep 29, 2022, 09:37 AMThe Puts and Calls sold of the September expiry have yielded a profit of about Rs. 4 Lakh. I will roll these over to October.

#26

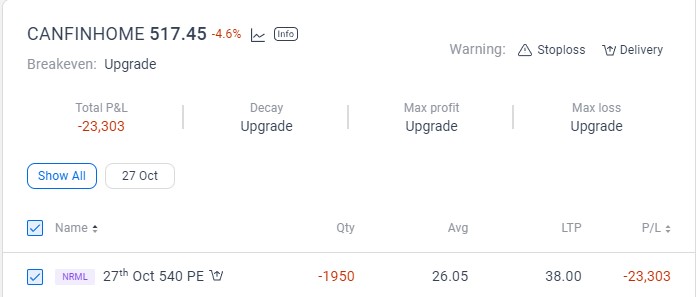

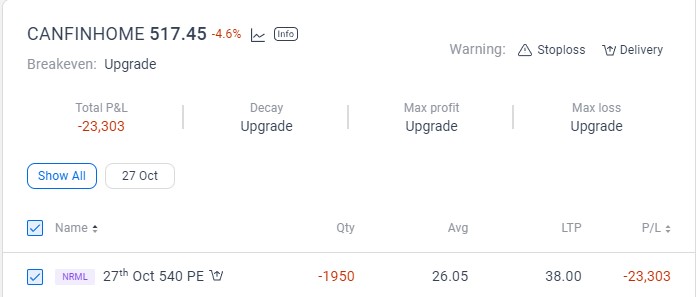

Our Current Trades / Re: Bullish trade in Can Fin H...

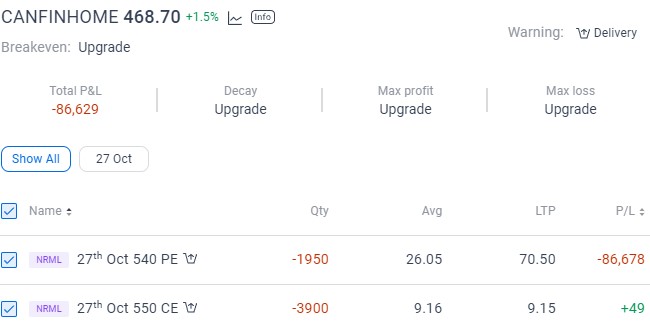

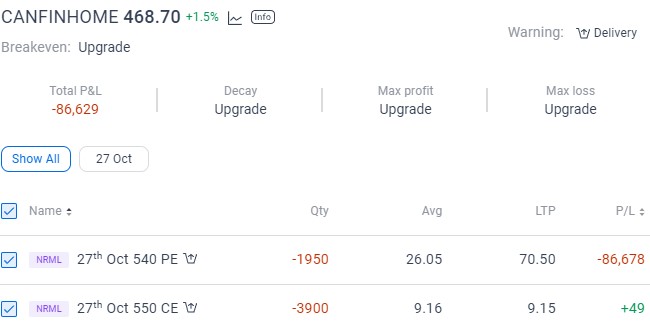

Last post by Michael Gonsalves - Sep 28, 2022, 12:54 PMTo salvage the situation, I sold 2x of the 550 Call. The stock has also bounced a bit.

#27

Our Current Trades / Re: Bullish trade in Can Fin H...

Last post by Michael Gonsalves - Sep 26, 2022, 09:56 AMCan Fin is in the Ban and so I cannot add any short calls to neutralize the loss on the short puts.

#28

Our Current Trades / Re: Bullish trade in Can Fin H...

Last post by Michael Gonsalves - Sep 25, 2022, 01:47 PMCan Fin Homes has dipped considerably causing a huge MTM loss. In hindsight, I ought to have sold calls to neutralize the loss. I will do so on Monday. However, capital is a problem because I already have several other Puts which are in-the-money and will require delivery to be taken.

#29

Guides & Tutorials / Expiry day options trading str...

Last post by Michael Gonsalves - Sep 24, 2022, 02:52 PMA trader named Angad Singh has suggested a strategy that can be adopted on expiry day.

On expiry day, 9.15 to 9.20

Consider ATM Ce n ATM Pe

If ( CE-PE ) is +ve consider selling CE

If ( CE-PE ) is -ve consider selling PE

Trade thrice with 30% as SL

Trade twice with 50% as SL

Trade only once with 100% as SL

https://twitter.com/Singh7575/status/1564956094413570048

Another trader has explained how the strategy can be implemented with practical examples.

On expiry day, 9.15 to 9.20

Consider ATM Ce n ATM Pe

If ( CE-PE ) is +ve consider selling CE

If ( CE-PE ) is -ve consider selling PE

Trade thrice with 30% as SL

Trade twice with 50% as SL

Trade only once with 100% as SL

https://twitter.com/Singh7575/status/1564956094413570048

Another trader has explained how the strategy can be implemented with practical examples.

#30

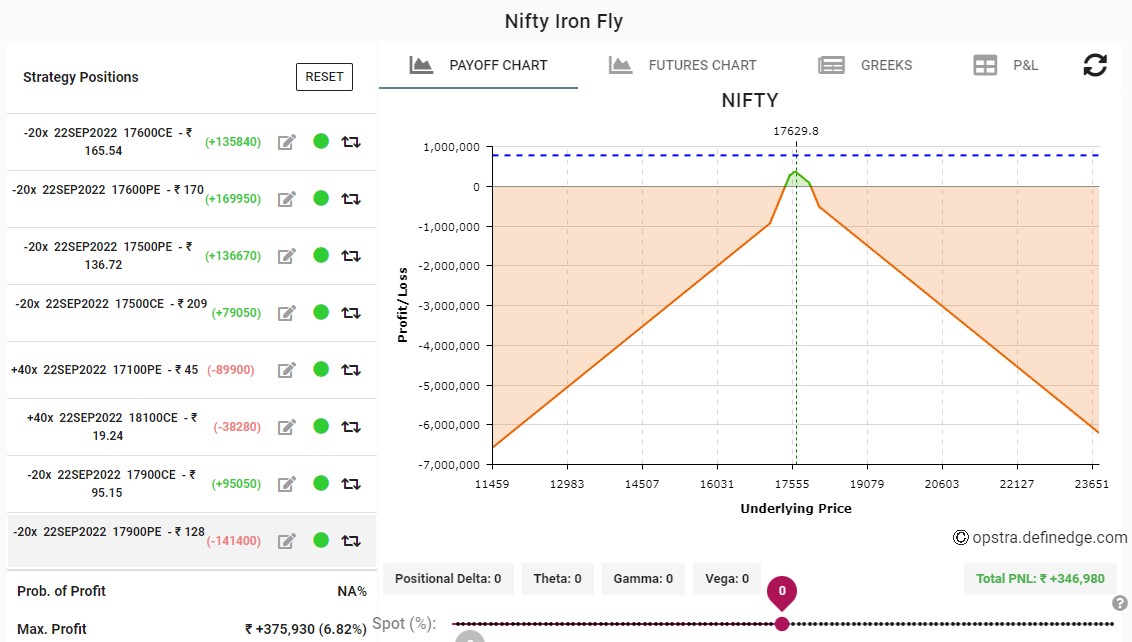

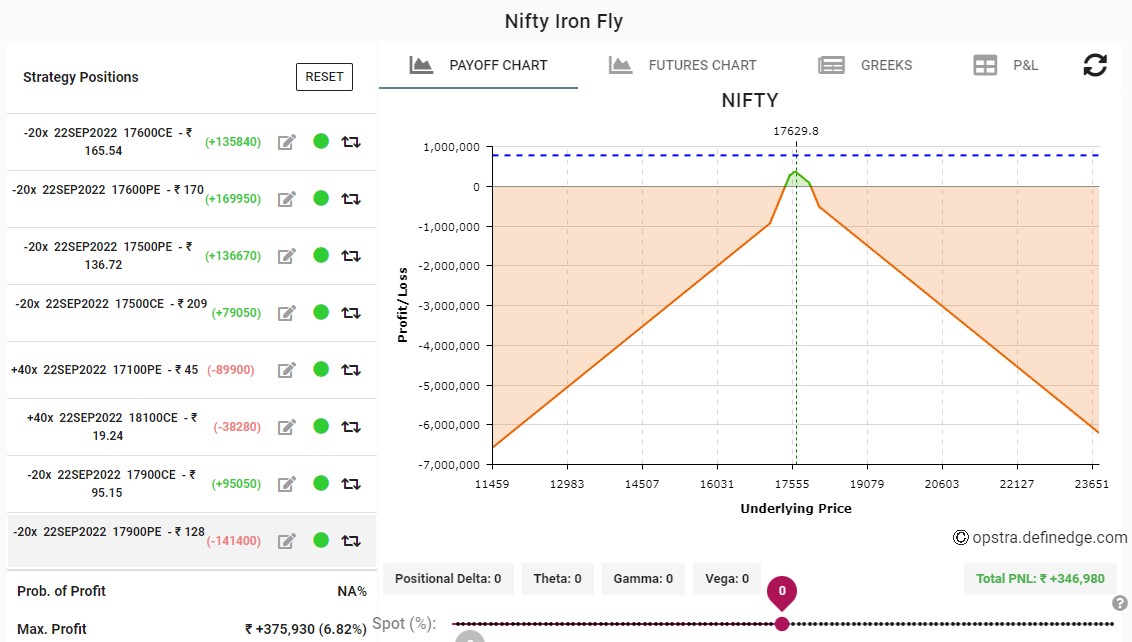

Our Current Trades / Re: Week ended 22nd September:...

Last post by Michael Gonsalves - Sep 22, 2022, 03:56 PMThis Iron Fly would have yielded a handsome profit of Rs 3.45 Lakh if i would have left it alone. However, i did not leave it alone. Instead, I exited yesterday at a loss of Rs 50000 because i was apprehensive that the FOMC would create unbearable volatility. I created a simpler Iron Fly with the center at 17700. This yielded a gain of about Rs 1 Lakh.