- Welcome to Traders & Investors Paradise.

Recent posts

#1

Best stocks to buy now / 'Thrice Beaten, Four Times Shy...

Last post by Michael Gonsalves - Oct 12, 2025, 01:08 PMMumbai: Nilesh Shah, the Managing Director of Kotak Mutual Fund, has severely criticized consumer durables company Eureka Forbes, detailing a series of frustrating experiences with their products and, more significantly, their customer service. Shah's public critique, shared on social media platform X (formerly Twitter), quickly triggered a wave of similar complaints from other users, painting a concerning picture of the brand's deteriorating post-sale support.

Shah's thread, titled "Power of Brand," recounts a three-part saga of disappointment. The first incident involved the purchase of a 'Dr Aquaguard' water purifier in October 2021, which he bought "for the promise of herb infused water." That promise, however, remained "unfulfilled as the product was stopped immediately thereafter."

Undeterred—or as Shah put it, "Once beaten twice shy? No"—he later purchased a 'zerobend MOP N VAC' vacuum cleaner. This device, according to the MD, began leaving scratches on his marble floor. Despite complaining multiple times, he received no solution and had to stop using the product.

The third and most recent incident concerns a new water purifier ordered on September 13th for immediate delivery. Shah detailed the company's sluggish process, stating they only "deposited our cheque on Sept 29th" after follow-up. The issue then shifted to delivery, where the company, initially "kind enough to reply and give dates," has now "stopped replying even on what's app." Shah concluded his post with a rhetorical question: "Thrice beaten four times shy? Well who knows! Brand can win over customer service."

A Torrent of Similar Complaints

The thread rapidly became a platform for other customers to share their own disappointing experiences, suggesting Shah's complaints are far from isolated incidents.

Prateek Jain described the service as "incredibly poor," detailing how a technician, instead of fixing an issue under an Annual Maintenance Contract (AMC), advised him not to buy from the company anymore and instead purchase new filters directly from him at a lower price. Jain ultimately "ended up throwing the purifier."

Amit Kumar called Eureka Forbes "The worst consumer brand today hands down," accusing the company of installing a "timer based limit on their filters" to slow down water flow and force consumers to pay for new filters every 6-9 months—a sign of "early signs of brand demise."

ML Gupta recalled that Eureka Forbes "used to be among the best for service" but has now "lost their key advantage." He cited an unsatisfactory change of tubes and "smelling water" after recently purchasing a two-year AMC.

GAUTAM shared a story of a robotic cleaner that stopped working just two months after purchase. A lodged complaint has been met with "no satisfactory reply" for 35 days, leaving him "highly disappointed."

Mandar Natekar concluded that it is "only a matter of time," noting that "Eureka Forbes has the worst customer service and now their product quality is also slipping."

The strong market reaction and the sheer volume of detailed negative experiences under Shah's post indicate a significant challenge for Eureka Forbes in maintaining customer trust. One user, Mr. X in Bombay, directly advised consumers to switch brands, suggesting LG for water purifiers and Philips for vacuum cleaners due to their "excellent service since last 5 years."

The rare positive note came from a user, Investors Cafe, who mentioned their Eureka Forbes vacuum cleaner purchased from Amazon was "perfectly working," suggesting the company's delivery and product quality is inconsistent, though the overwhelming focus remains on the poor post-sale experience.

The conversation has brought to light a critical problem for the storied consumer brand: a perceived failure in product quality follow-up, coupled with a collapse in customer service, which, as Nilesh Shah noted, tests the very "Power of Brand" to retain loyalty.

Shah's thread, titled "Power of Brand," recounts a three-part saga of disappointment. The first incident involved the purchase of a 'Dr Aquaguard' water purifier in October 2021, which he bought "for the promise of herb infused water." That promise, however, remained "unfulfilled as the product was stopped immediately thereafter."

Undeterred—or as Shah put it, "Once beaten twice shy? No"—he later purchased a 'zerobend MOP N VAC' vacuum cleaner. This device, according to the MD, began leaving scratches on his marble floor. Despite complaining multiple times, he received no solution and had to stop using the product.

The third and most recent incident concerns a new water purifier ordered on September 13th for immediate delivery. Shah detailed the company's sluggish process, stating they only "deposited our cheque on Sept 29th" after follow-up. The issue then shifted to delivery, where the company, initially "kind enough to reply and give dates," has now "stopped replying even on what's app." Shah concluded his post with a rhetorical question: "Thrice beaten four times shy? Well who knows! Brand can win over customer service."

A Torrent of Similar Complaints

The thread rapidly became a platform for other customers to share their own disappointing experiences, suggesting Shah's complaints are far from isolated incidents.

Prateek Jain described the service as "incredibly poor," detailing how a technician, instead of fixing an issue under an Annual Maintenance Contract (AMC), advised him not to buy from the company anymore and instead purchase new filters directly from him at a lower price. Jain ultimately "ended up throwing the purifier."

Amit Kumar called Eureka Forbes "The worst consumer brand today hands down," accusing the company of installing a "timer based limit on their filters" to slow down water flow and force consumers to pay for new filters every 6-9 months—a sign of "early signs of brand demise."

ML Gupta recalled that Eureka Forbes "used to be among the best for service" but has now "lost their key advantage." He cited an unsatisfactory change of tubes and "smelling water" after recently purchasing a two-year AMC.

GAUTAM shared a story of a robotic cleaner that stopped working just two months after purchase. A lodged complaint has been met with "no satisfactory reply" for 35 days, leaving him "highly disappointed."

Mandar Natekar concluded that it is "only a matter of time," noting that "Eureka Forbes has the worst customer service and now their product quality is also slipping."

The strong market reaction and the sheer volume of detailed negative experiences under Shah's post indicate a significant challenge for Eureka Forbes in maintaining customer trust. One user, Mr. X in Bombay, directly advised consumers to switch brands, suggesting LG for water purifiers and Philips for vacuum cleaners due to their "excellent service since last 5 years."

The rare positive note came from a user, Investors Cafe, who mentioned their Eureka Forbes vacuum cleaner purchased from Amazon was "perfectly working," suggesting the company's delivery and product quality is inconsistent, though the overwhelming focus remains on the poor post-sale experience.

The conversation has brought to light a critical problem for the storied consumer brand: a perceived failure in product quality follow-up, coupled with a collapse in customer service, which, as Nilesh Shah noted, tests the very "Power of Brand" to retain loyalty.

#2

Best stocks to buy now / The Ganesh Consumer Saga: A Ca...

Last post by Michael Gonsalves - Oct 11, 2025, 08:29 PMThe recent listing of Ganesh Consumer Products Ltd. has delivered a harsh lesson to investors who blindly followed the steps of market veterans, reigniting the perennial debate about celebrity endorsements and personal due diligence in the stock market. Shares of the Kolkata-based FMCG company, in which prominent investor Ashish Kacholia holds a 1.46% stake, listed at an 8% discount to the IPO price of ₹322, leaving many retail followers "in the red."

The initial public offering (IPO) of ₹409 crore, which closed on September 24, was moderately subscribed 2.68 times overall. The tepid response was largely driven by subdued retail participation, which stood at just 1.17 times, suggesting a degree of caution among small investors from the outset. In contrast, Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs) showed greater interest, subscribing 4.03 and 4.41 times, respectively.

However, for those who did invest, the listing day proved disappointing. The stock opened at ₹295 and ₹296 on the BSE and NSE, respectively, sinking below the anchor investor price of ₹322.

The Blind Following Conundrum

The immediate losses prompted a public exchange on social media between an investor and Ashish Kacholia, who was associated with the stock through his holding. When confronted about the losses, Mr. Kacholia responded with a succinct piece of market wisdom: "Crowd should not follow blindly, right?"

This exchange encapsulates a critical issue in the Indian equity market. While investments by "celebrity investors" generate immediate headlines and draw retail attention, the underlying risks and entry points are often vastly different for an HNIs/QIBs versus a small retail investor. As one user aptly put it, "When celebrity investors invest, they get headlines. When you copy them, you get headaches."

A Buying Opportunity or a Value Trap?

Despite the current negative sentiment and below-par listing, some investors see a silver lining. Proponents of the company point to its strong regional presence, particularly in West Bengal, where it is a dominant FMCG brand for wheat-based derivatives like *atta*, *maida*, and *sooji*, and its diversification into packaged instant mixes and spices. The company's B2C segment drives nearly 77% of its revenue, highlighting its consumer connect.

Financially, Ganesh Consumer reported revenues of ₹855.16 crore in FY25, up 12% year-on-year, with Profit After Tax (PAT) growing 31% to ₹35.43 crore. However, the business operates in a high-volume, low-margin segment, reflected in its FY25 EBITDA margin of 8.61% and PAT margin of 4.17%.

The company plans to use the fresh issue proceeds for debt repayment and setting up a new gram flour manufacturing unit in Darjeeling.

The current situation highlights that while a company's fundamentals and regional dominance (as evidenced by the West Bengal presence) might appeal to long-term value investors, a "star" investor's backing is not a guarantee against short-term volatility or a poor listing. The Ganesh Consumer episode serves as a powerful reminder that every investor, regardless of who they follow, must conduct independent research before committing capital. The risk—and the reward—ultimately belongs to the individual.

The initial public offering (IPO) of ₹409 crore, which closed on September 24, was moderately subscribed 2.68 times overall. The tepid response was largely driven by subdued retail participation, which stood at just 1.17 times, suggesting a degree of caution among small investors from the outset. In contrast, Qualified Institutional Buyers (QIBs) and Non-Institutional Investors (NIIs) showed greater interest, subscribing 4.03 and 4.41 times, respectively.

However, for those who did invest, the listing day proved disappointing. The stock opened at ₹295 and ₹296 on the BSE and NSE, respectively, sinking below the anchor investor price of ₹322.

The Blind Following Conundrum

The immediate losses prompted a public exchange on social media between an investor and Ashish Kacholia, who was associated with the stock through his holding. When confronted about the losses, Mr. Kacholia responded with a succinct piece of market wisdom: "Crowd should not follow blindly, right?"

This exchange encapsulates a critical issue in the Indian equity market. While investments by "celebrity investors" generate immediate headlines and draw retail attention, the underlying risks and entry points are often vastly different for an HNIs/QIBs versus a small retail investor. As one user aptly put it, "When celebrity investors invest, they get headlines. When you copy them, you get headaches."

A Buying Opportunity or a Value Trap?

Despite the current negative sentiment and below-par listing, some investors see a silver lining. Proponents of the company point to its strong regional presence, particularly in West Bengal, where it is a dominant FMCG brand for wheat-based derivatives like *atta*, *maida*, and *sooji*, and its diversification into packaged instant mixes and spices. The company's B2C segment drives nearly 77% of its revenue, highlighting its consumer connect.

Financially, Ganesh Consumer reported revenues of ₹855.16 crore in FY25, up 12% year-on-year, with Profit After Tax (PAT) growing 31% to ₹35.43 crore. However, the business operates in a high-volume, low-margin segment, reflected in its FY25 EBITDA margin of 8.61% and PAT margin of 4.17%.

The company plans to use the fresh issue proceeds for debt repayment and setting up a new gram flour manufacturing unit in Darjeeling.

The current situation highlights that while a company's fundamentals and regional dominance (as evidenced by the West Bengal presence) might appeal to long-term value investors, a "star" investor's backing is not a guarantee against short-term volatility or a poor listing. The Ganesh Consumer episode serves as a powerful reminder that every investor, regardless of who they follow, must conduct independent research before committing capital. The risk—and the reward—ultimately belongs to the individual.

#3

Best stocks to buy now / Ace Investor Vijay Kedia Buys ...

Last post by Michael Gonsalves - Oct 07, 2025, 11:40 PMAce investor Vijay Kedia, known for identifying long-term multibagger opportunities in the mid- and small-cap space, has recently bought 57,441 shares of Eimco Elecon (India) Ltd for approximately ₹19 crore, signaling renewed investor interest in the niche engineering firm.

Company Overview

Eimco Elecon (India) Ltd, part of the Elecon Group, is an established player in the mining and construction equipment segment. The company designs and manufactures a wide range of machinery used in underground and open-cast mining, cement, and construction industries. Its expertise and legacy in mechanical and hydraulic equipment make it a key supplier to India's resource and infrastructure sectors.

Key Financial Metrics

Market Capitalization: ₹1,100 crore

P/E Ratio: 23x — moderate valuation considering niche industrial exposure

Debt Status: Debt-free — strong indicator of financial prudence

Promoter Holding: 73.64% — reflecting strong promoter confidence

Mutual Fund Holding: Nil — the absence of institutional participation suggests potential for future re-rating

Stock Performance

Eimco Elecon's stock has underperformed over the past year, reflecting the broader slowdown in the industrial equipment sector. However, investors with a longer horizon have reaped significant rewards — the stock has delivered an impressive 500%+ return over the last five years. This combination of short-term underperformance and strong long-term growth often attracts contrarian investors like Vijay Kedia.

Why Vijay Kedia's Move Matters

Vijay Kedia's investment philosophy centers around identifying companies with strong management, robust balance sheets, and scalable businesses available at reasonable valuations. His entry into Eimco Elecon aligns with these principles:

The company is debt-free and promoter-driven, ensuring stability.

The engineering-for-mining niche is poised to benefit from India's increasing focus on domestic resource extraction and infrastructure development.

Low institutional ownership leaves room for re-rating once broader markets recognize its potential.

Outlook

While Eimco Elecon operates in a cyclical sector, its clean balance sheet, experienced management, and growing demand for mining and construction machinery could provide a foundation for future growth. With one of India's most respected investors taking a position, market sentiment around the stock may improve in the near term.

Conclusion

Vijay Kedia's latest bet on Eimco Elecon highlights the growing investor interest in niche industrial manufacturers that combine sound financials with long-term potential. Though the stock's short-term trajectory may depend on macro and sectoral factors, its fundamentals and Kedia's backing make it a company worth watching closely.

Company Overview

Eimco Elecon (India) Ltd, part of the Elecon Group, is an established player in the mining and construction equipment segment. The company designs and manufactures a wide range of machinery used in underground and open-cast mining, cement, and construction industries. Its expertise and legacy in mechanical and hydraulic equipment make it a key supplier to India's resource and infrastructure sectors.

Key Financial Metrics

Market Capitalization: ₹1,100 crore

P/E Ratio: 23x — moderate valuation considering niche industrial exposure

Debt Status: Debt-free — strong indicator of financial prudence

Promoter Holding: 73.64% — reflecting strong promoter confidence

Mutual Fund Holding: Nil — the absence of institutional participation suggests potential for future re-rating

Stock Performance

Eimco Elecon's stock has underperformed over the past year, reflecting the broader slowdown in the industrial equipment sector. However, investors with a longer horizon have reaped significant rewards — the stock has delivered an impressive 500%+ return over the last five years. This combination of short-term underperformance and strong long-term growth often attracts contrarian investors like Vijay Kedia.

Why Vijay Kedia's Move Matters

Vijay Kedia's investment philosophy centers around identifying companies with strong management, robust balance sheets, and scalable businesses available at reasonable valuations. His entry into Eimco Elecon aligns with these principles:

The company is debt-free and promoter-driven, ensuring stability.

The engineering-for-mining niche is poised to benefit from India's increasing focus on domestic resource extraction and infrastructure development.

Low institutional ownership leaves room for re-rating once broader markets recognize its potential.

Outlook

While Eimco Elecon operates in a cyclical sector, its clean balance sheet, experienced management, and growing demand for mining and construction machinery could provide a foundation for future growth. With one of India's most respected investors taking a position, market sentiment around the stock may improve in the near term.

Conclusion

Vijay Kedia's latest bet on Eimco Elecon highlights the growing investor interest in niche industrial manufacturers that combine sound financials with long-term potential. Though the stock's short-term trajectory may depend on macro and sectoral factors, its fundamentals and Kedia's backing make it a company worth watching closely.

#4

Best stocks to buy now / Ashish Kacholia’s Early Bet on...

Last post by Michael Gonsalves - Oct 07, 2025, 11:38 PMAce investor Ashish Kacholia, often dubbed the "Big Whale of Midcaps," has struck gold—quite literally—with his early investment in Jain Recycling Ltd. The specialty metals and gold refining company, which went public recently, has delivered a 41% gain from its IPO price of ₹232 per share.

Kacholia, known for spotting high-growth industrial and manufacturing stories before the crowd, was allotted a 1.14% pre-IPO stake in Jain Recycling. That holding, now worth approximately ₹128 crore, underscores his knack for identifying scalable businesses in under-the-radar sectors.

Institutional Frenzy Meets Retail Enthusiasm

The IPO of Jain Recycling witnessed robust institutional demand, with the qualified institutional buyers (QIB) portion oversubscribed 27 times. Analysts attribute this to the company's strong fundamentals and its position in the fast-expanding circular economy value chain.

Post listing, the stock has seen continued buying interest from mutual funds and long-only investors, indicating confidence in the company's long-term profitability.

"Jain Recycling operates in a segment with strong tailwinds — precious metal recovery and responsible waste processing," said a fund manager at a large domestic AMC. "Its efficient refining process and steady margins make it a rare sustainable play in metals."

Business Outlook

Jain Recycling is engaged in recycling non-ferrous metals and refining gold, catering to industries spanning jewelry, electronics, and automotive manufacturing. The company benefits from the growing regulatory push for metal recovery and the rising demand for refined gold in the domestic market.

Analysts expect the firm's margins to expand further as it scales capacity and capitalizes on India's evolving recycling ecosystem.

Kacholia's timely bet reaffirms his reputation for identifying high-quality businesses at an early stage. For Jain Recycling, the strong listing and continued institutional appetite suggest the market is rewarding companies aligned with sustainability, resource efficiency, and India's formalization of the recycling industry.

Kacholia, known for spotting high-growth industrial and manufacturing stories before the crowd, was allotted a 1.14% pre-IPO stake in Jain Recycling. That holding, now worth approximately ₹128 crore, underscores his knack for identifying scalable businesses in under-the-radar sectors.

Institutional Frenzy Meets Retail Enthusiasm

The IPO of Jain Recycling witnessed robust institutional demand, with the qualified institutional buyers (QIB) portion oversubscribed 27 times. Analysts attribute this to the company's strong fundamentals and its position in the fast-expanding circular economy value chain.

Post listing, the stock has seen continued buying interest from mutual funds and long-only investors, indicating confidence in the company's long-term profitability.

"Jain Recycling operates in a segment with strong tailwinds — precious metal recovery and responsible waste processing," said a fund manager at a large domestic AMC. "Its efficient refining process and steady margins make it a rare sustainable play in metals."

Business Outlook

Jain Recycling is engaged in recycling non-ferrous metals and refining gold, catering to industries spanning jewelry, electronics, and automotive manufacturing. The company benefits from the growing regulatory push for metal recovery and the rising demand for refined gold in the domestic market.

Analysts expect the firm's margins to expand further as it scales capacity and capitalizes on India's evolving recycling ecosystem.

Kacholia's timely bet reaffirms his reputation for identifying high-quality businesses at an early stage. For Jain Recycling, the strong listing and continued institutional appetite suggest the market is rewarding companies aligned with sustainability, resource efficiency, and India's formalization of the recycling industry.

#5

Best stocks to buy now / A no-cost options strategy to ...

Last post by Michael Gonsalves - Jan 27, 2024, 04:23 PMAccording to the article A no-cost options strategy to get long Tesla if this sell-off is just an emotional overreaction in CNBC, traders who want to benefit from the correction in Tesla shares can deploy an options strategy if they feel that the correction is overdone. The technicals are also showing an oversold condition.

The recommended options trade strategy is a credit spread, better known as a risk reversal. This credit spread can be established by selling an at-the-money put and using the premium collected in writing that put option to buy an upside out-of-the-money call. The same expiration will be used for both the put and the call options. Tesla Risk Reversal: Sold the regular expiration March $185 put for $11.00 (collected) Bought the regular expiration March $200 call for $6.50 The result in the sale of the ATM $185 put and the purchase of the upside $200 call results in a credit spread collecting $4.50 or $450 every one lot.

The recommended options trade strategy is a credit spread, better known as a risk reversal. This credit spread can be established by selling an at-the-money put and using the premium collected in writing that put option to buy an upside out-of-the-money call. The same expiration will be used for both the put and the call options. Tesla Risk Reversal: Sold the regular expiration March $185 put for $11.00 (collected) Bought the regular expiration March $200 call for $6.50 The result in the sale of the ATM $185 put and the purchase of the upside $200 call results in a credit spread collecting $4.50 or $450 every one lot.

#6

Our Current Trades / High Probability Iron Condor E...

Last post by Michael Gonsalves - Jan 27, 2024, 04:15 PMAccording to an article in CNBC (link), the historical price movements of Netflix post the last five earnings events reveals a trend, namely, that most earnings-related shifts are typically confined within a 10% range. However, there are outliers like the 13% move on Oct. 19, 2022 and the 16% move on Oct. 19, 2023. These outliers show Netflix's inherent volatility.

It is also stated that the price movement after earnings in January of the previous year was recorded at 8.5%. This historical context provides insights into the potential magnitude of market reactions following the upcoming earnings announcement.

One can take advantage of the increase in implied volatility (IV) which causes an increase in the prices of options expiring shortly after the event. Once earnings are announced the IV (implied volatility) of the options declines forcefully. This is instantly reflected in options pricing on the following day after earnings, and options lose all this inflated juice thereby dropping drastically in value. This is also known as "IV Crush".

The trade recommended is an "Iron Condor". An earnings iron condor Selling an iron condor is an options trading strategy where you simultaneously sell out-of-the-money call spreads and put spreads. Since you are selling spreads (instead of selling naked calls and puts, your risk and reward are both defined at the time of entry).

To construct this trade, a trader can sell a put spread of $485 (current price) – $38 (expected move) on the expectation that NFLX will not drop below $447. To add some more buffer to this, the trader could sell a $435 put option and buy a $420 put option at the same time (thereby constructing put spread side of the trade).

On the same logic, the call spread can be $485 (current price) + $38 (expected move) is $523. We could add some more buffer to this and sell a $535 call option and buy a 540 call option simultaneously.

Trade Structure and Analysis:

SELL -1 NFLX 535-540 C\u002F435-430 P Iron Condor CREDIT (also max profit): $140 MAX LOSS: $360 Trade

Execution: These post-earnings trades are quick. Traders put them on 1 to 2 hours before the market close on the day earnings are about to be announced. This maximizes the premium one will capture on the trade. You may notice that the premium you are receiving goes up the longer you wait to put on this trade.

Note that the put side has a 88% probability of success and the call side has approximately 80% probability of success. Those are very good odds. However, as is the nature of high probability trading, the risk is higher than the max profit. So, we need to have clearly defined risk-reward targets for this trade.

It is also stated that these trades are high probability trades and so 8 out of every 10 trades are expected to become winners. However, there must be a pre-determined stop loss.

It is also stated that the price movement after earnings in January of the previous year was recorded at 8.5%. This historical context provides insights into the potential magnitude of market reactions following the upcoming earnings announcement.

One can take advantage of the increase in implied volatility (IV) which causes an increase in the prices of options expiring shortly after the event. Once earnings are announced the IV (implied volatility) of the options declines forcefully. This is instantly reflected in options pricing on the following day after earnings, and options lose all this inflated juice thereby dropping drastically in value. This is also known as "IV Crush".

The trade recommended is an "Iron Condor". An earnings iron condor Selling an iron condor is an options trading strategy where you simultaneously sell out-of-the-money call spreads and put spreads. Since you are selling spreads (instead of selling naked calls and puts, your risk and reward are both defined at the time of entry).

To construct this trade, a trader can sell a put spread of $485 (current price) – $38 (expected move) on the expectation that NFLX will not drop below $447. To add some more buffer to this, the trader could sell a $435 put option and buy a $420 put option at the same time (thereby constructing put spread side of the trade).

On the same logic, the call spread can be $485 (current price) + $38 (expected move) is $523. We could add some more buffer to this and sell a $535 call option and buy a 540 call option simultaneously.

Trade Structure and Analysis:

SELL -1 NFLX 535-540 C\u002F435-430 P Iron Condor CREDIT (also max profit): $140 MAX LOSS: $360 Trade

Execution: These post-earnings trades are quick. Traders put them on 1 to 2 hours before the market close on the day earnings are about to be announced. This maximizes the premium one will capture on the trade. You may notice that the premium you are receiving goes up the longer you wait to put on this trade.

Note that the put side has a 88% probability of success and the call side has approximately 80% probability of success. Those are very good odds. However, as is the nature of high probability trading, the risk is higher than the max profit. So, we need to have clearly defined risk-reward targets for this trade.

It is also stated that these trades are high probability trades and so 8 out of every 10 trades are expected to become winners. However, there must be a pre-determined stop loss.

#7

Our Current Trades / Re: I lost Rs. 23.71 lakh due ...

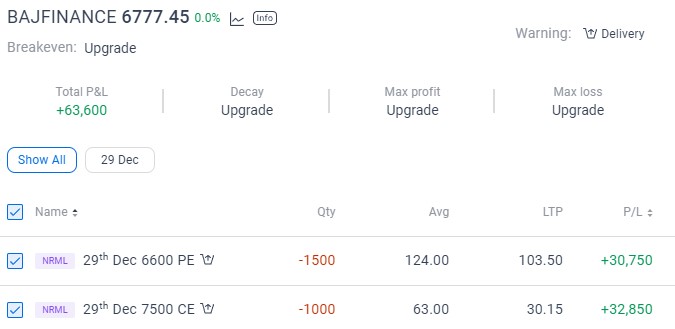

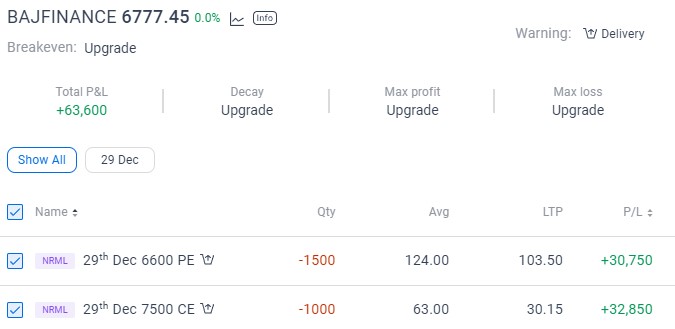

Last post by Michael Gonsalves - Nov 30, 2022, 09:19 AMMacquarie on Bajaj Fin

U-P, TP Rs 5275

Weakening cross-sell franchise & co's weaker digital footprint will affect loan growth going ahead

Expect RoA to moderate from 4.6% in FY23E to 4.2% over FY23-25E, while consensus builds no moderation

Risk-reward unfavourable @6.4x FY24E BV

https://twitter.com/nimeshscnbc/status/1597778991313997825

U-P, TP Rs 5275

Weakening cross-sell franchise & co's weaker digital footprint will affect loan growth going ahead

Expect RoA to moderate from 4.6% in FY23E to 4.2% over FY23-25E, while consensus builds no moderation

Risk-reward unfavourable @6.4x FY24E BV

https://twitter.com/nimeshscnbc/status/1597778991313997825

#8

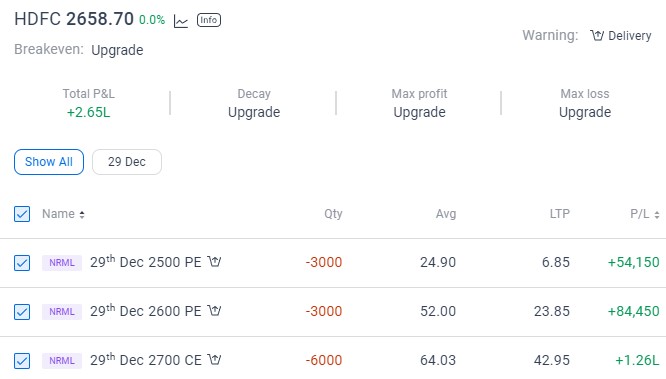

Our Current Trades / Re: I lost Rs. 23.71 lakh due ...

Last post by Michael Gonsalves - Nov 29, 2022, 08:31 AMBajaj Finance has lost a bit of ground. The 6800 Put came into the money. However, instead of delivering the stock, I rolled it down to the 6600PE. Hopefully the stock will stay above that till the Nov expiry.

#9

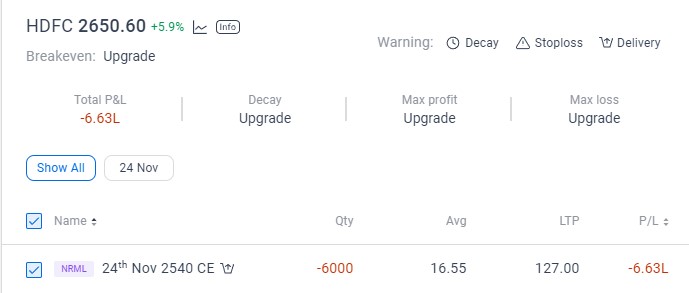

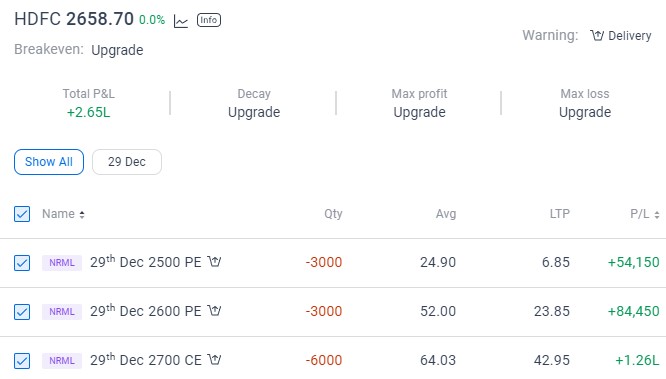

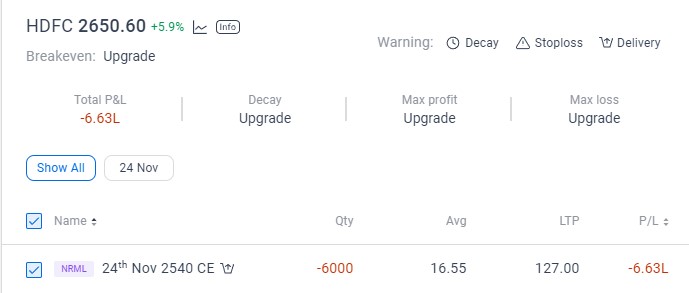

Our Current Trades / Re: Loss of Rs 6.63 Lakh due t...

Last post by Michael Gonsalves - Nov 29, 2022, 08:26 AMI didn't want to give delivery as the stock is worth keeping and there would be a liability for capital gains tax in case I delivered it. So, I covered the position and absorbed the loss. I have sold Calls and Puts and hope to recover the loss in the next few months.

#10

Our Current Trades / Loss of Rs 6.63 Lakh due to co...

Last post by Michael Gonsalves - Nov 11, 2022, 03:26 PMI have sold 6000 2540CE Calls in HDFC Ltd for Rs 16.55 each. Today, the stock surged nearly 6% to Rs 2650. This was because the DOW had surged 900 points (3%) yesterday because inflation is falling. Also, news came in that under the amended MSCI M&A RULES, HDFC, HDFC BANK Merged entity can see double the current MSCI weight. MSCI Weight post merger can go from 5.78% to 13%. Adjustment factor of 1x applicable instead of 0.5x.

https://twitter.com/YatinMota/status/1590940849302802434

The result is that I am bleeding profusely from the short calls.

I have the stock in my portfolio and will give delivery in case adjustment is not feasible.

https://twitter.com/YatinMota/status/1590940849302802434

The result is that I am bleeding profusely from the short calls.

I have the stock in my portfolio and will give delivery in case adjustment is not feasible.