- Welcome to Traders & Investors Paradise.

Recent posts

#91

Our Current Trades / Week ended 16th December: OTM ...

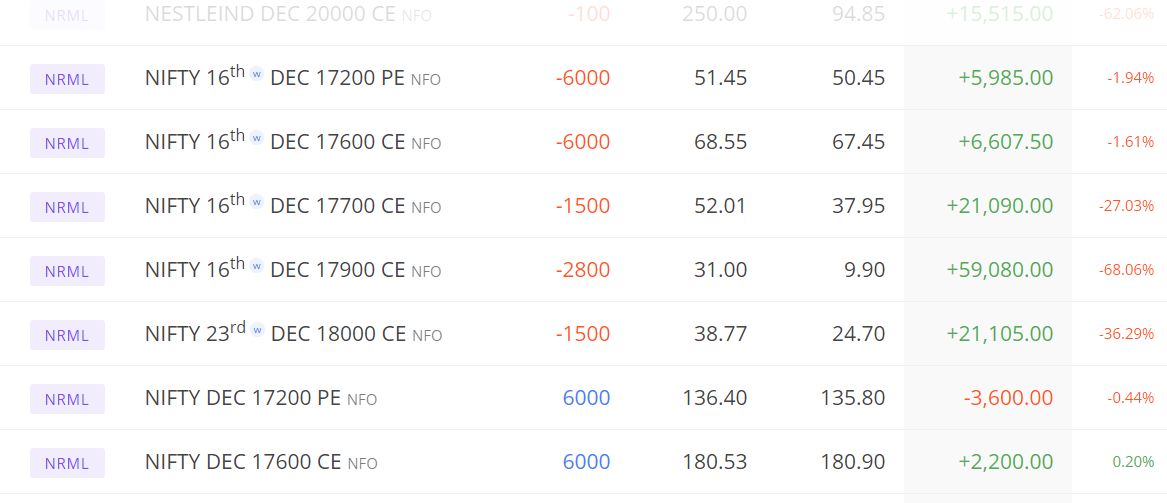

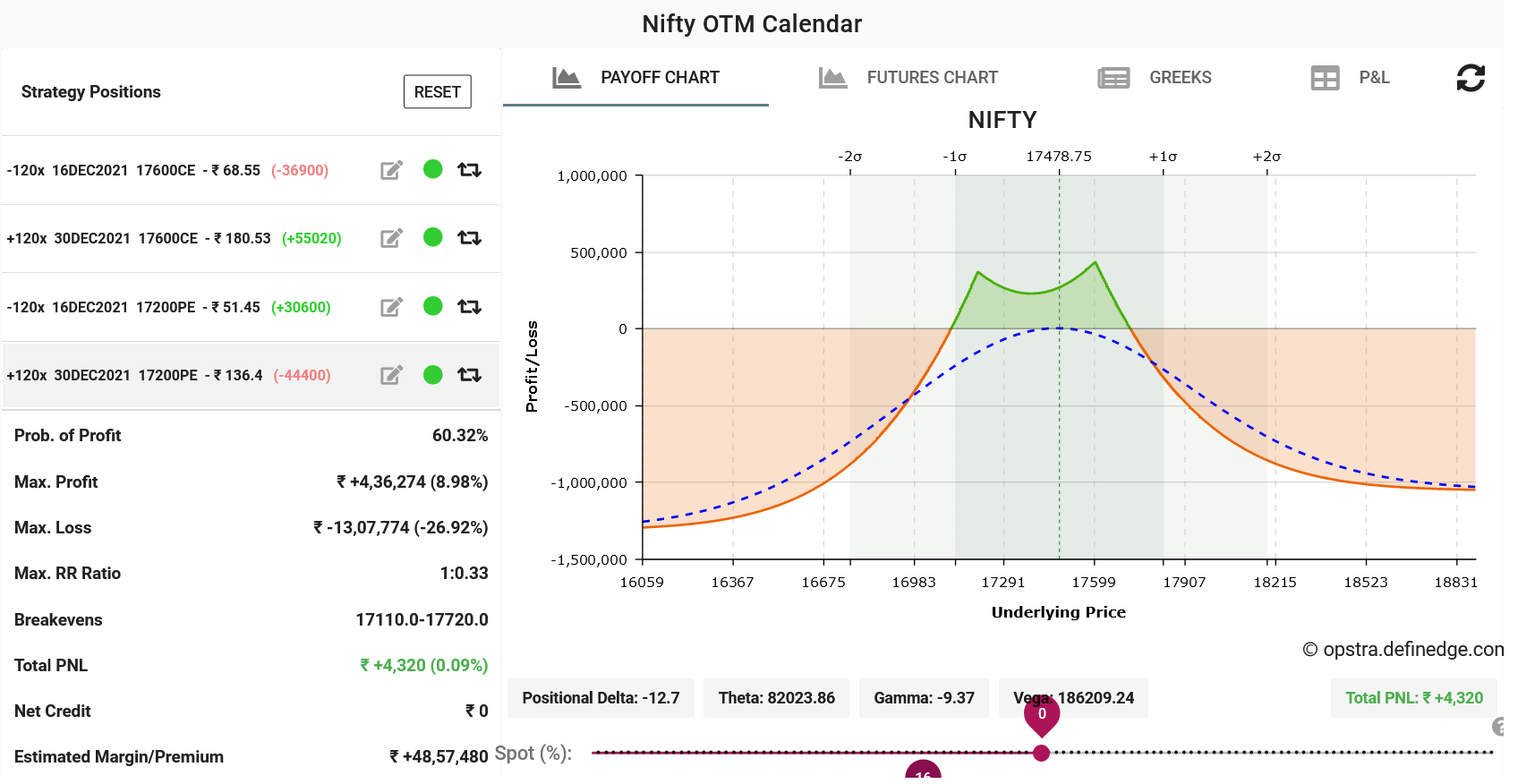

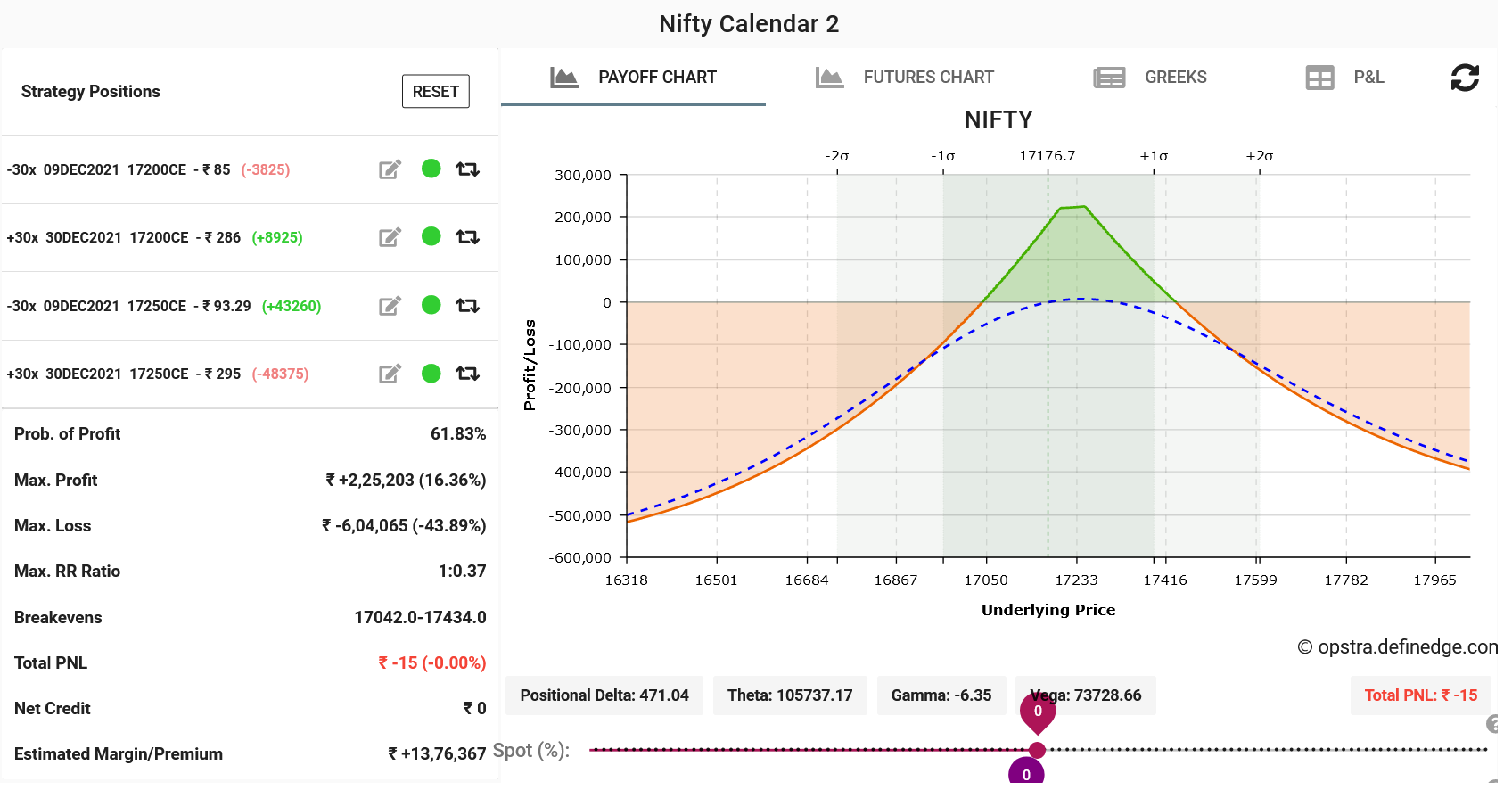

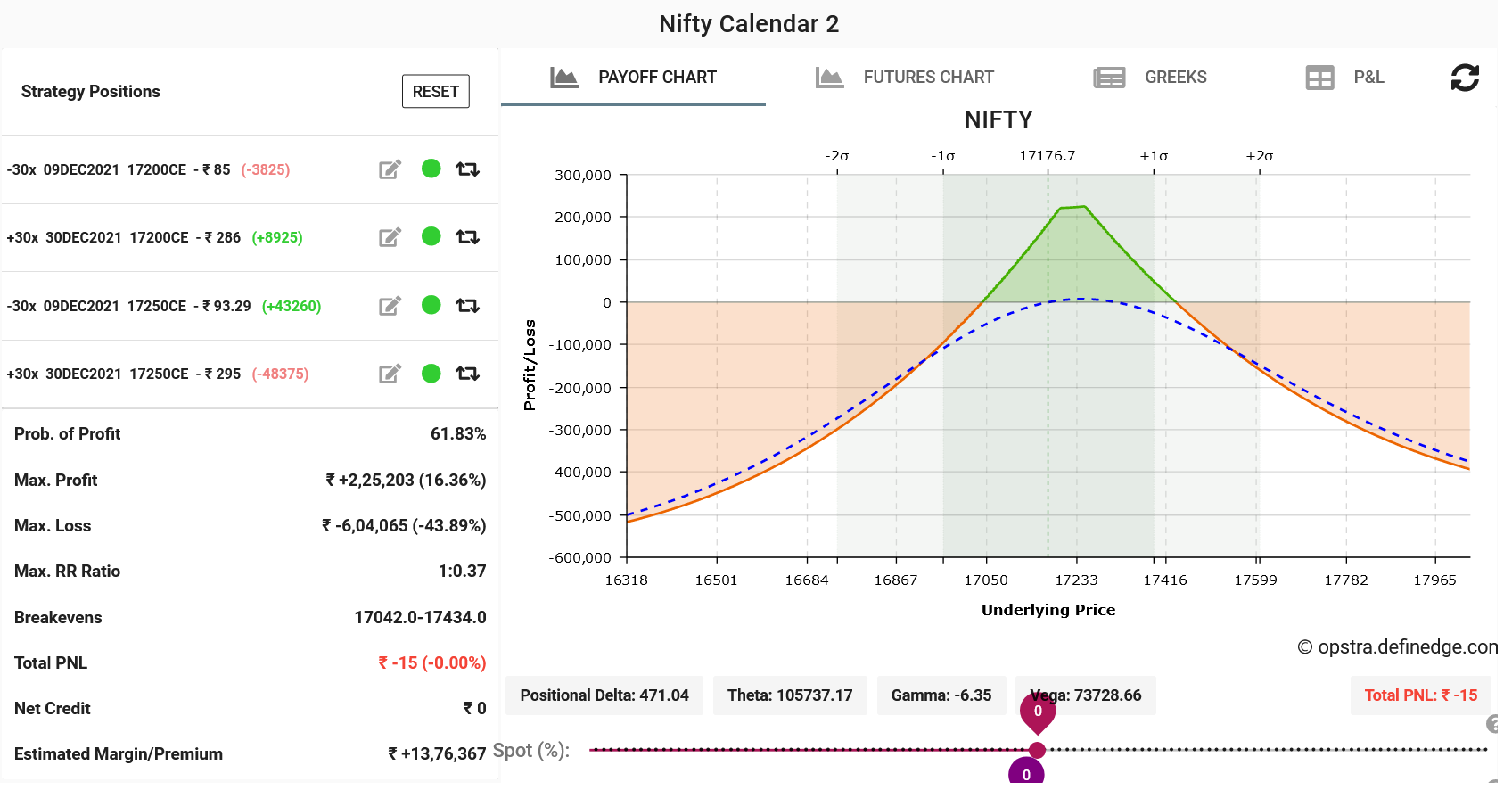

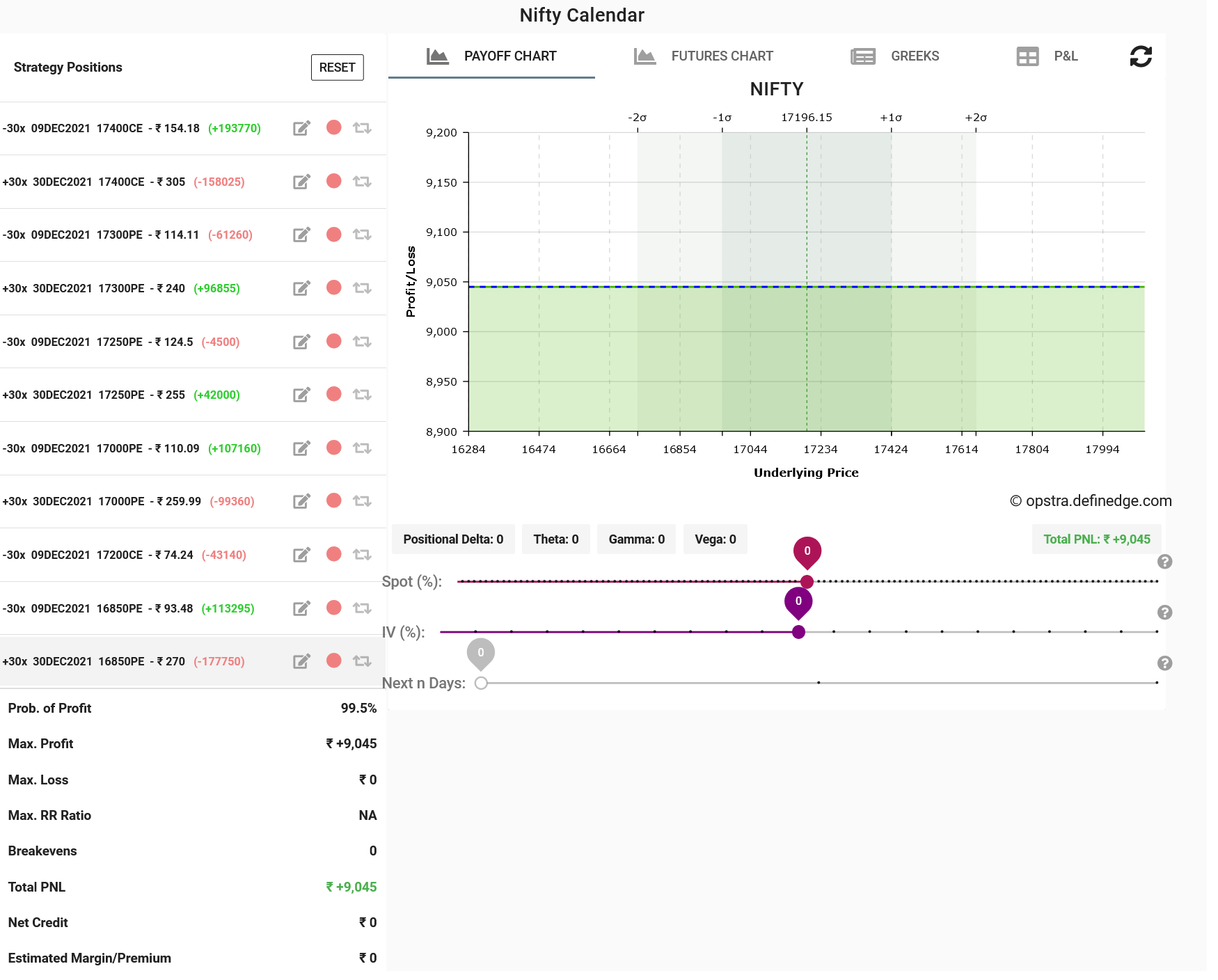

Last post by Michael Gonsalves - Dec 10, 2021, 11:07 AMThis week, I want to try my hand with an OTM Calendar spread instead of an ATM Calendar spread to see if it improves my chances of winning. The max profit with the OTM is obviously lower than that of the ATM. However, it is a fact that the concept of max profit is an illusion that is unachievable most of the time. Even if one can lay hands on a portion of that, it would count as a successful trade.

#92

Our Current Trades / Week ended 16th December: Cale...

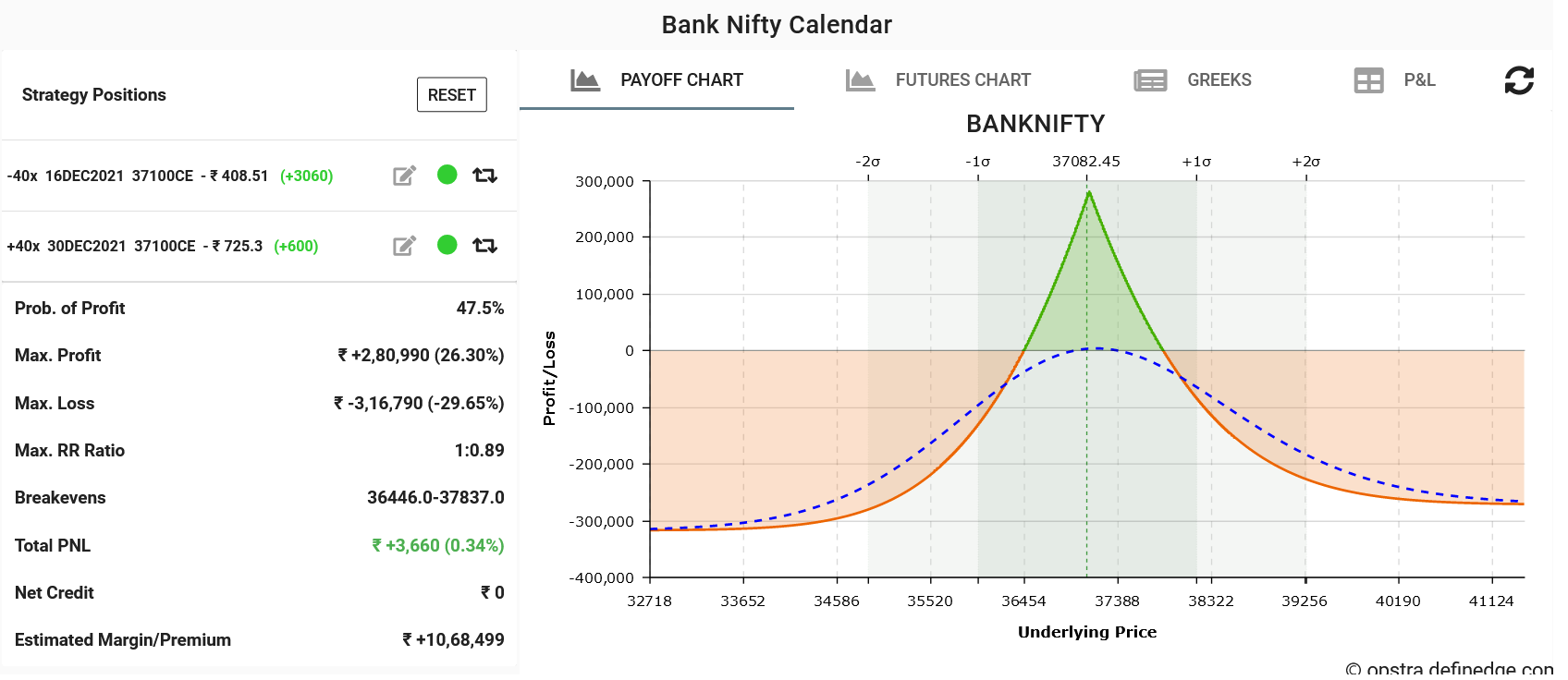

Last post by Michael Gonsalves - Dec 09, 2021, 08:30 PMFor the week ended 16th December 2021, I am going back to a Calendar in the Bank Nifty. This time, I will be careful not to make wanton adjustments and squander away my gains.

#93

Our Current Trades / Re: Week ended 9th December: C...

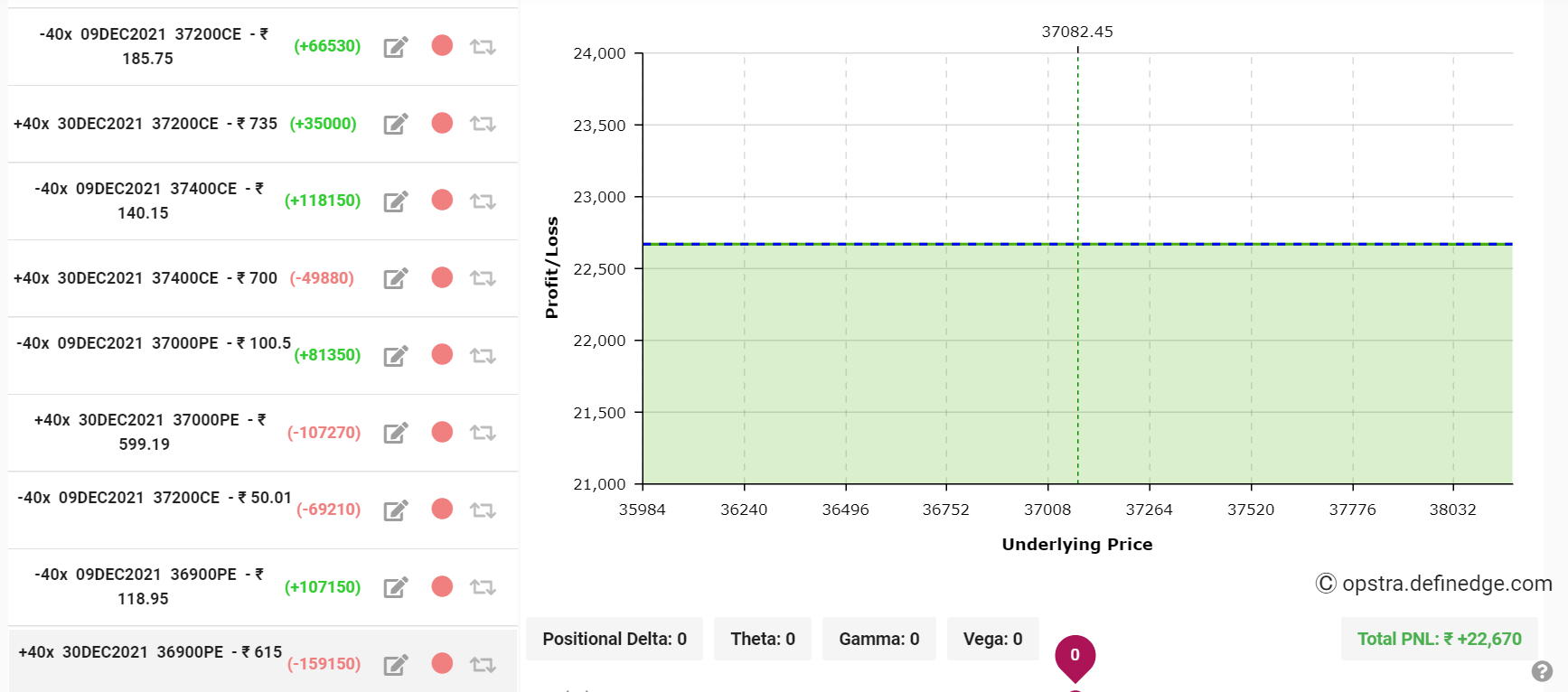

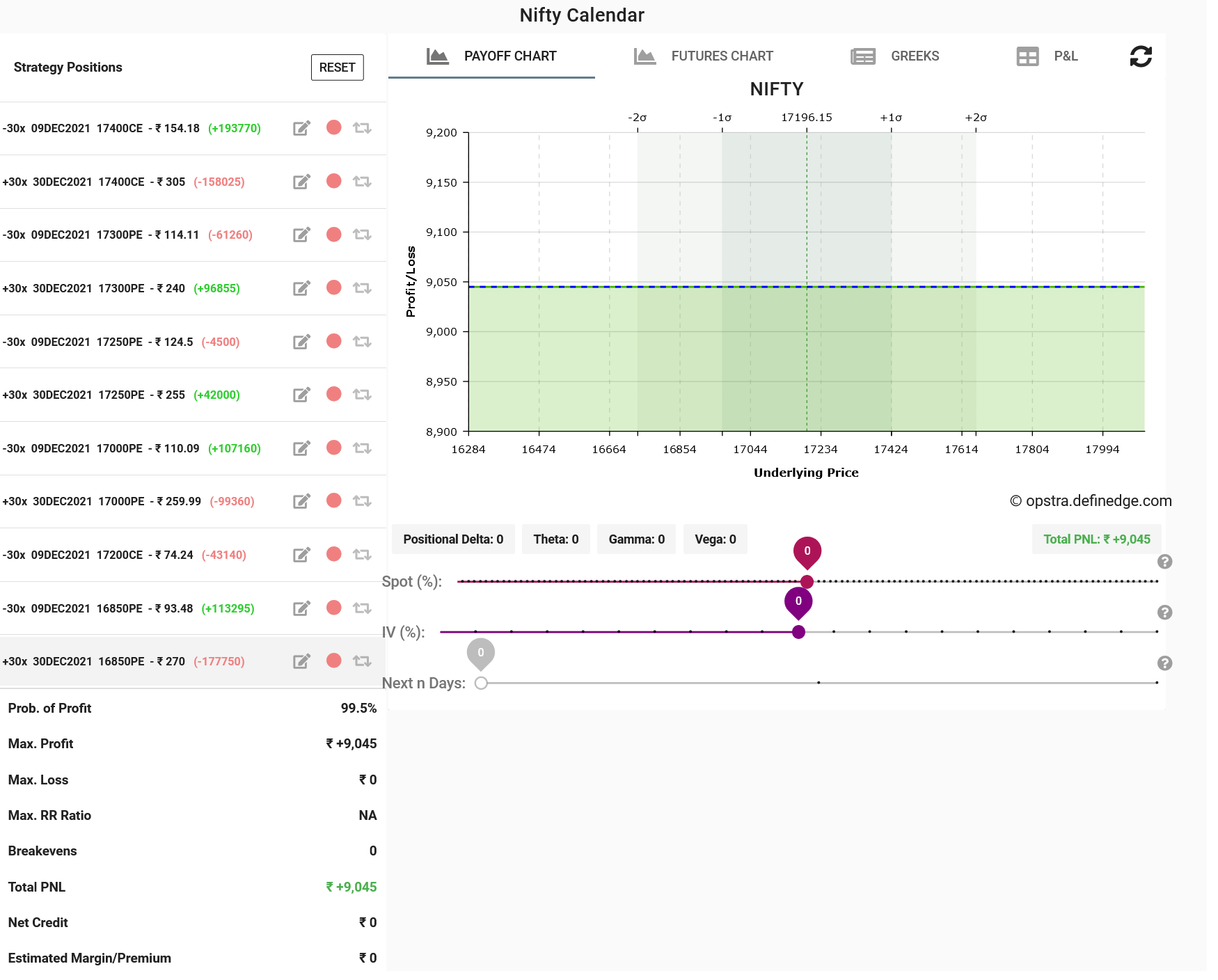

Last post by Michael Gonsalves - Dec 09, 2021, 07:20 PMI also had a Calendar in the Bank Nifty which was grossly mismanaged. If I had let the Calendar alone, it would have yielded a hefty gain of Rs. 2.35 lakh. However, due to my adjustments, the gains were reduced to a paltry Rs. 22000.

#94

Our Current Trades / Re: Week ended 9th December: C...

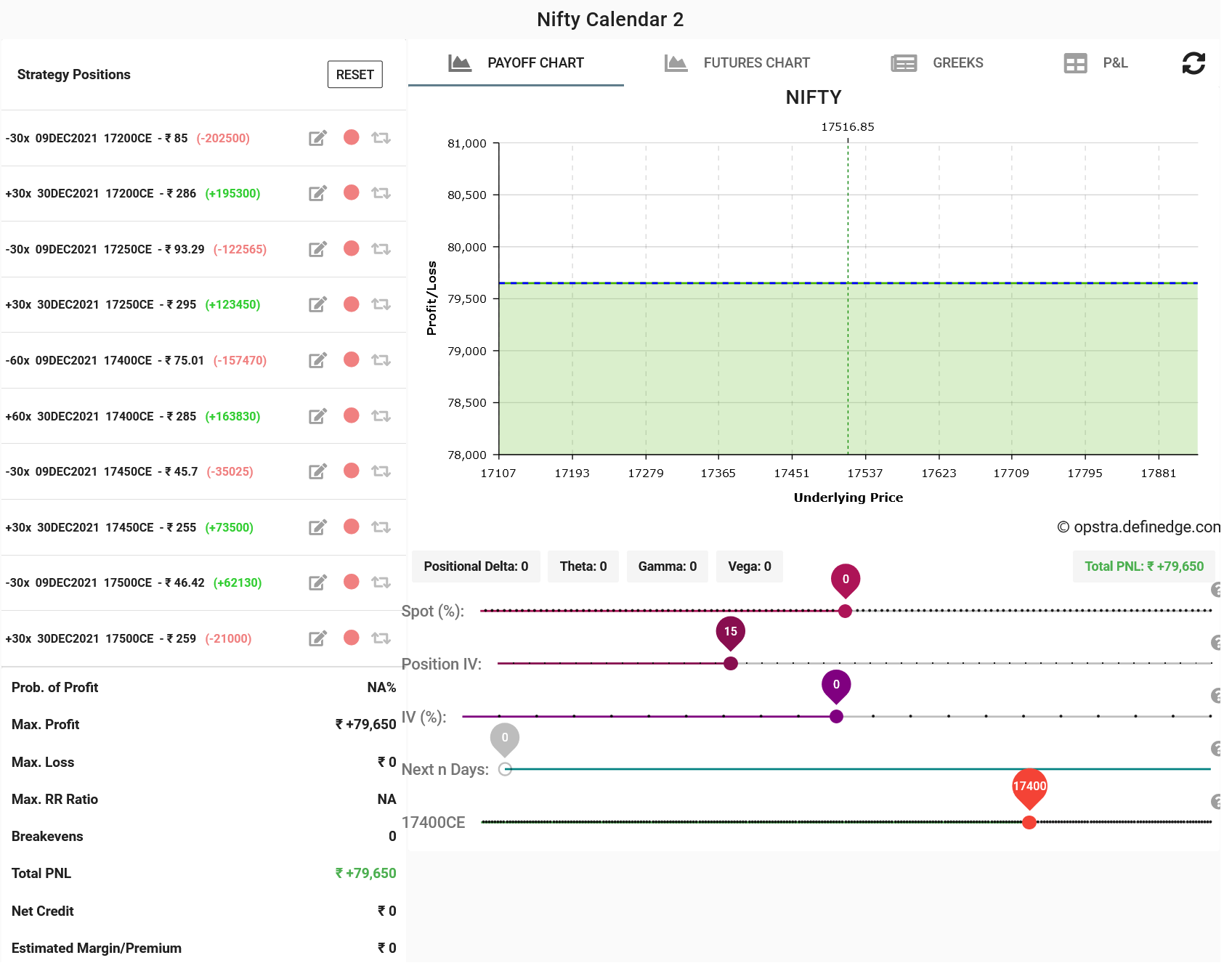

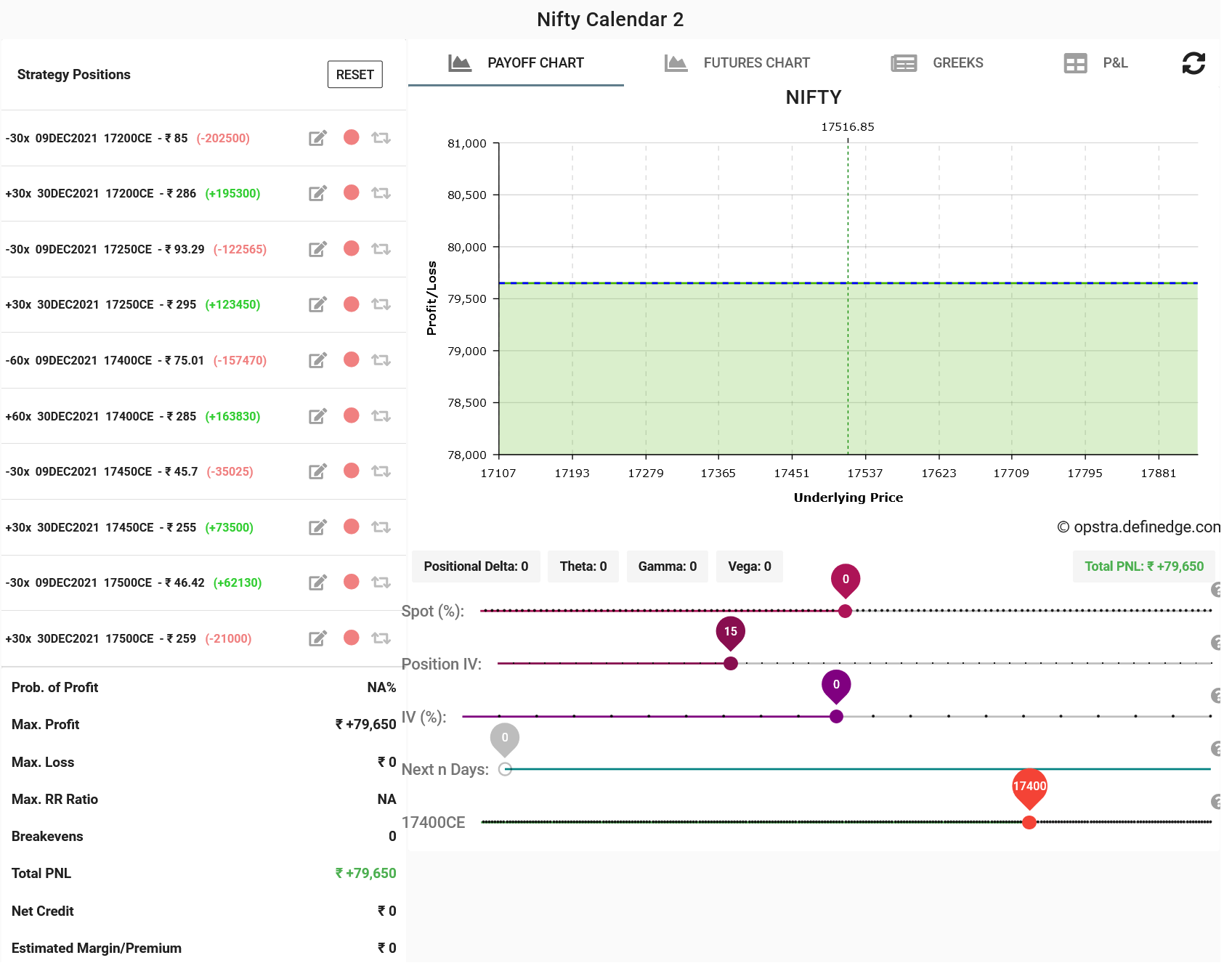

Last post by Michael Gonsalves - Dec 09, 2021, 07:00 PMI committed some blunders while making adjustments which crunched my profit. If I would not have made any adjustments, I would have had a profit of Rs. 1.35 lakh +. My take-home is now about Rs. 79000.

#95

Guides & Tutorials / Re: Option Buying Set up by As...

Last post by Michael Gonsalves - Dec 07, 2021, 10:14 PMAsit Baran Pati has further elaborated on his options buying strategy in a face-to-face interaction with Vivek Bajaj.

He has talked about his journey as an options buyer. He has also given a practical demonstration of options trading.

The presentation explains how we can become a successful trader with the help of a few simple strategies that require hard work and perseverance.

The interesting part is that Asit Baran Pati has given examples of options traders and buyers which will serve as a case study for a better understanding.

He has talked about his journey as an options buyer. He has also given a practical demonstration of options trading.

The presentation explains how we can become a successful trader with the help of a few simple strategies that require hard work and perseverance.

The interesting part is that Asit Baran Pati has given examples of options traders and buyers which will serve as a case study for a better understanding.

#96

Guides & Tutorials / Option Buying Set up by Asit P...

Last post by Michael Gonsalves - Dec 07, 2021, 10:09 PMAsit Pati has explained in detail his options buying strategy. He has explained what his set up is and how he uses that to maximize gains from buying options. However, it must be said that the strategy is quite complex and requires a detailed understanding of various indications and technical analysis.

#97

Our Current Trades / Re: Dumb straddle (9.20 am) st...

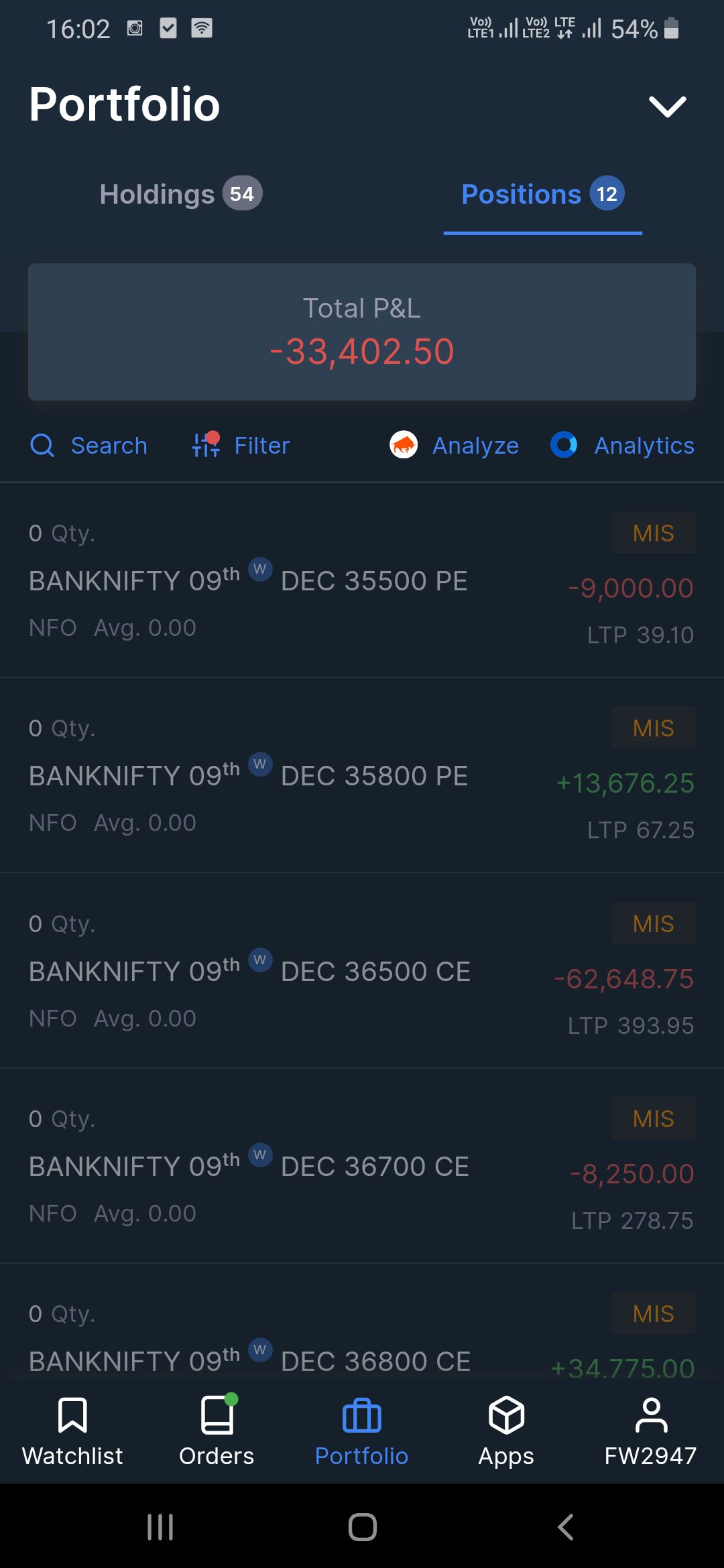

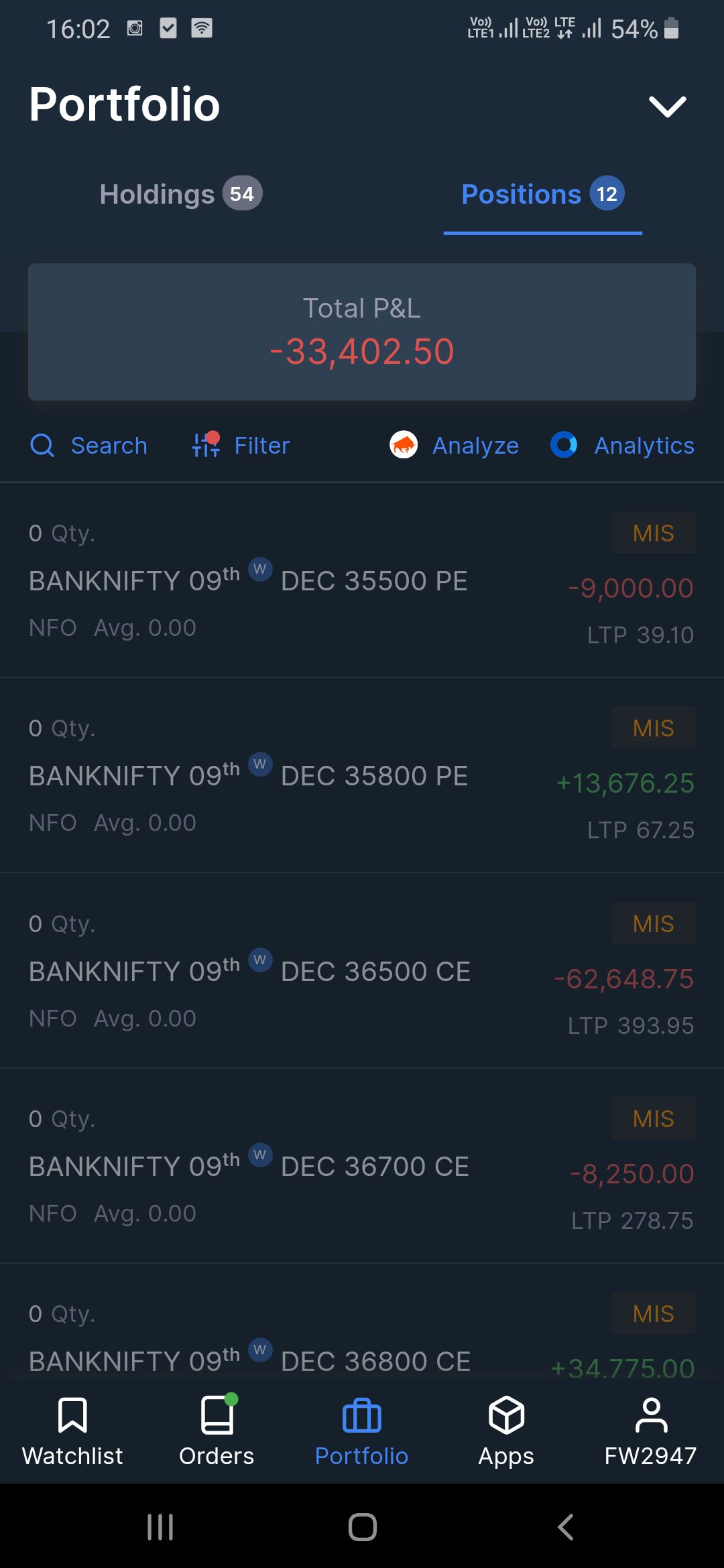

Last post by Michael Gonsalves - Dec 07, 2021, 04:08 PMToday, I goofed up. I thought the market would be weak and so I sold the 36500 Call. However, the market was aggressively bullish and surged 1000+ points. I tried to salvage the situation but the damage was done. I ought to have done a dumb straddle. On trending days, the Dumb straddle works well. I lot a chunk of Rs. 33500.

#98

Our Current Trades / Re: Week ended 9th December: C...

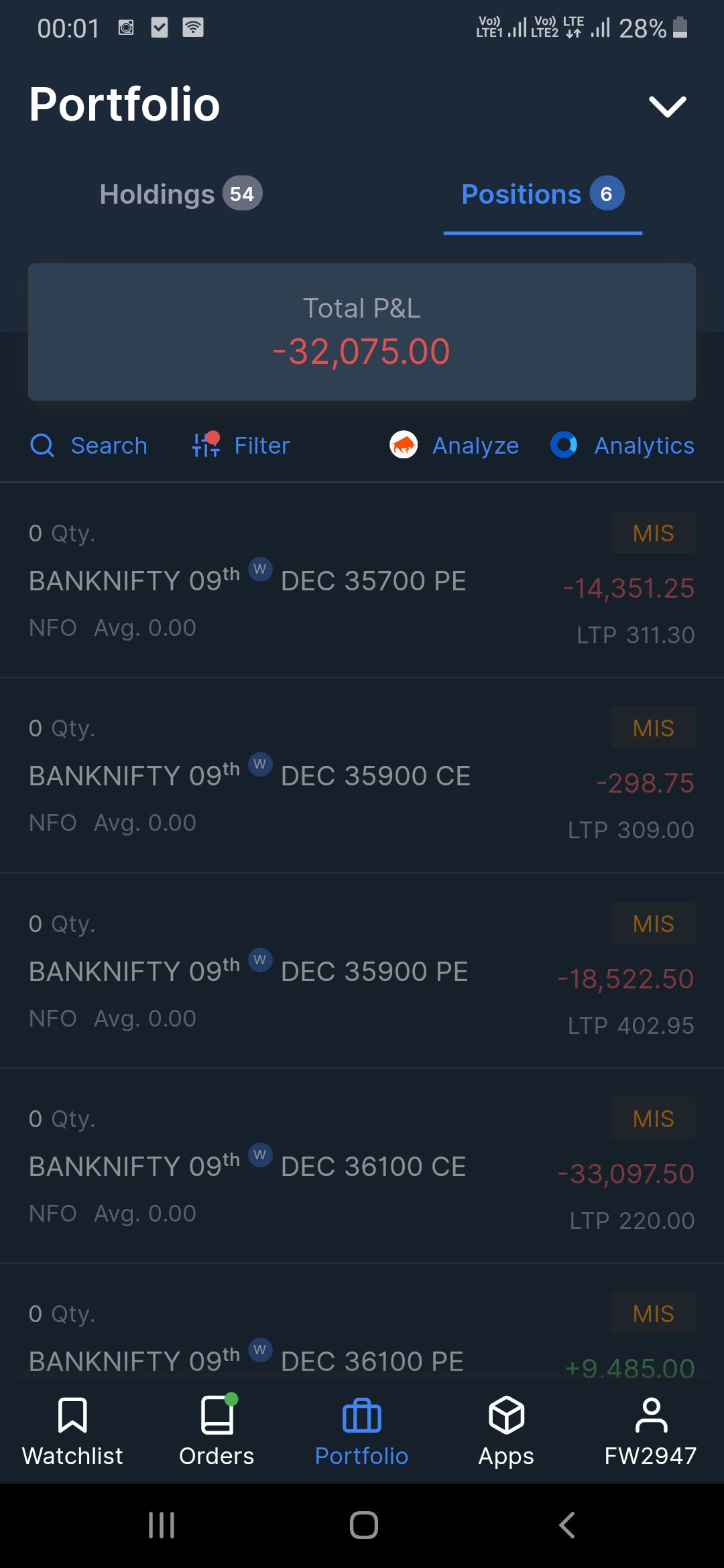

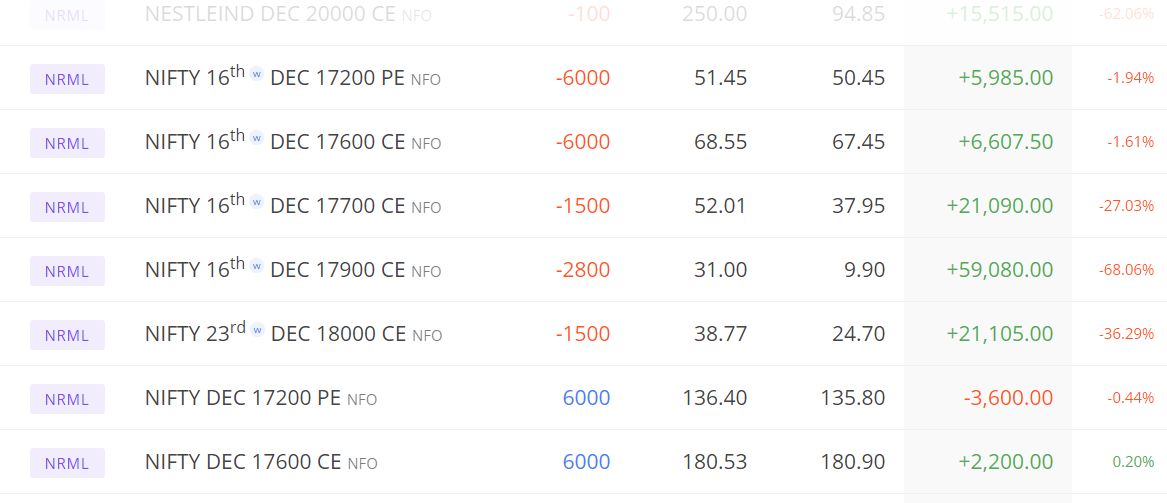

Last post by Michael Gonsalves - Dec 07, 2021, 04:01 PMThe new Calendar is as follows. Hopefully, the Nifty will stay range-bound and enable me to make some money

#99

Our Current Trades / Re: Week ended 9th December: C...

Last post by Michael Gonsalves - Dec 07, 2021, 01:02 PMThe Calendar position was looking extremely unwieldy with a large number of assorted Calls and Puts. So, I did the sensible thing of squaring off all positions with the intention of having a fresh positions.

#100

Our Current Trades / Re: Dumb straddle (9.20 am) st...

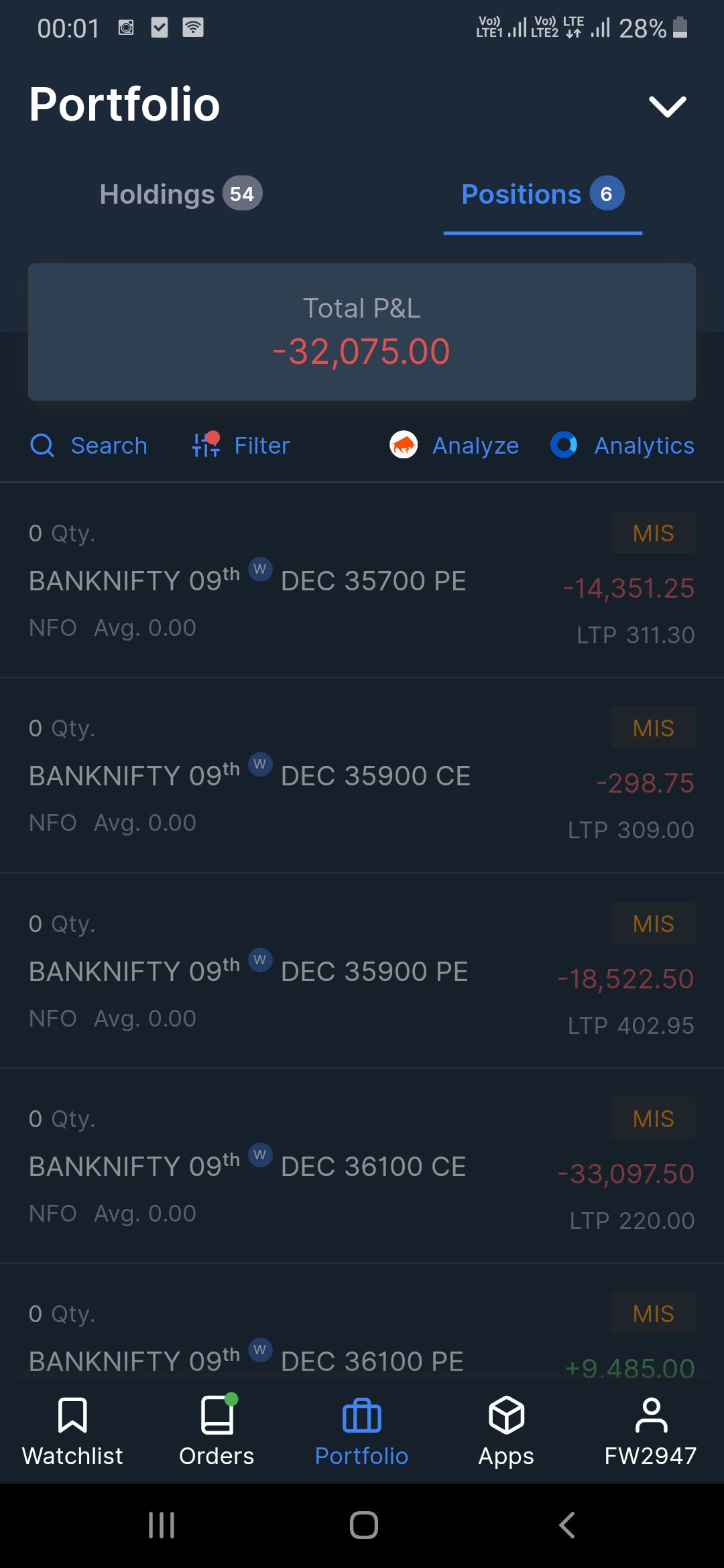

Last post by Michael Gonsalves - Dec 07, 2021, 12:05 AMToday, the Bank Nifty displayed violent movement on both sides which put my dumb straddle in a difficult position. I lost about Rs. 32000 today.