- Welcome to Traders & Investors Paradise.

Recent posts

#11

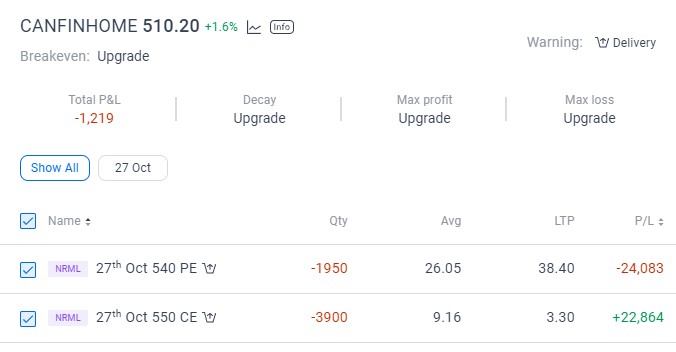

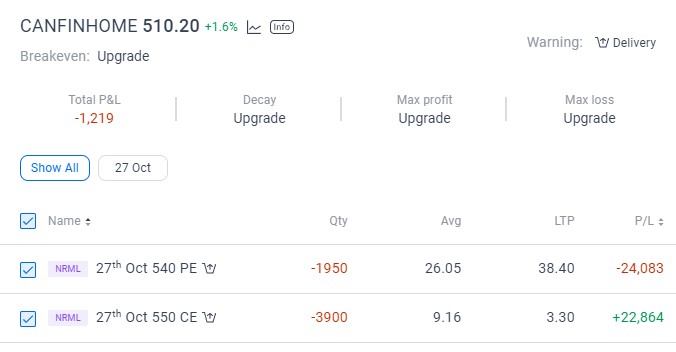

Our Current Trades / Re: Bullish trade in Can Fin H...

Last post by Michael Gonsalves - Oct 18, 2022, 11:10 AMThe strategy of selling Calls helped to neutralize the loss on the Puts. If the stock closes below Rs 540 by expiry, I will take delivery and selling Rs 540 Calls of November.

#12

Best stocks to buy now / Re: veteran investor Vijay ked...

Last post by Michael Gonsalves - Oct 10, 2022, 04:36 PMAtul Auto is up 7% today over this news of Vijay Kedia's investment.

#13

Best stocks to buy now / veteran investor Vijay kedia t...

Last post by Babul - Oct 10, 2022, 09:10 AMAtul auto in focus

veteran investor Vijay kedia to invest in Atul auto

To invest 115cr via preferential issue

58.08 lakh warrants at price of 198rs each

Vijay kedia shareholding to increase to 18.2% post conversion to equity

https://twitter.com/_soniashenoy/status/1579307745886769152

veteran investor Vijay kedia to invest in Atul auto

To invest 115cr via preferential issue

58.08 lakh warrants at price of 198rs each

Vijay kedia shareholding to increase to 18.2% post conversion to equity

https://twitter.com/_soniashenoy/status/1579307745886769152

#14

Our Current Trades / Re: Week ended 6th October: Ca...

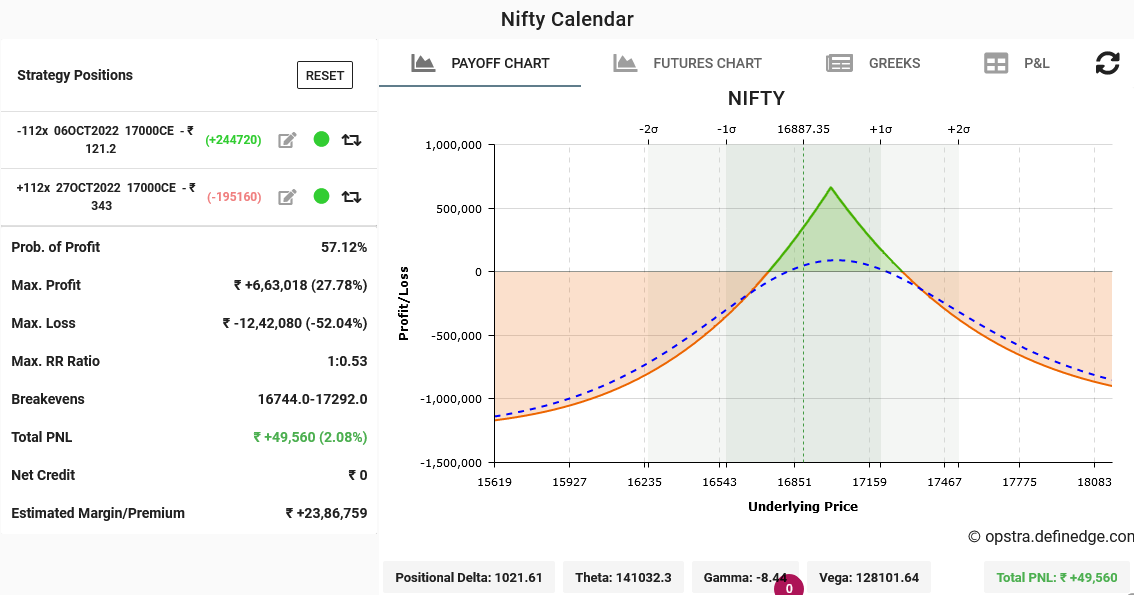

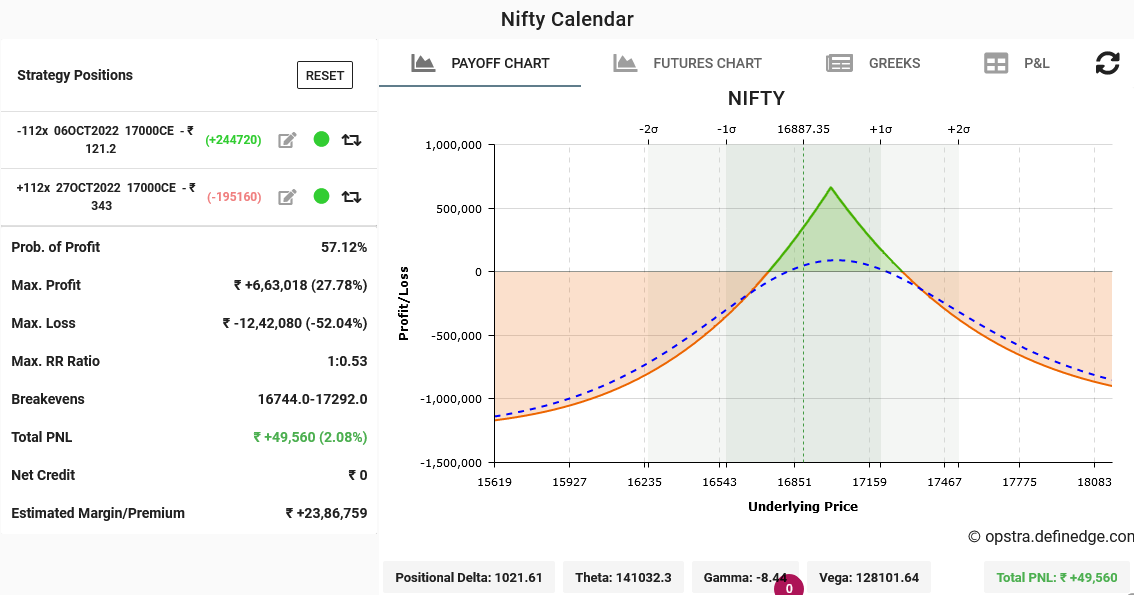

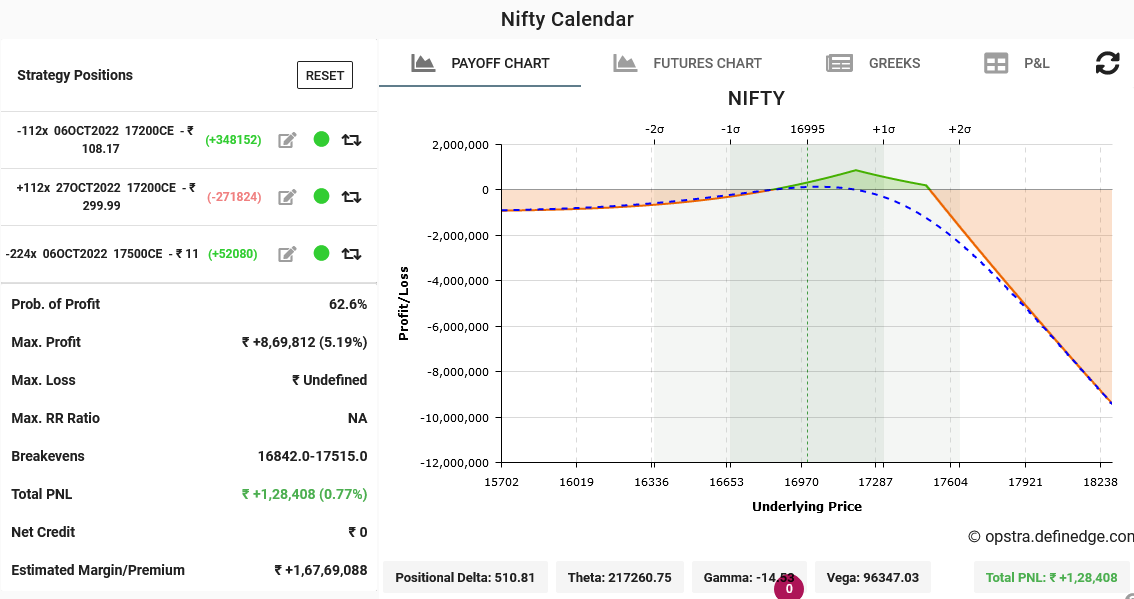

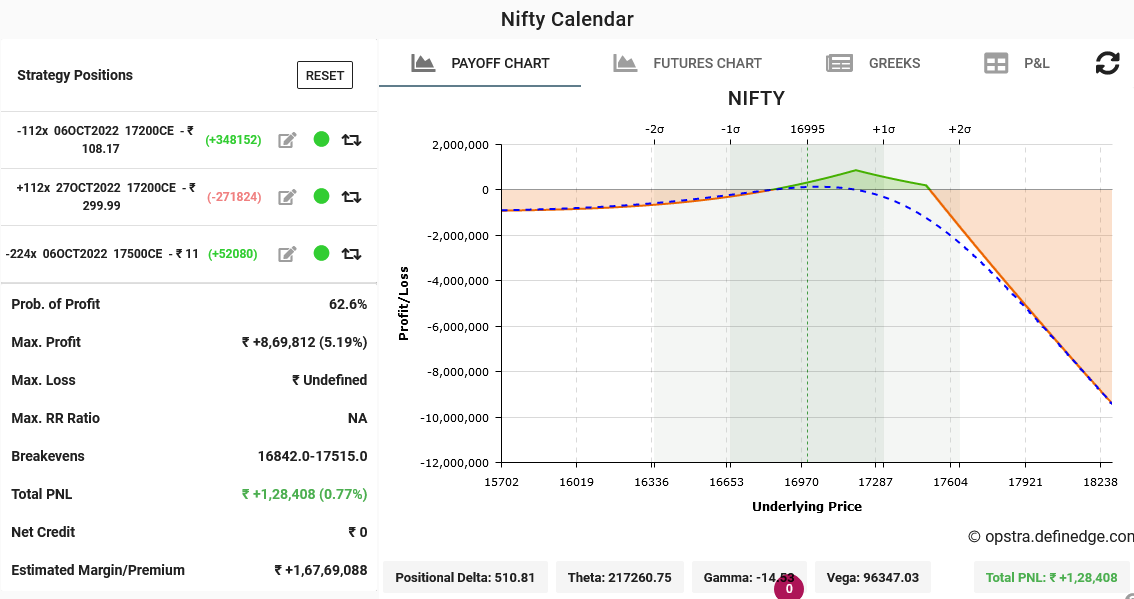

Last post by Michael Gonsalves - Oct 04, 2022, 07:06 PMBecause the Nifty shot up 387 points and came close to my BEP, I had to square off the 17000 Calendar. Unfortunately, the ViX also fell 8.42% causing a loss in the long leg. I suffered a loss of about 50000+. I know have a 17300CE - 17400CE Calendar with a BEP of 17500.

#15

Our Current Trades / Re: Week ended 6th October: Ca...

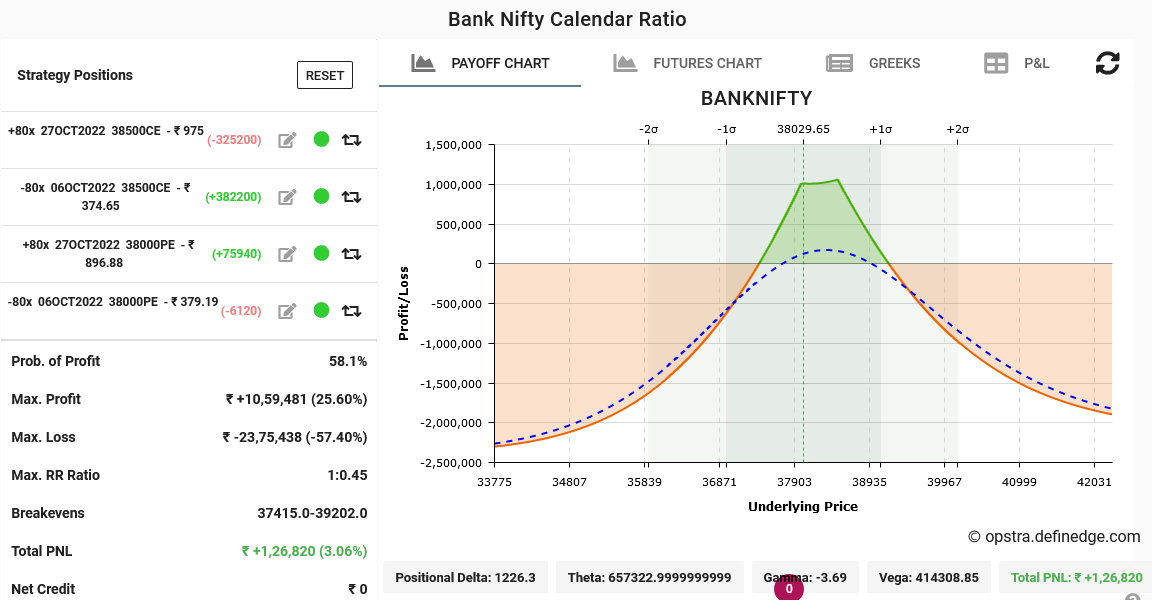

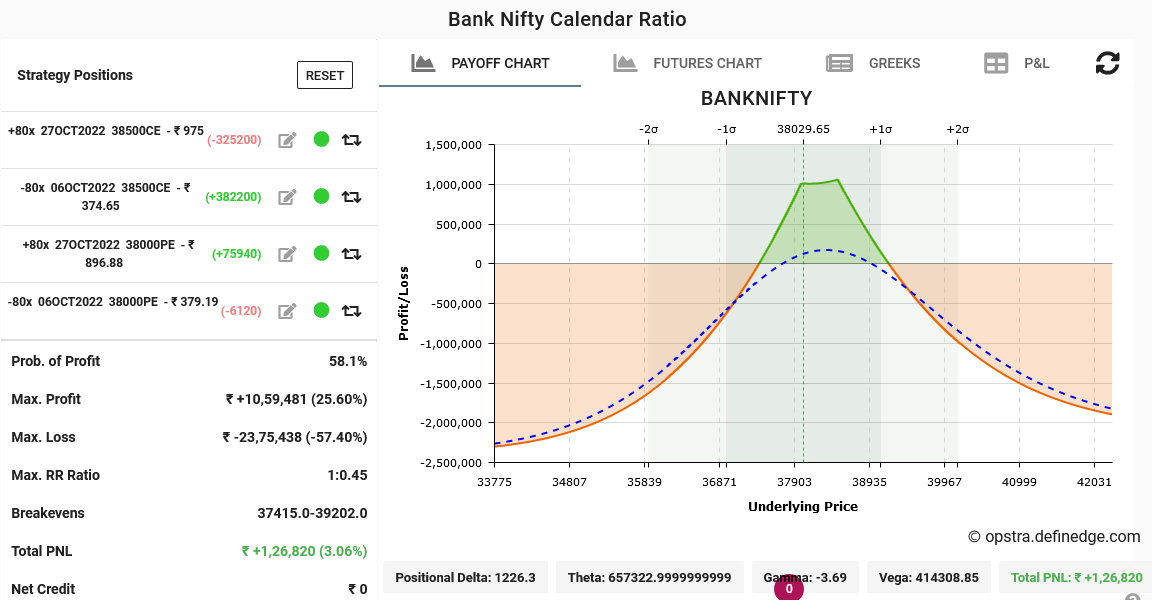

Last post by Michael Gonsalves - Oct 04, 2022, 10:17 AMThe unexpected surge of 1000+ points on the Bank Nifty put my position in a loss. I aggressively sold some puts. There was a bit of panic (because I unnecessarily had several other positions as well). I lost about Rs 1 Lakh. If I would have held on a little longer, the position would have shown a little profit.

Anyway, I squared off and created a new Call Calendar at 38000CE Oct and 38200CE 6th October.

Anyway, I squared off and created a new Call Calendar at 38000CE Oct and 38200CE 6th October.

#16

Our Current Trades / Re: Week ended 6th October: Ca...

Last post by Michael Gonsalves - Oct 03, 2022, 04:52 PMThe Nifty 17000 Call Calendar looks like this. Because the IV increased, the position is in a nice profit.

#17

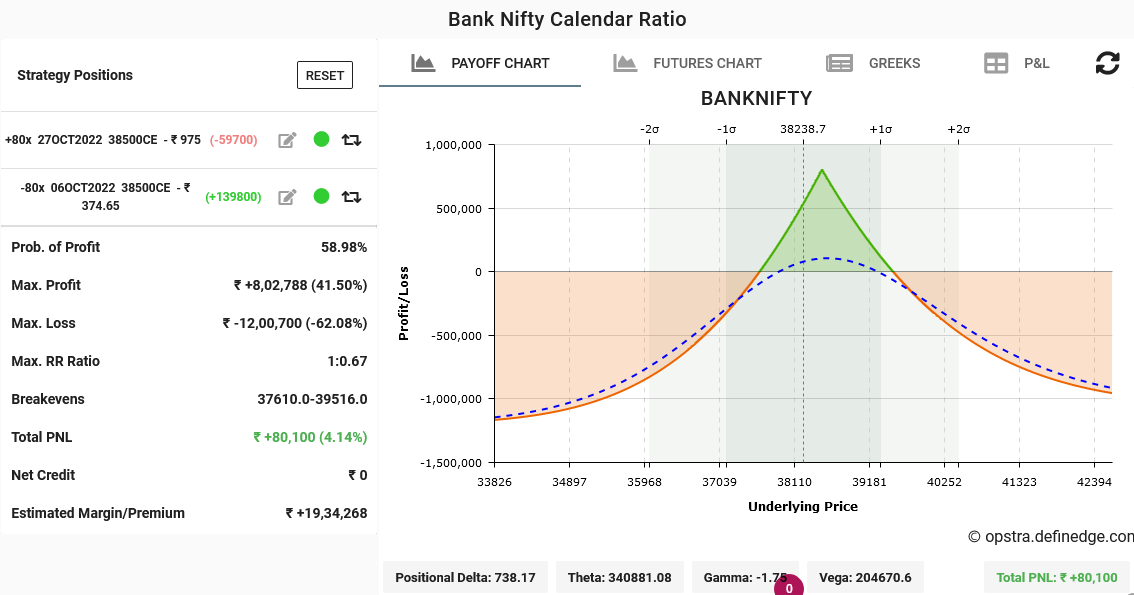

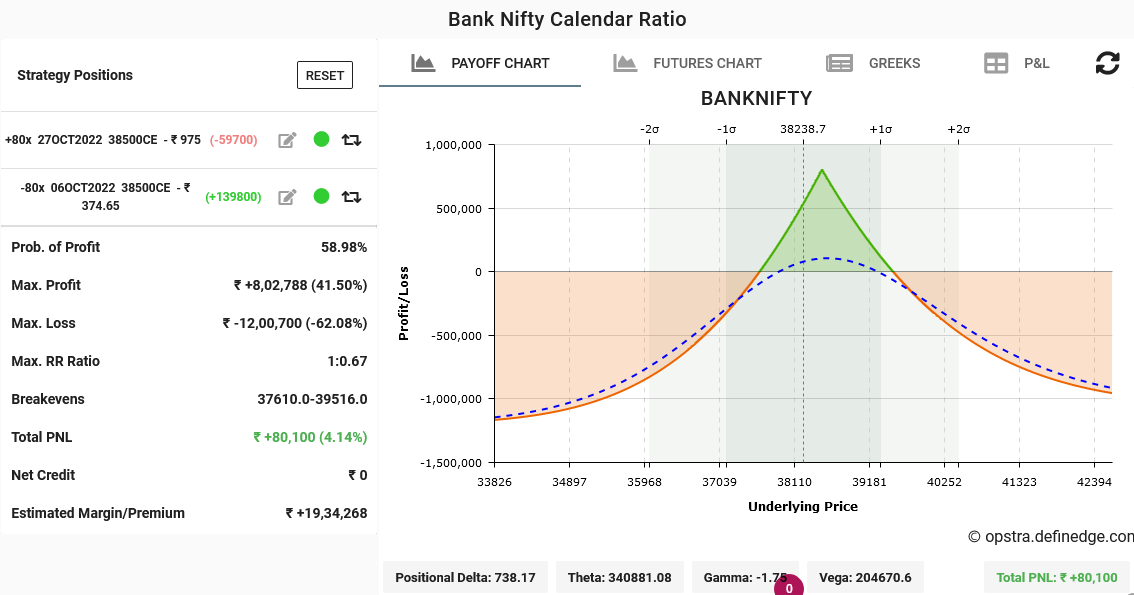

Our Current Trades / Re: Week ended 6th October: Ca...

Last post by Michael Gonsalves - Oct 03, 2022, 04:48 PMI don't want to square off the 38500 CE because it still has premium worth Rs 183 in it. So, I added a Put Calendar at 38000PE in case the Bank Nifty continues to plunge. I will shift the 38500CE to 38300 or even 38200 if the softness continues.

#18

Our Current Trades / Re: Week ended 6th October: Ca...

Last post by Michael Gonsalves - Oct 03, 2022, 01:53 PMThe Nifty has gone below 17000 and so it is not safe to hold on to the 17200 long position. I squared it off and shifted to a 17000 Call Calendar.

#19

Our Current Trades / Re: Week ended 6th October: Ca...

Last post by Michael Gonsalves - Oct 03, 2022, 11:22 AMThe Bank Nifty plunged to 38200. However, my position is in a profit of about Rs 80000. I would like to exit and re-enter.

#20

Our Current Trades / Re: covered call in 1100 share...

Last post by Michael Gonsalves - Sep 30, 2022, 05:38 PMGreat. One of the safest strategies in blue-chip stocks.