- Welcome to Traders & Investors Paradise.

Recent posts

#41

Our Current Trades / Re: Week ended 22nd September:...

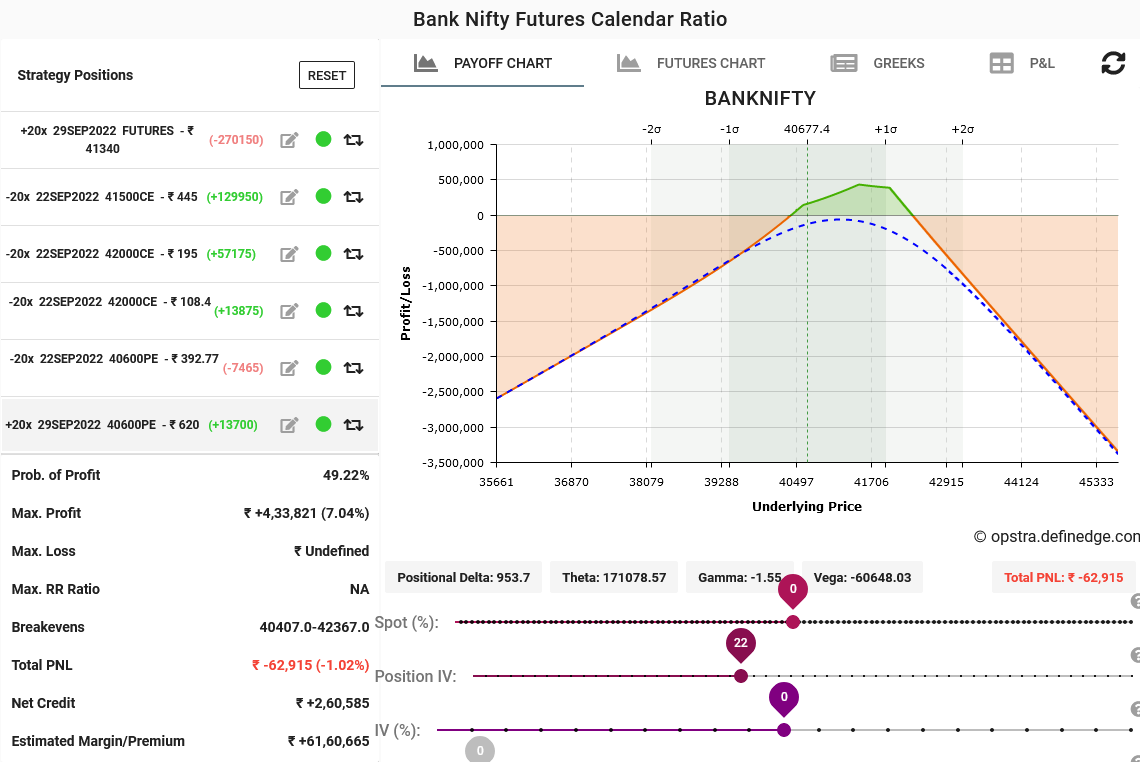

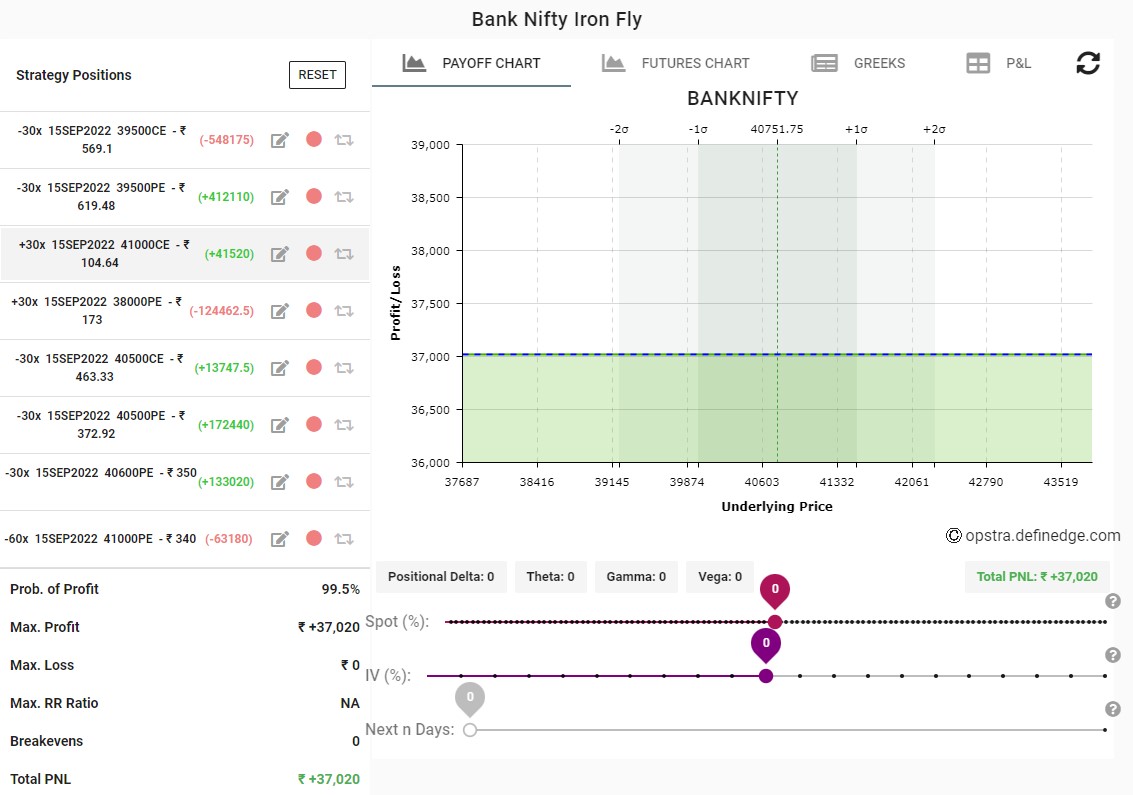

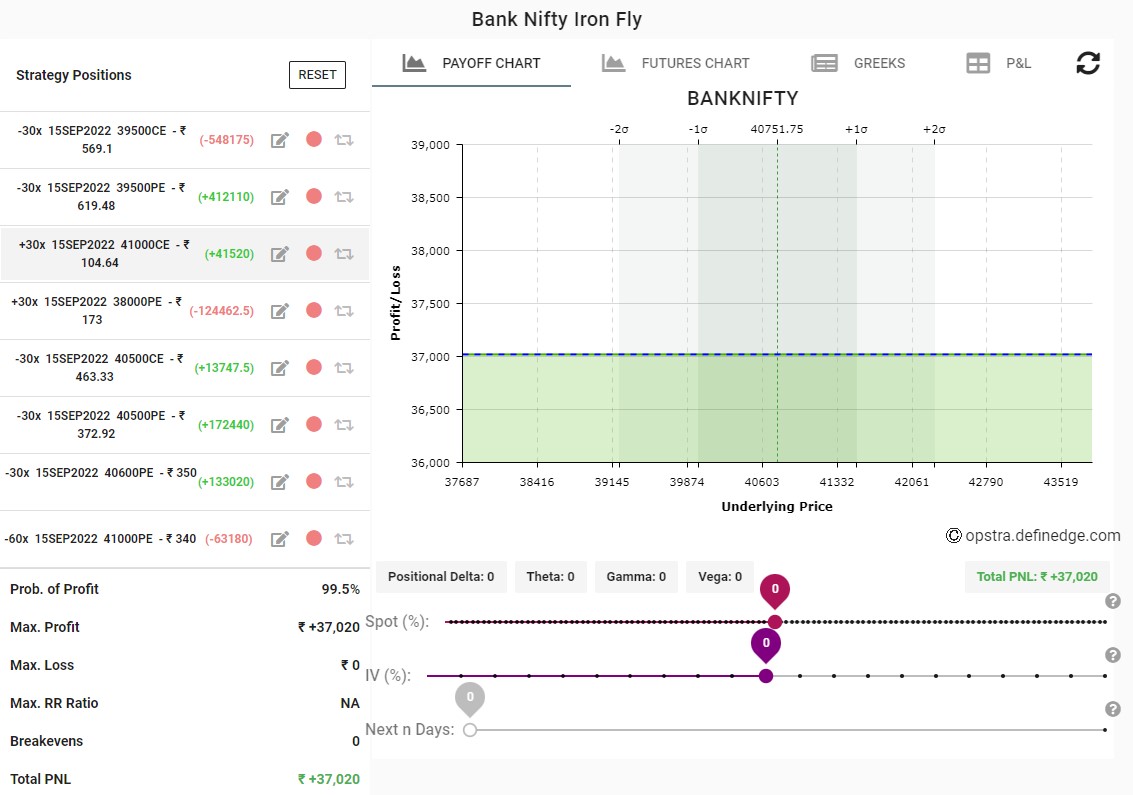

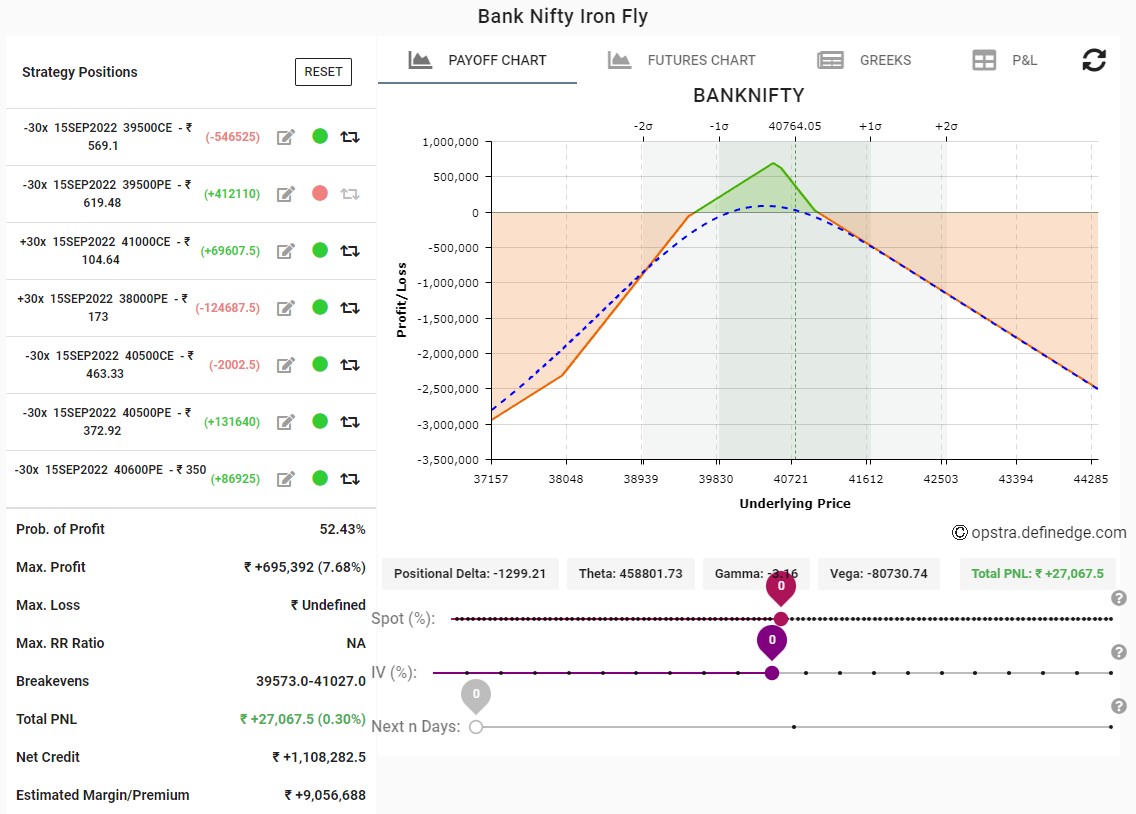

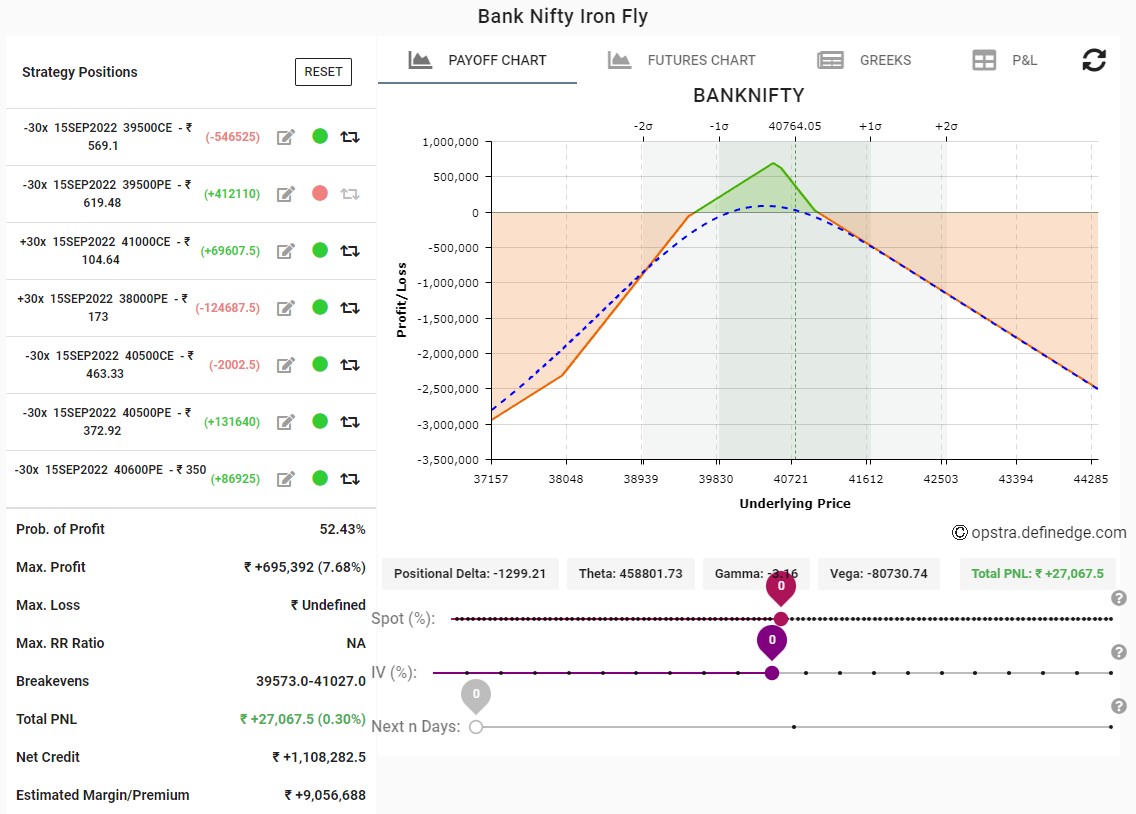

Last post by Michael Gonsalves - Sep 16, 2022, 02:59 PMThe Bank Nifty dipped further to 40500 and came close to the BEP. Instead of moving the Call shorts closer, I added a Put Calendar. This extended the lower BEP to 40400. On Monday or Tuesday, I will roll down the Call shorts if there is no bounce.

#42

Our Current Trades / Re: Week ended 22nd September:...

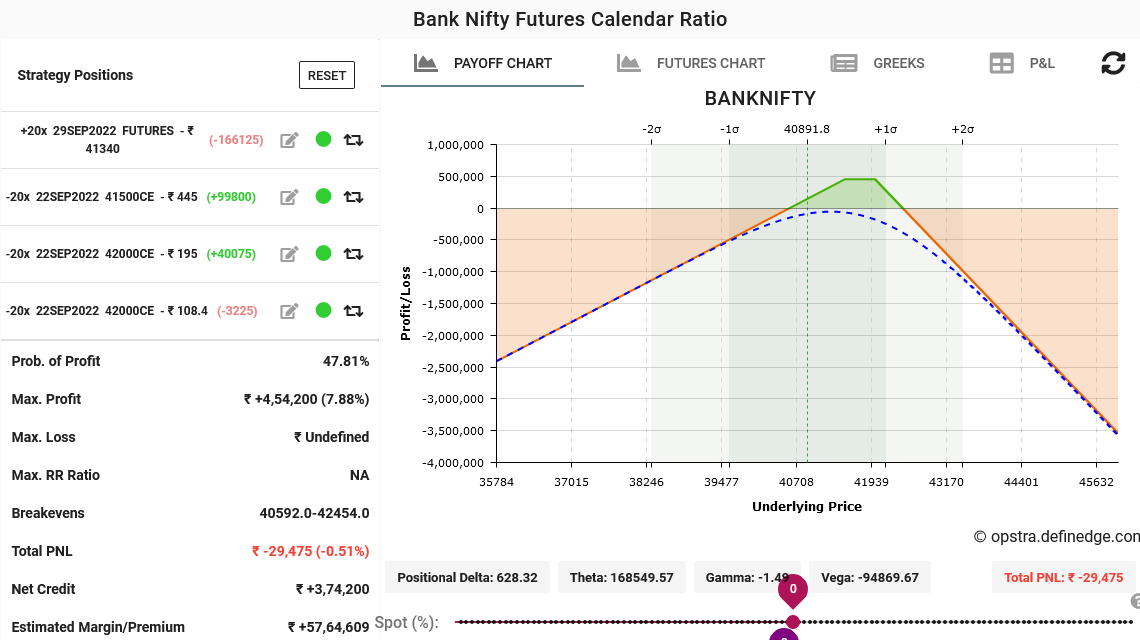

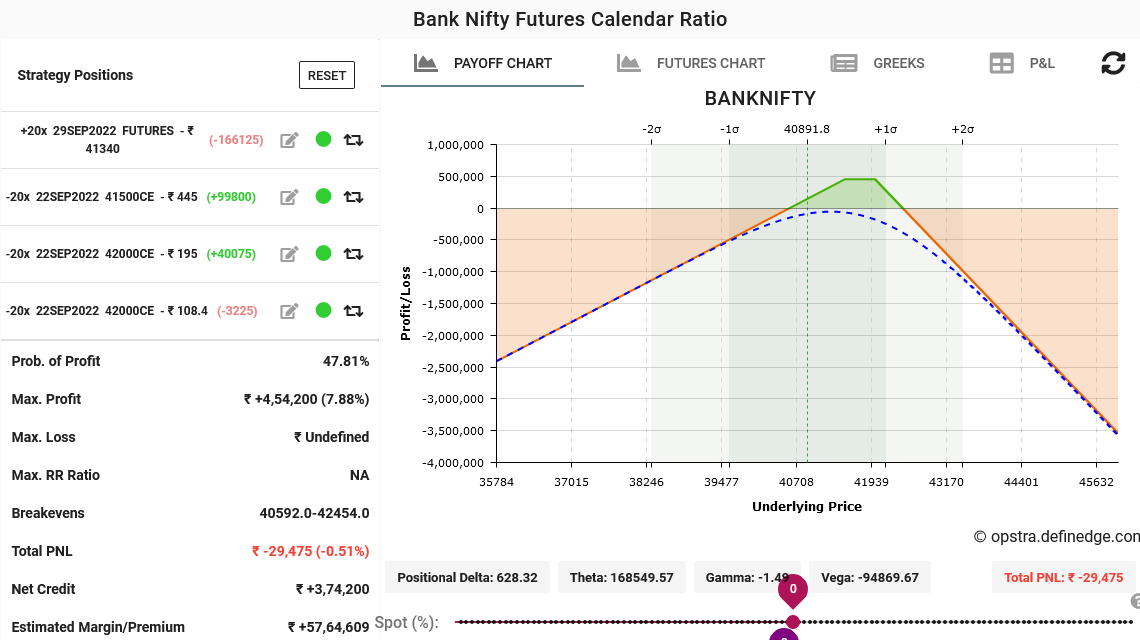

Last post by Michael Gonsalves - Sep 16, 2022, 10:13 AMThe Bank Nifty has softened a bit. My option is to either roll down the short calls or to add more quantities. As I am flush with funds, I chose to add more rather than rolling down. If the Bank Nifty comes closer to the BEP, I will either roll down the short calls (depending on the premium remaining) or add a Put Calendar to extend the lower BEP.

#43

Our Current Trades / Week ended 22nd September: Ban...

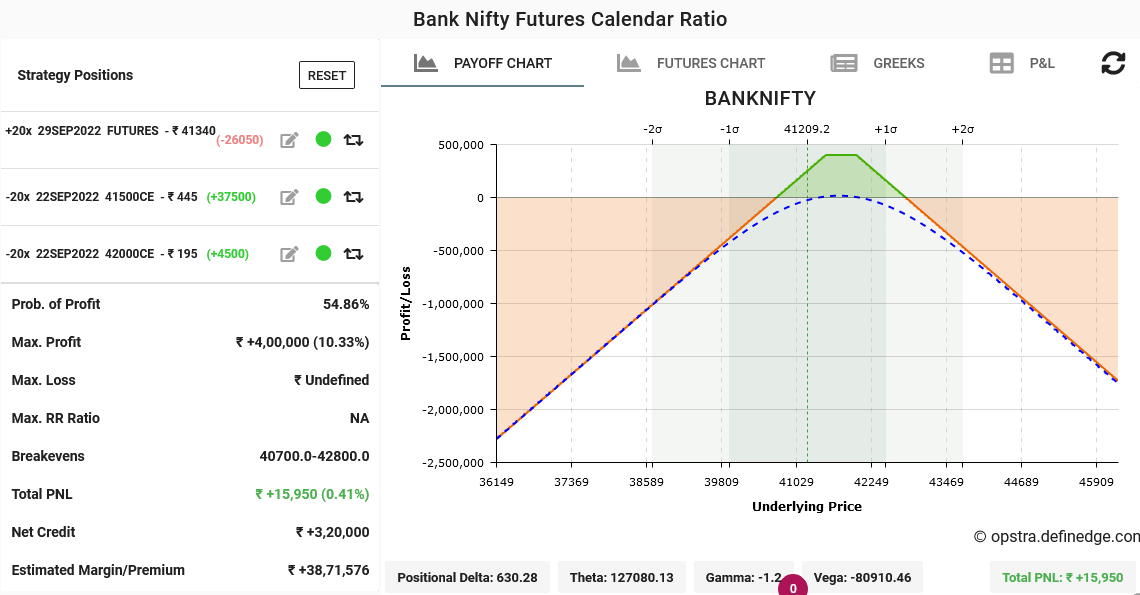

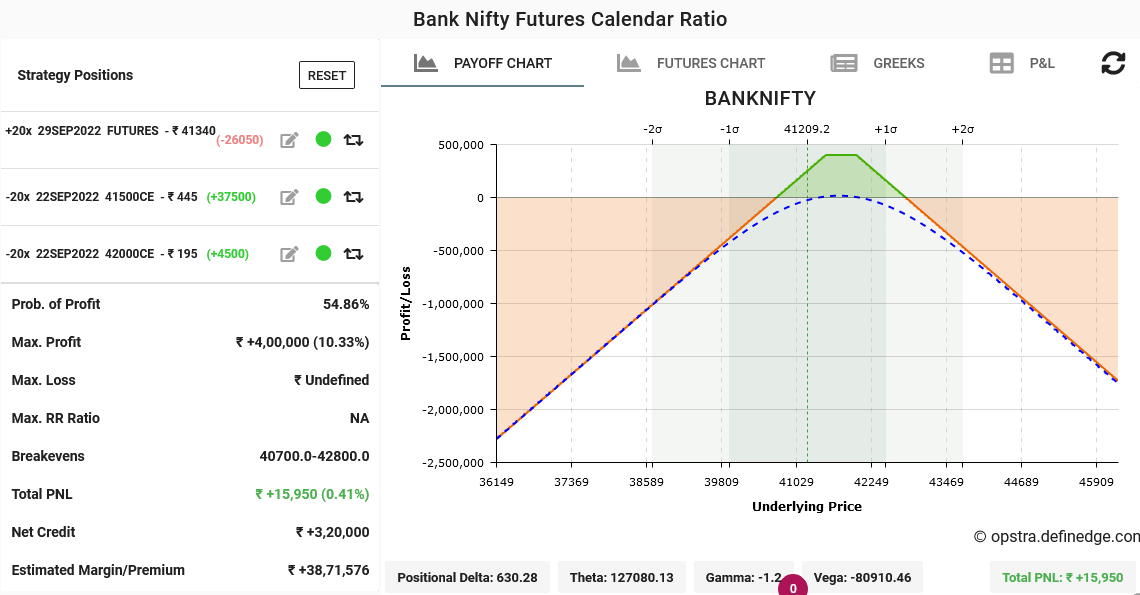

Last post by Michael Gonsalves - Sep 15, 2022, 08:04 PMI had bought Futures to salvage a naked Call short in the expiry of 15th September. The Call expired worthless and so I decided to shift the Call to the next expiry. I also sold a 42000 Call as additional precaution. This makes it a ratio spread with a lower BEP of 40700 and a higher BEP of 42800.

#44

Our Current Trades / Re: Week ended 15th September:...

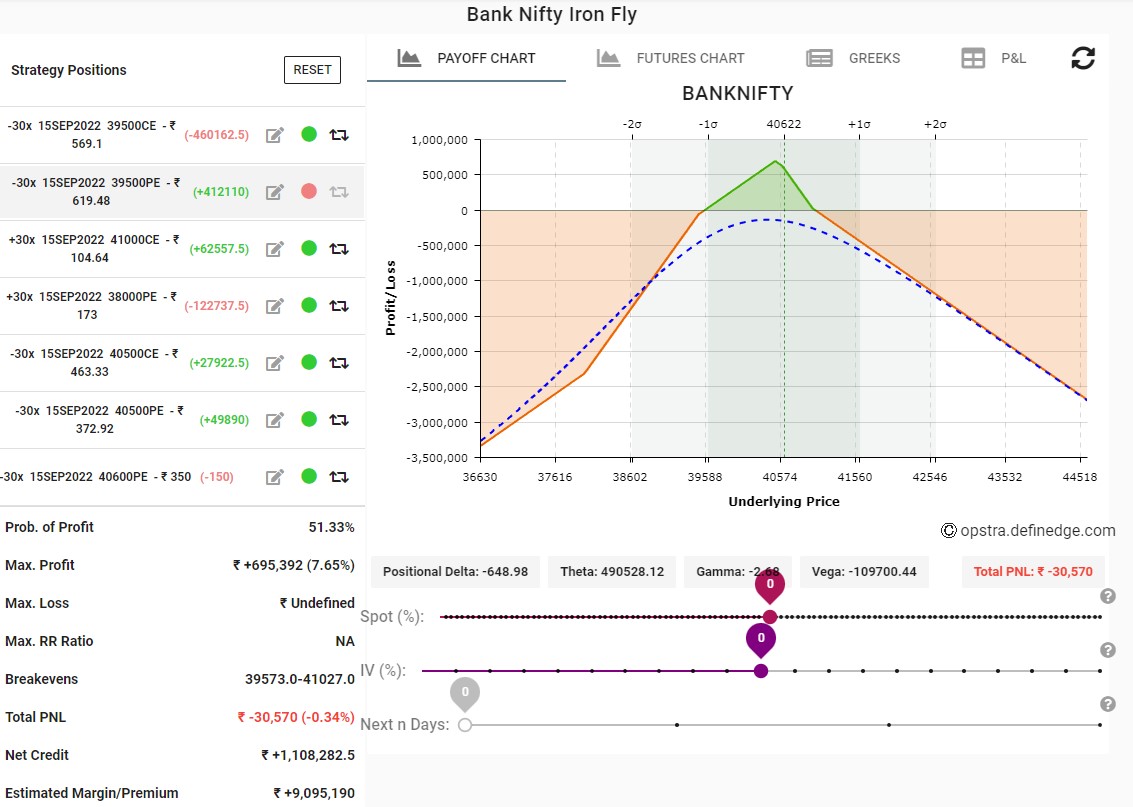

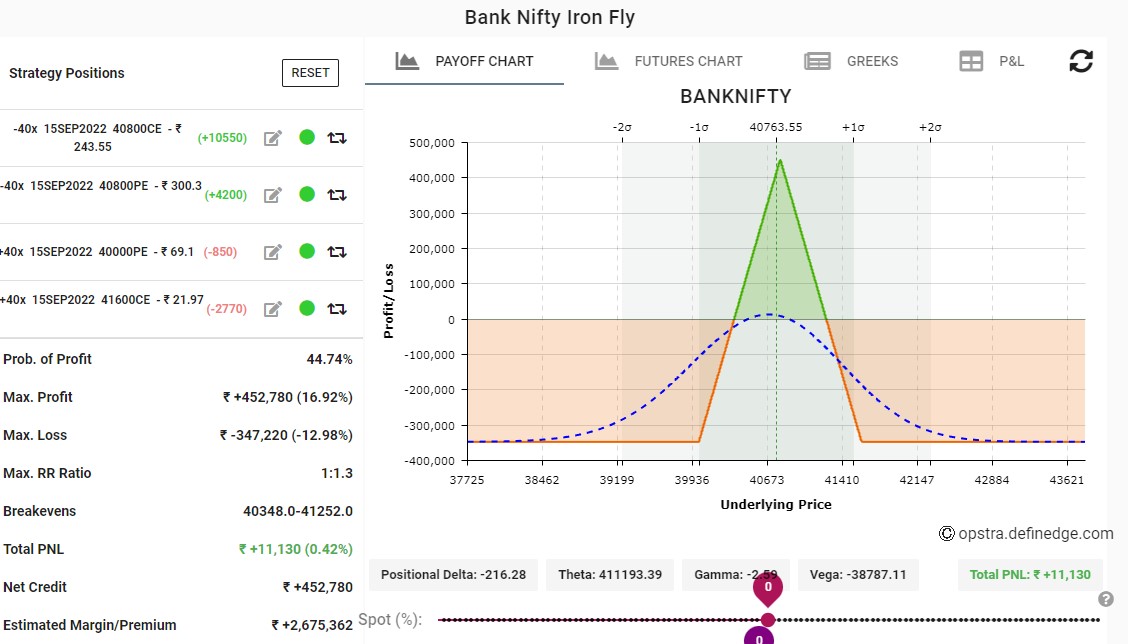

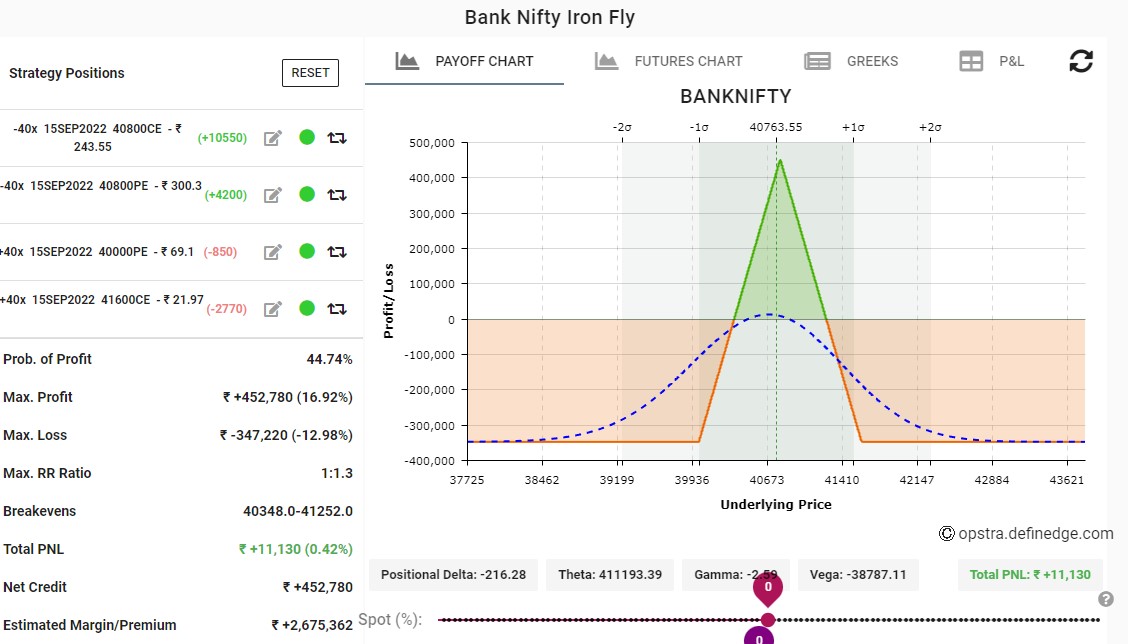

Last post by Michael Gonsalves - Sep 15, 2022, 11:43 AMAfter breaching the ATH of 41800, the Bank Nifty took a breather and plunged to 41100. At the present level, my Iron Fly is in a profit. It is best to sqaure off because there are too many positions and it is not manageable if there is a sudden move either way.

#45

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 15, 2022, 09:02 AMThe Iron Fly got into trouble from the very start because the Bank Nifty surged to 41600. To salvage the situation, I added a straddle at 41300 and also moved the 40800PE to 41300. When even this BEP was at risk, I added a Call Calendar of 41400CE Sept and 41800CE of 15th Sept.

#46

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 14, 2022, 10:03 AMThe IV is high. Tomorrow is the expiry. So, I set up a new Iron Fly with 40800 as the straddle.

#47

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 14, 2022, 09:58 AMThe Bank Nifty opened gap down about 600 points but fortuitously almost immediately recovered. This saved me because my 41000 Puts were bleeding. I also had some naked positions. Anyway, I decided to square off and take new positions.

#48

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 13, 2022, 02:56 PMThe Bank Nifty came close to touching the 41000 mark. So, I squared off the puts at 40500 and 40600 and shifted them to 41000PE. This has extended the BEP on the upside to 41300.

#49

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 13, 2022, 10:55 AMThe Bank Nifty is very bullish and has crossed 40800. My position is at a no-profit no-loss stage. My options are:

(i) Stay with the position until 41000 is reached.

(ii) Book profits in the 40500 straddle and the 40600 short call. Open a new straddle at 40800 or 40900.

(iii) Square off all positions and open a new Iron Fly at the spot.

(i) Stay with the position until 41000 is reached.

(ii) Book profits in the 40500 straddle and the 40600 short call. Open a new straddle at 40800 or 40900.

(iii) Square off all positions and open a new Iron Fly at the spot.

#50

Our Current Trades / Re: Week ended 15th September:...

Last post by Michael Gonsalves - Sep 12, 2022, 10:42 AMThere is a relentless surge in the Indices. The Bank Nifty crossed 40600. So, I squared off 39500PE and shifted to 40600PE. This extends the BEP to 41000.