Title: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 07, 2021, 08:47 PM

Post by: Michael Gonsalves on Oct 07, 2021, 08:47 PM

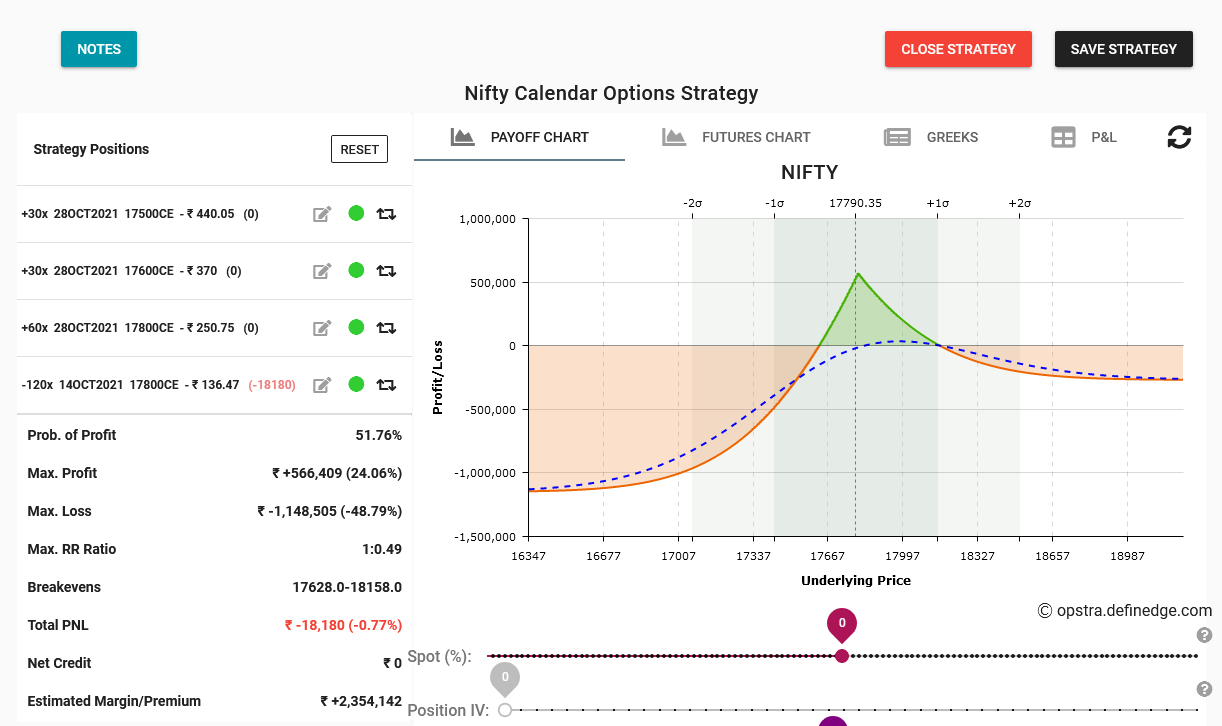

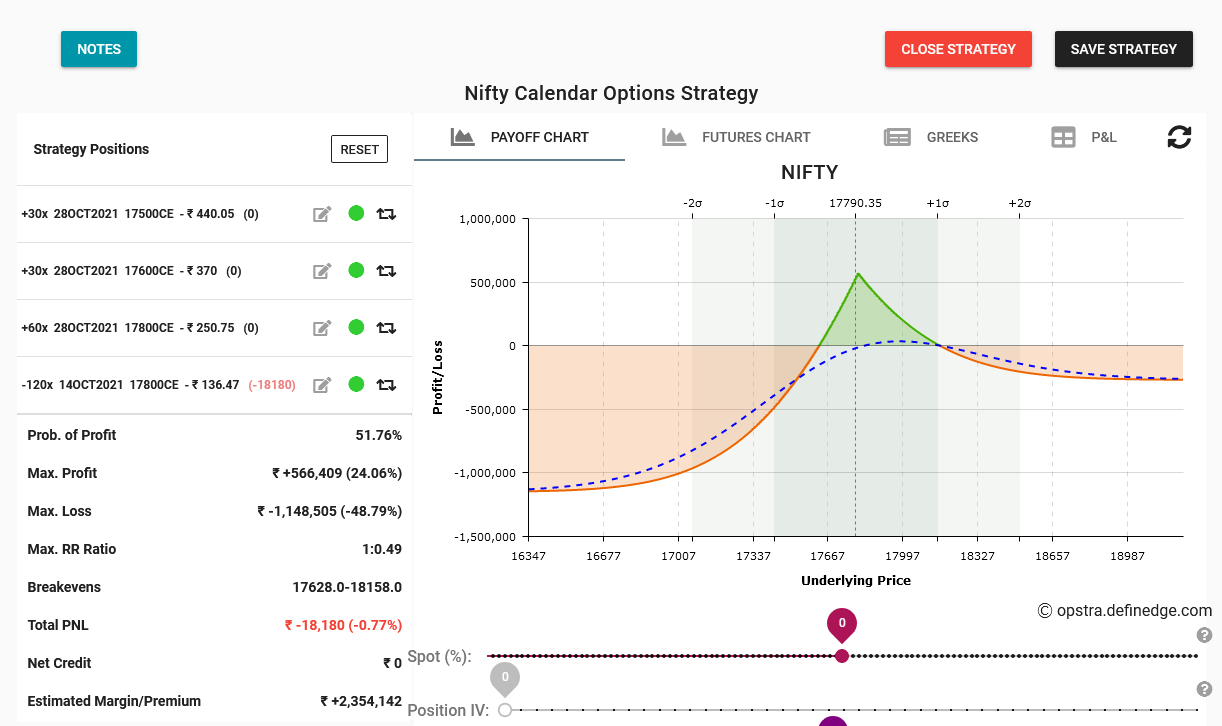

My Calendar trade for the week ended 7th October was a fiasco. When the market plunged, I heavily sold many naked CE options. I also rolled down the short positions. However, when the market reversed and surged, I was caught on the backfoot and had to roll up the positions.

Ultimately, there were so many adjustments that I lost track of what I was doing and should be doing.

This week, I intend to be very disciplined and not make any adjustments until the Break even point is reached.

Ultimately, there were so many adjustments that I lost track of what I was doing and should be doing.

This week, I intend to be very disciplined and not make any adjustments until the Break even point is reached.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 08, 2021, 08:37 PM

Post by: Michael Gonsalves on Oct 08, 2021, 08:37 PM

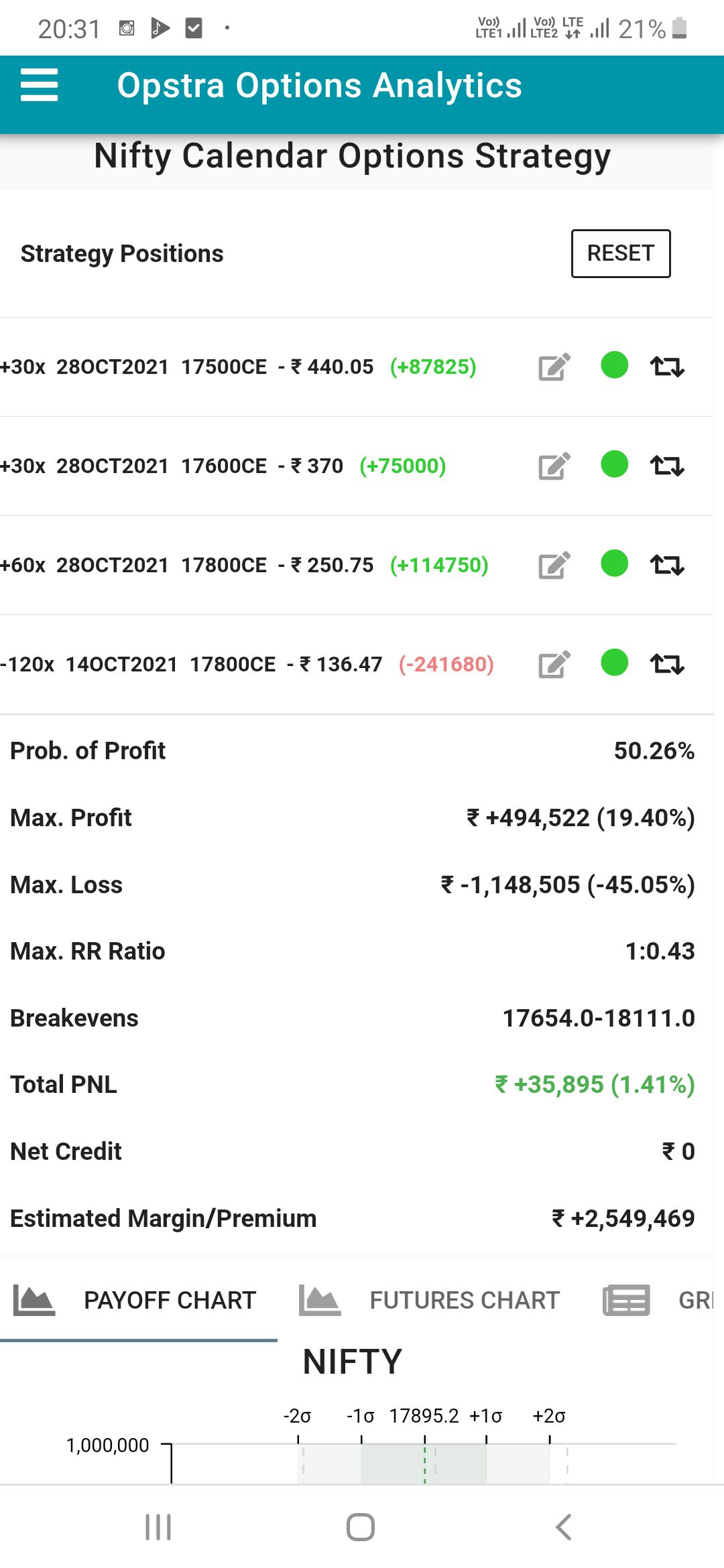

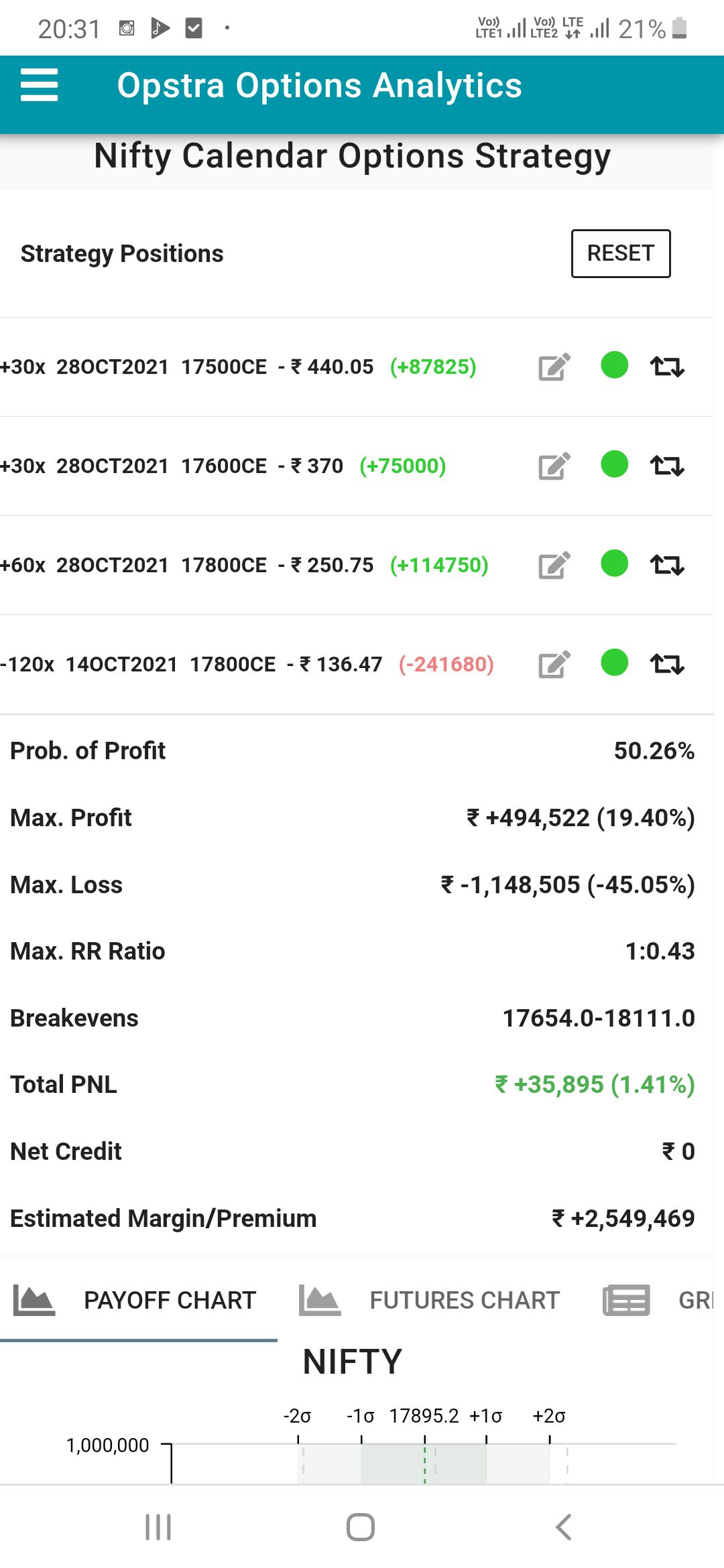

As of today, the short call at 17800 is bleeding profusely though it is more than compensated by the long calls. The strategy is presently showing a MTM gain of Rs 35000 which is about 1.5% of the margin deployed. Hopefully, if the market stagnates in the next few days, more gains may be available.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 11, 2021, 06:45 PM

Post by: Michael Gonsalves on Oct 11, 2021, 06:45 PM

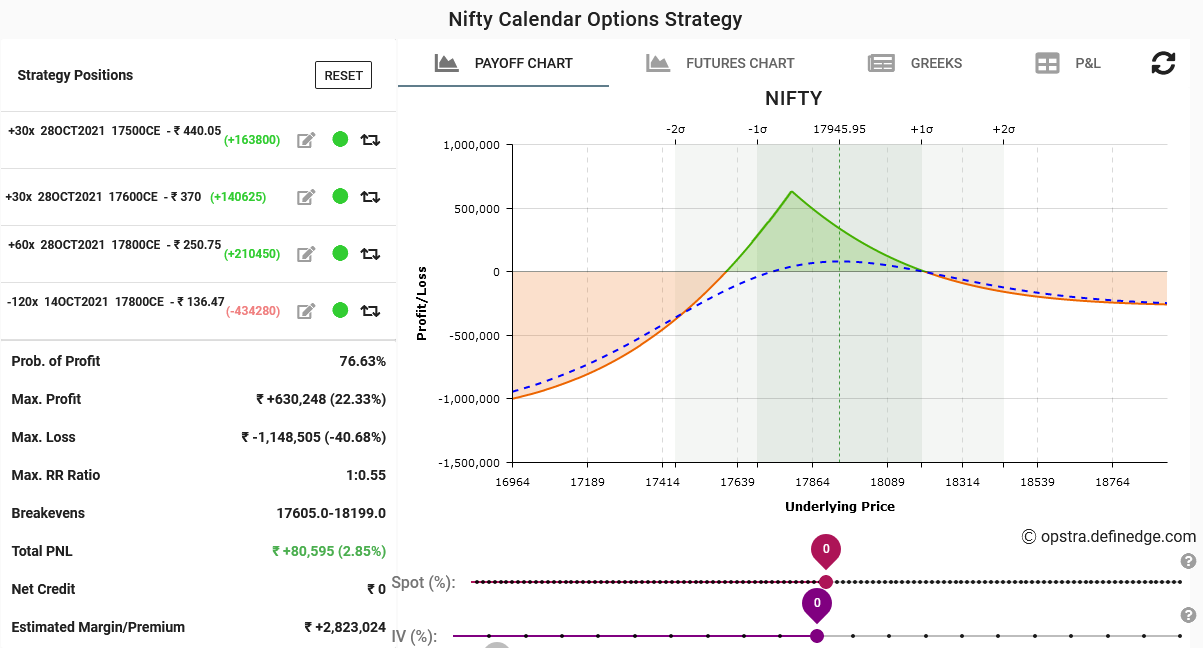

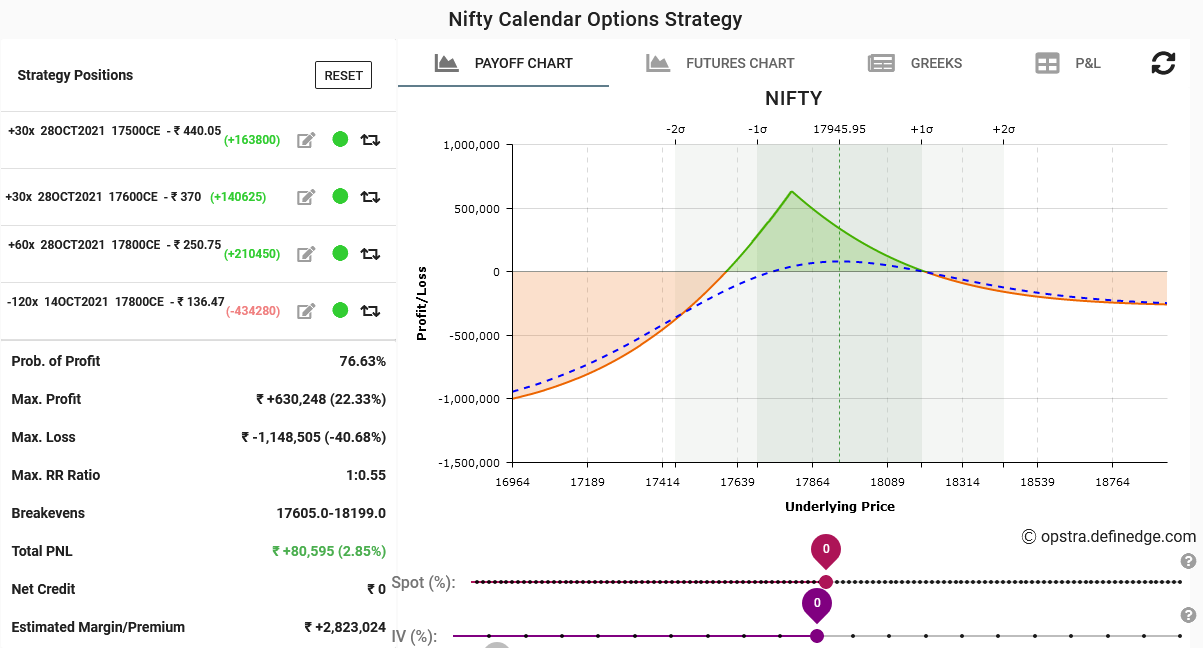

When the market crosses 18000 today, I was tempted to make some sort of adjustment because my short call was bleeding profusely. Luckily, I restrained myself, remembering my promise to stay disciplined and not make any adjustments until the BEPs are breached.

This was a fortuitous decision because the Nifty later retraced to 17945, coupled with a mild increase in the ViX.

This led my position to show a MTM of Rs. 80000.

This was a fortuitous decision because the Nifty later retraced to 17945, coupled with a mild increase in the ViX.

This led my position to show a MTM of Rs. 80000.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 12, 2021, 04:12 PM

Post by: Michael Gonsalves on Oct 12, 2021, 04:12 PM

The steep surge in the Nifty has put my Calendar in a precarious position though it is still in the green by about 1.5%. In hindsight, it might have been better to shift the short strike upward as it would have bled less as compared to the present one which is dèep ITM.

Tomorrow, i might square off the Calendar and open a new one at 18000.

Tomorrow, i might square off the Calendar and open a new one at 18000.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 13, 2021, 11:50 AM

Post by: Michael Gonsalves on Oct 13, 2021, 11:50 AM

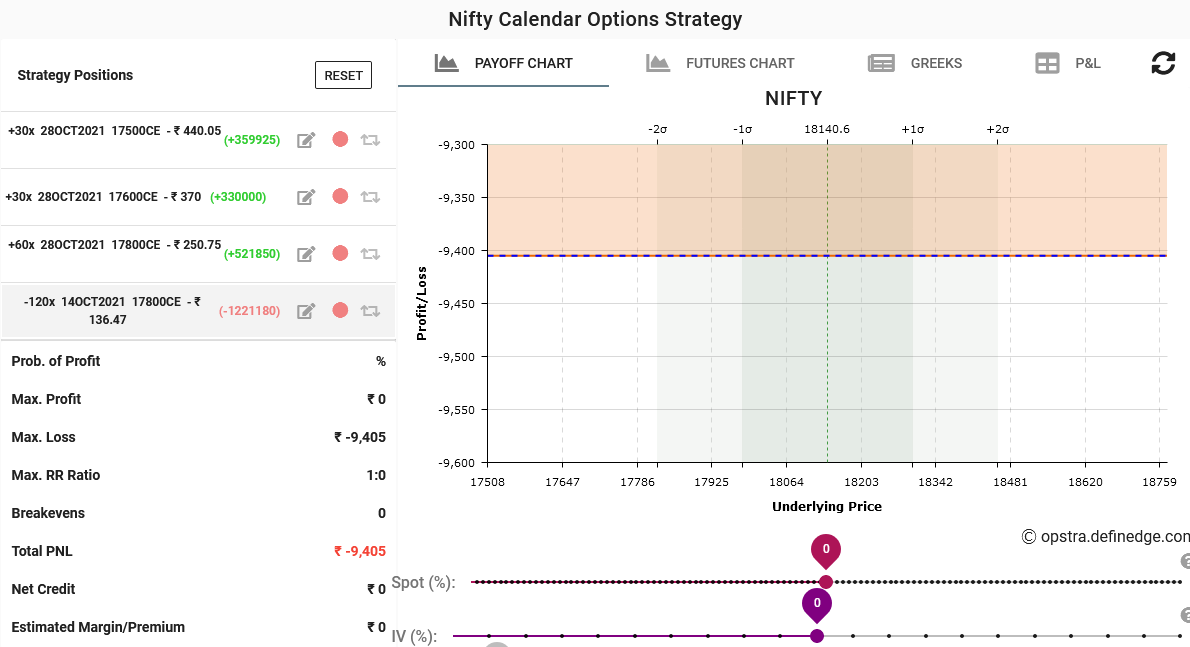

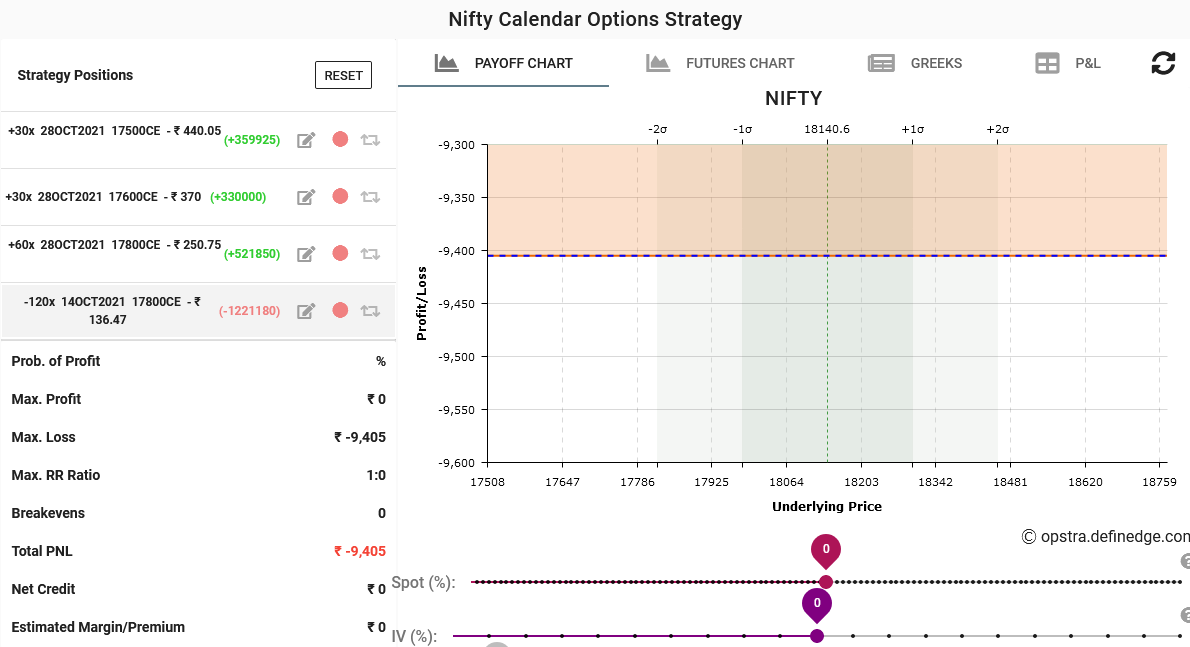

The surge in the Nifty to 18140, led by the 19% rise in Tata Motors, took my Calendar beyond the upper BEP. I squared off all the positions in the Calendar so as to be able to think straight and without pressure.

Luckily, though my short call of 17800 was deep ITM, I escaped with a nominal loss of Rs. 9500.

Luckily, though my short call of 17800 was deep ITM, I escaped with a nominal loss of Rs. 9500.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 13, 2021, 09:19 PM

Post by: Michael Gonsalves on Oct 13, 2021, 09:19 PM

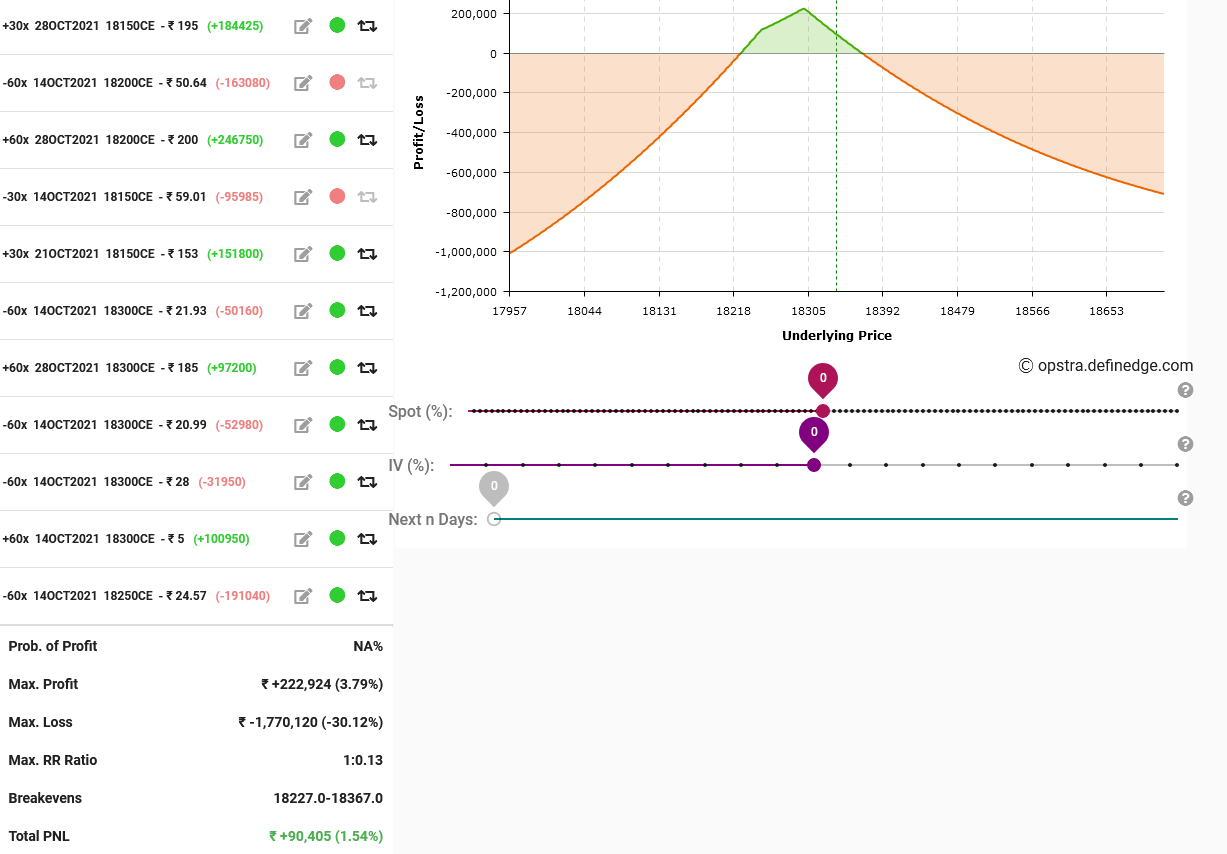

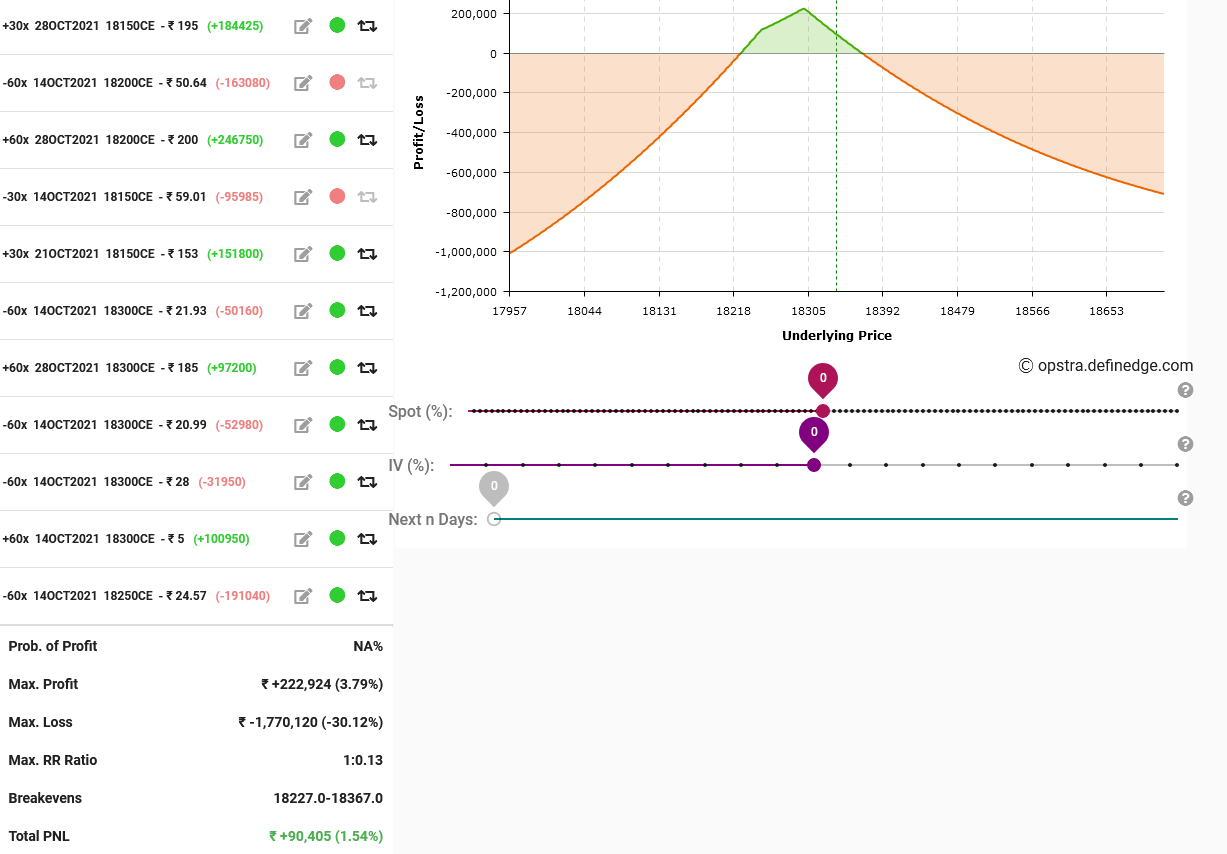

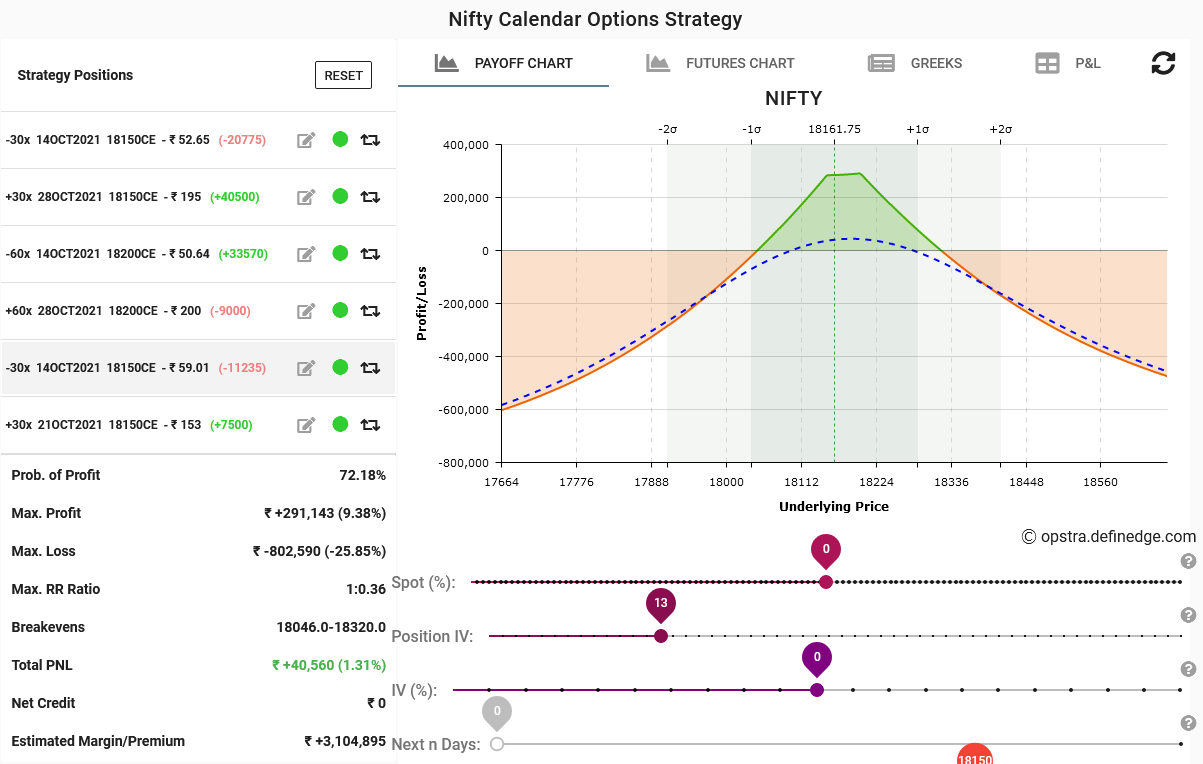

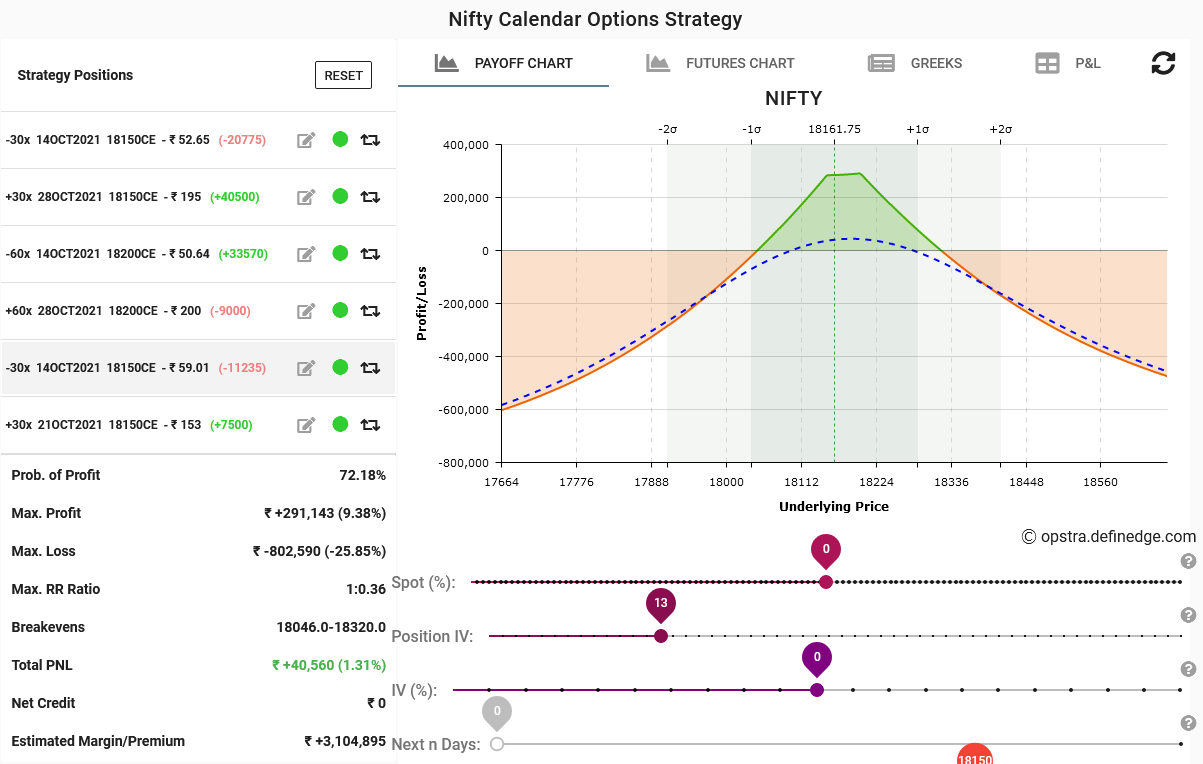

I opened a new Calendar on the Nifty at 18150 and 18200. My timing was fortuitous because the decay coupled with an increase in the ViX led to a MTM gain of about Rs. 40000.

Title: Re: Week ending 14th Oct: Calendar in the Nifty

Post by: Michael Gonsalves on Oct 14, 2021, 07:28 PM

Post by: Michael Gonsalves on Oct 14, 2021, 07:28 PM

The Calendar yielded a gain of Rs. 90,000. The profits were truncated because of the fall in ViX.