- Welcome to Traders & Investors Paradise.

Recent posts

#51

Guides & Tutorials / Kavita, Options trader, is ear...

Last post by Babul - Sep 11, 2022, 07:10 PMKavita quickly mastered the ropes in options strategies and was able to generate decent return on her capital. Calling herself a positional trader Kavita trades on weekly and monthly options.

She got a formal understanding of other aspects of trading during a training session conducted by a brokerage on Futures and Options in 2016. Kavita then started trading in futures but lost a good amount of money doing so. Simultaneously, she also started reading about what mutual funds and what big investors did to recover the losses. It was then she discovered the covered call options strategy.

Despite her success in trading, she believes that one's source of income should not be just trading.

She ardently said that one must have an additional source of income instead of relying completely on the stock market. To newbies in stock market her advice: Keep working and keep the stock market as your side hustle, till you have gathered enough fund, knowledge and confidence in the stock market.

Kavita too had her fair share of losses too. Her biggest-ever loss in the stock market was ₹8 lakh.

However, through her learning and experience, she now generates decent returns through options trading annually. Kavita's biggest gain in options trading has been ₹14 lakh in a single day to date.

https://www.livemint.com/market/stock-market-news/from-a-tutor-to-techie-to-earnings-millions-from-stock-market-trading-kavita-options-traderkavitastocks-11662860170947.html

She got a formal understanding of other aspects of trading during a training session conducted by a brokerage on Futures and Options in 2016. Kavita then started trading in futures but lost a good amount of money doing so. Simultaneously, she also started reading about what mutual funds and what big investors did to recover the losses. It was then she discovered the covered call options strategy.

Despite her success in trading, she believes that one's source of income should not be just trading.

She ardently said that one must have an additional source of income instead of relying completely on the stock market. To newbies in stock market her advice: Keep working and keep the stock market as your side hustle, till you have gathered enough fund, knowledge and confidence in the stock market.

Kavita too had her fair share of losses too. Her biggest-ever loss in the stock market was ₹8 lakh.

However, through her learning and experience, she now generates decent returns through options trading annually. Kavita's biggest gain in options trading has been ₹14 lakh in a single day to date.

https://www.livemint.com/market/stock-market-news/from-a-tutor-to-techie-to-earnings-millions-from-stock-market-trading-kavita-options-traderkavitastocks-11662860170947.html

#52

Guides & Tutorials / Bank Nifty Option 2.20 Trading...

Last post by Babul - Sep 11, 2022, 05:27 PMBank Nifty Option 93 Lakh strategy !! Bank Nifty Option 2.20 Trading Strategy

Ghanshyam has explained his new trading strategy.

Ghanshyam has explained his new trading strategy.

#53

Guides & Tutorials / A 21 Years College Kid has cla...

Last post by Babul - Sep 11, 2022, 05:20 PMA 21 Years College Kid has claimed to have made 1.4 CRORE from Rs. 40K in Just 9 Months.

#54

Our Current Trades / Re: Week ended 15th September:...

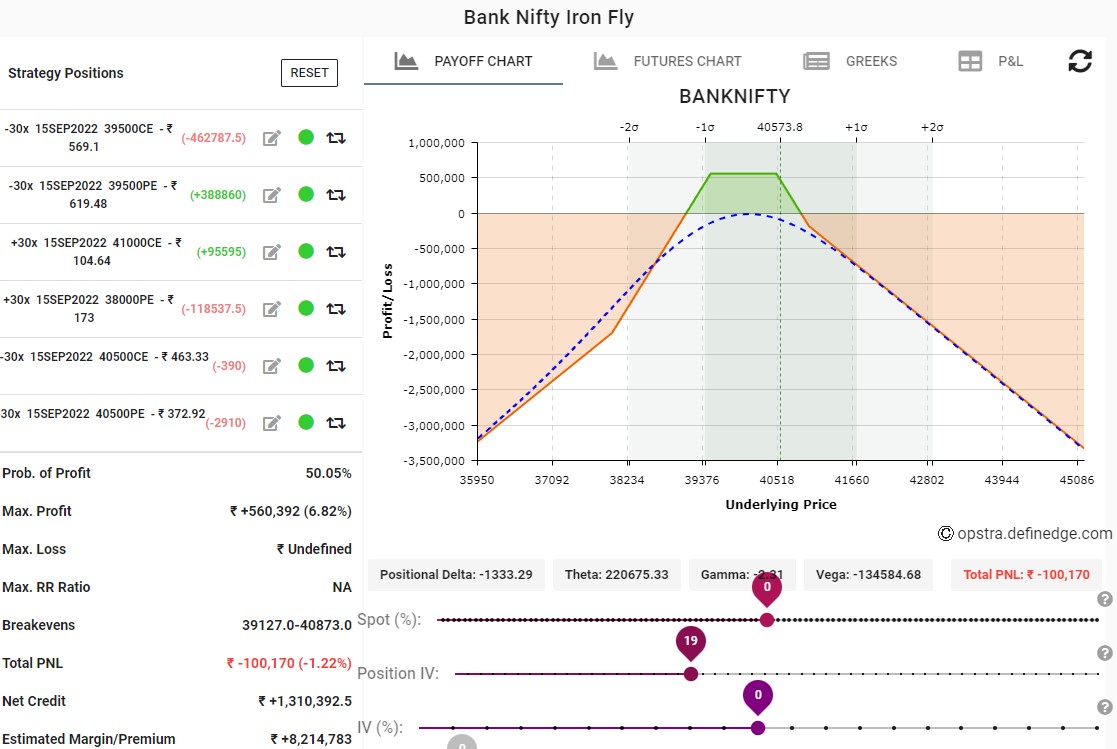

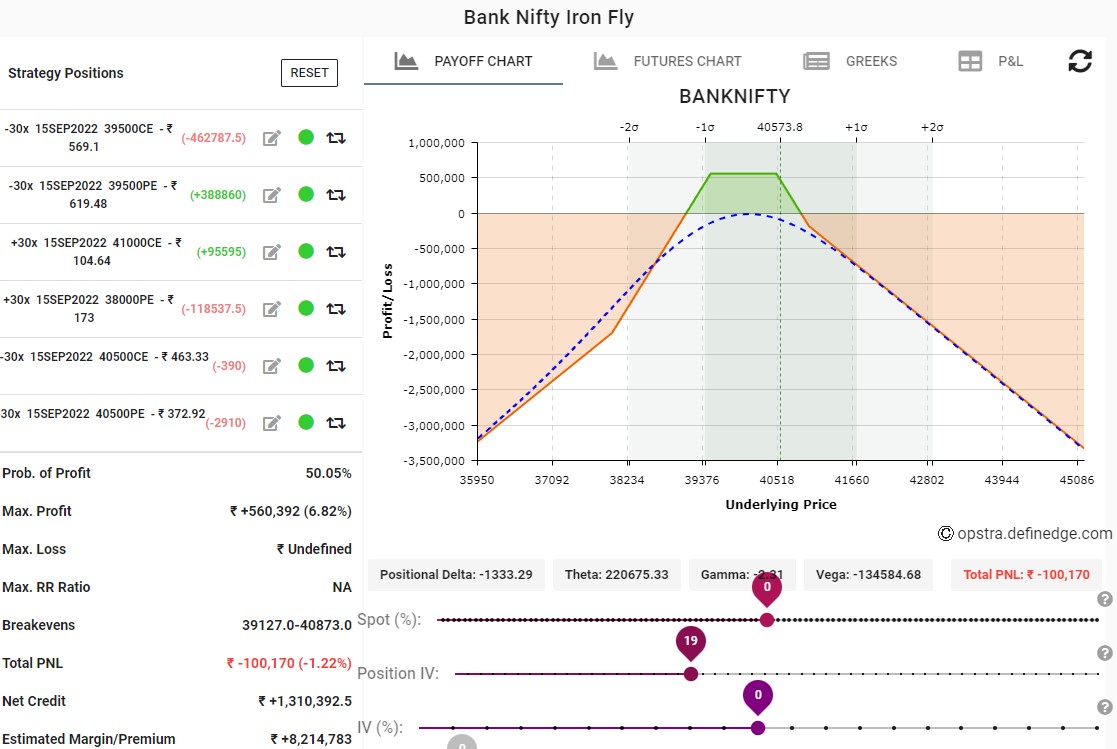

Last post by Michael Gonsalves - Sep 09, 2022, 09:32 AMThe Bank Nifty opened gap-up at 40500, putting my Iron Fly into a deep loss of Rs 1 Lakh. I added a straddle at 40500 which extends my BEP on the upside to 40873. If there is some retracement, the Iron Fly will be back in the green.

#55

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 08, 2022, 09:55 PMThe Iron Fly was in good profit of about Rs 60000 till yesterday. However, today's 750 point surge in the Bank Nifty spoilt the show and led to a MTM loss of about Rs 27000. The spot is at 40200 while the Breakeven is at 40400. The best option is to square off the Fly and open a new one at the spot.

#56

Our Current Trades / Re: Net Profit Rs 67 Lakh from...

Last post by Babul - Sep 04, 2022, 05:55 PMThis is actually a mediocre and sub-par performance. A trader on twitter has claimed to have earned Rs. 1.13 crore in the month of August itself which is a whopping 23% return. See the post I put here

https://zerodha.trade/index.php?topic=98.msg220#new

https://zerodha.trade/index.php?topic=98.msg220#new

#57

Guides & Tutorials / Aakanksha Gupta made Rs 1.13 c...

Last post by Babul - Sep 04, 2022, 05:51 PMAakanksha Gupta, who goes by the name of @aakankshalovely on twitter has claimed that in the August Expiry she made Rs. 1.13 crore on capital of 4.69 crore. "ROI is 23%. Nifty rose by 3% and BN by 4%. So outperformed the indexes by wide margin.I play very aggressive in my own account and this sort of return is only due to that, she said.

https://twitter.com/aakankshalovely/status/1565915777525583872

https://twitter.com/aakankshalovely/status/1565915777525583872

#58

Guides & Tutorials / Options trading strategy of an...

Last post by Babul - Sep 04, 2022, 05:47 PMThe preparation for my trading starts a night before. Since I mainly trade in indices, I look at the Nifty and the Bank Nifty charts on various timeframes at hourly, 5 minutes and 15 minutes to give me an idea of the short term trend.

I then go through scenario planning, keeping ready my action plans based on various scenarios. If for instance, I get a trend wrong and the market moves in the other direction, I will have a Plan B ready to tackle the situation.

If by looking at the charts I expect the market to rally the next day, I will be ready with the Put strikes which I will be shorting, keeping in mind the support levels. I will enter the trade when the charts agree, with a stop loss below the support line, depending on the timeframe I am trading on.

Now if the stop loss at the support level is hit, I will trade according to the back-up plan or Plan B. This way I am ready with a plan to act upon the situation, rather than react to it, which helps to avert a panic decision.

Now that the market has taken me out of the long position and if it is falling on good volumes, I will be selling call options keeping my stop loss at the same support level, which now acts as a resistance level.

While trading intra-day, I trade based on price action. Various setups are there depending on the market condition. I also use some overlays on my chart like VWAP (volume weighted average based price), volume, 20-period exponential moving average (EMA) for trailing my trades and the 200-period EMA for support and resistance. At times, I also use open interest.

The important levels to watch out for are the previous day's VWAP close and the previous day's high and low levels. I trade based on how price behaves around these levels.

The chart below of August 31, 2020, explains how I trade based on price actions and the levels lust mentioned.

For overnight trades when the market has moved up sharply, I am ready for it to consolidate. This is the time when I trade by selling Straddles (call and put options of the same strike) and Strangles (OTM call and put options).

But if the market stays range-bound for 3-4 days, I get cautious and prepare myself for a breakout from the range on either side. I will be ready to cut my loss-making trade and add more in the direction of the trend.

As an option seller, it is important to know when to use which strategy. One cannot trade with a one-strategy-fits-all scenario

Q: Can you tell us about your trading statistics and drawdowns?

A. An option seller always has a good win-loss ratio as time plays in favour of the option seller. The problem area is the average win to average loss, which is where the discipline of keeping a hard stop comes into play.

I then go through scenario planning, keeping ready my action plans based on various scenarios. If for instance, I get a trend wrong and the market moves in the other direction, I will have a Plan B ready to tackle the situation.

If by looking at the charts I expect the market to rally the next day, I will be ready with the Put strikes which I will be shorting, keeping in mind the support levels. I will enter the trade when the charts agree, with a stop loss below the support line, depending on the timeframe I am trading on.

Now if the stop loss at the support level is hit, I will trade according to the back-up plan or Plan B. This way I am ready with a plan to act upon the situation, rather than react to it, which helps to avert a panic decision.

Now that the market has taken me out of the long position and if it is falling on good volumes, I will be selling call options keeping my stop loss at the same support level, which now acts as a resistance level.

While trading intra-day, I trade based on price action. Various setups are there depending on the market condition. I also use some overlays on my chart like VWAP (volume weighted average based price), volume, 20-period exponential moving average (EMA) for trailing my trades and the 200-period EMA for support and resistance. At times, I also use open interest.

The important levels to watch out for are the previous day's VWAP close and the previous day's high and low levels. I trade based on how price behaves around these levels.

The chart below of August 31, 2020, explains how I trade based on price actions and the levels lust mentioned.

For overnight trades when the market has moved up sharply, I am ready for it to consolidate. This is the time when I trade by selling Straddles (call and put options of the same strike) and Strangles (OTM call and put options).

But if the market stays range-bound for 3-4 days, I get cautious and prepare myself for a breakout from the range on either side. I will be ready to cut my loss-making trade and add more in the direction of the trend.

As an option seller, it is important to know when to use which strategy. One cannot trade with a one-strategy-fits-all scenario

Q: Can you tell us about your trading statistics and drawdowns?

A. An option seller always has a good win-loss ratio as time plays in favour of the option seller. The problem area is the average win to average loss, which is where the discipline of keeping a hard stop comes into play.

#59

Our Current Trades / Re: I lost Rs. 23.71 lakh due ...

Last post by Michael Gonsalves - Sep 04, 2022, 02:50 PMI want to buy back Bajaj Finance and so I have sold Puts. I had sold 2000 Puts in the August expiry which expired out of the money. I made about Rs 2 lakh or odd from it.

In the September expiry, I have sold 2250 Puts which will make me Rs. 3.28 lakh if Bajaj Finance closes above Rs 7000. I had also sold 1000 Calls of the strike price of Rs 8000 which will make me Rs 42000.

Of course, this is not a speculative bet. I have the funds to take delivery if the stocks falls for some reason. I also have the stock in my portfolio to give delivery.

In the September expiry, I have sold 2250 Puts which will make me Rs. 3.28 lakh if Bajaj Finance closes above Rs 7000. I had also sold 1000 Calls of the strike price of Rs 8000 which will make me Rs 42000.

Of course, this is not a speculative bet. I have the funds to take delivery if the stocks falls for some reason. I also have the stock in my portfolio to give delivery.

#60

Our Current Trades / Week ended 15th September: Iro...

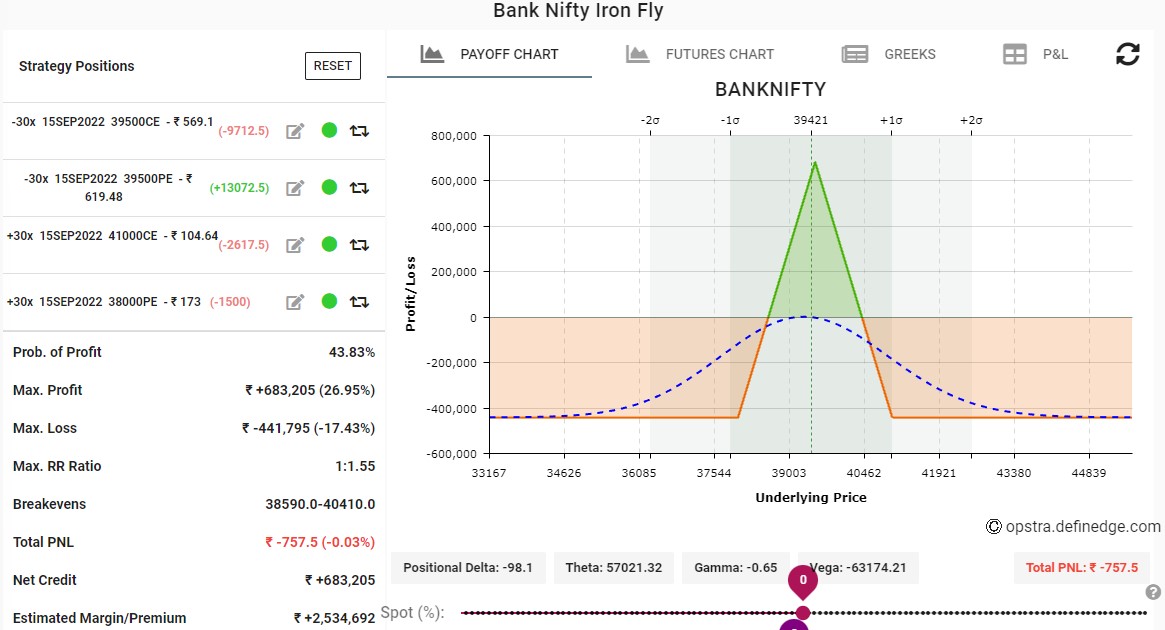

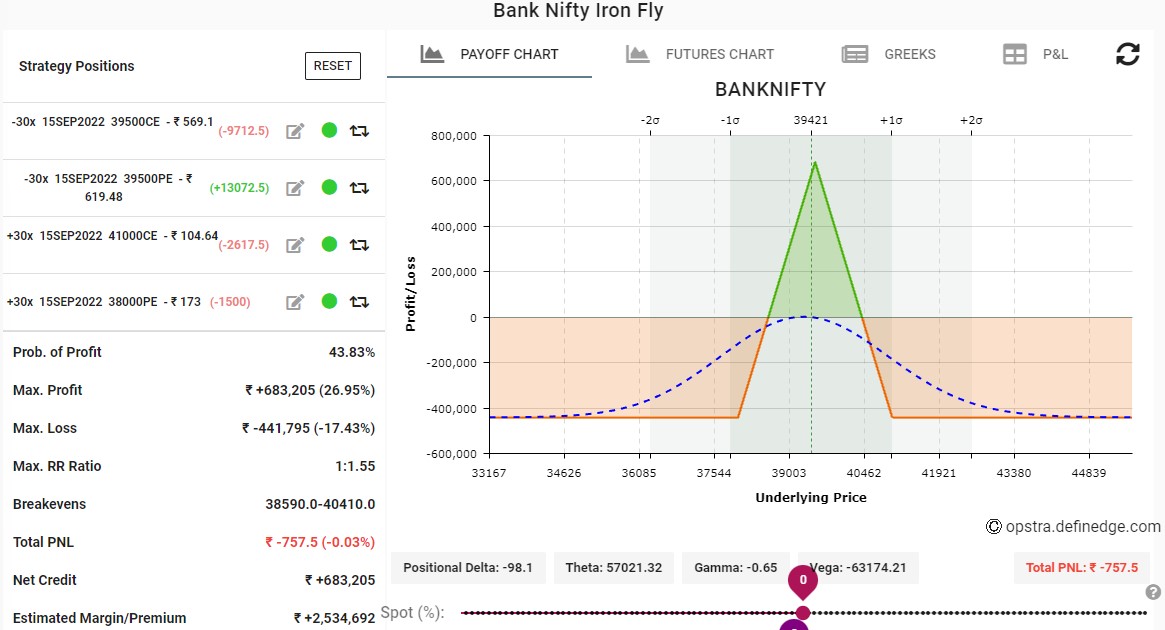

Last post by Michael Gonsalves - Sep 04, 2022, 01:57 PMOn Friday, 2nd September, the ViX was quite high at 19.55 in view of the Jobs report which was due to be presented that night in the USA.

So, I deployed an Iron Fly in the Bank Nifty. I chose the 15th September expiry so that I would have enough room to maneuver if things go haywire.

The spot is at 39400. The Break Evens are quite wide at 38950 (-2.1%) and 40400 (+2.5%).

Hopefully, if the ViX cools down and there is no aggressive movement on either side, I can take home a packet.

So, I deployed an Iron Fly in the Bank Nifty. I chose the 15th September expiry so that I would have enough room to maneuver if things go haywire.

The spot is at 39400. The Break Evens are quite wide at 38950 (-2.1%) and 40400 (+2.5%).

Hopefully, if the ViX cools down and there is no aggressive movement on either side, I can take home a packet.