- Welcome to Traders & Investors Paradise.

Recent posts

#61

Our Current Trades / Net Profit Rs 67 Lakh from 1st...

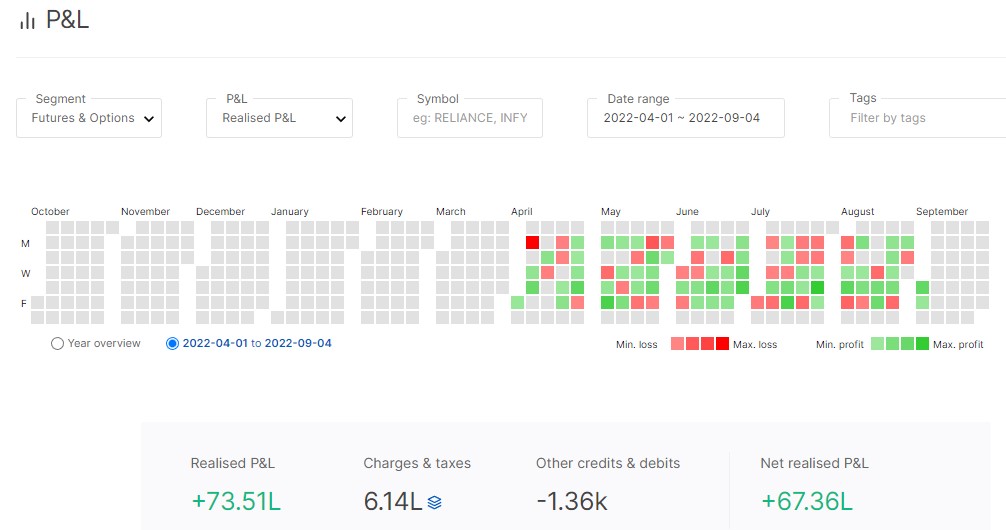

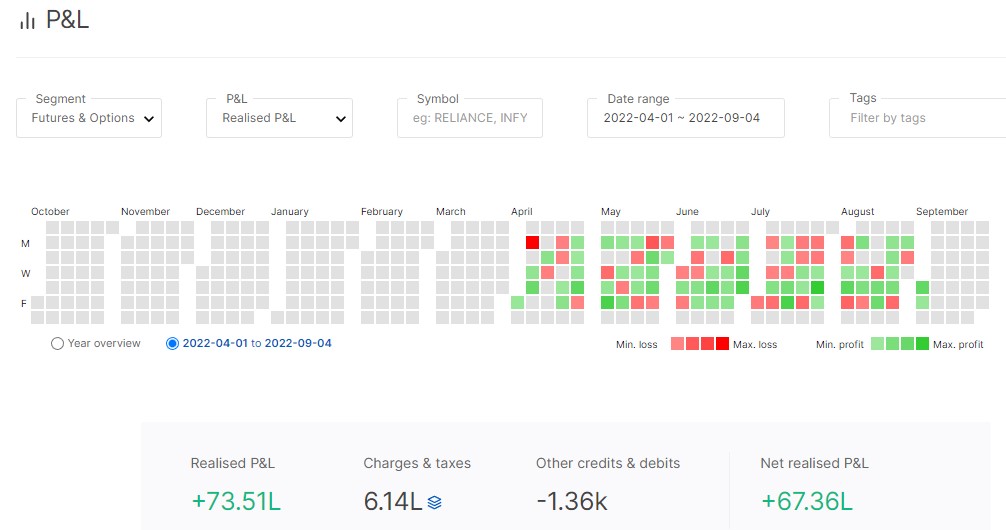

Last post by Michael Gonsalves - Sep 04, 2022, 01:49 PMIn the period from 1st April 2022 to 3rd September 2022, I earned a gross profit Of Rs. 73 lakh and a net profit of Rs 67 lakh.

The strategies deployed were Calendars, Covered Calls, Cash Secured Puts and naked short calls (no Puts).

The capital deployed was about Rs. 4 crore approx which means that my RoI is about 16%. On an annulaized basis, the return is about 25%.

I committed a number of blunders which caused me to lose significant money. Also, the markets were extremely volatile for a part of the year which also led to losses. I will be more circumspect with my trades henceforth.

The strategies deployed were Calendars, Covered Calls, Cash Secured Puts and naked short calls (no Puts).

The capital deployed was about Rs. 4 crore approx which means that my RoI is about 16%. On an annulaized basis, the return is about 25%.

I committed a number of blunders which caused me to lose significant money. Also, the markets were extremely volatile for a part of the year which also led to losses. I will be more circumspect with my trades henceforth.

#62

Our Current Trades / I lost Rs. 23.71 lakh due to a...

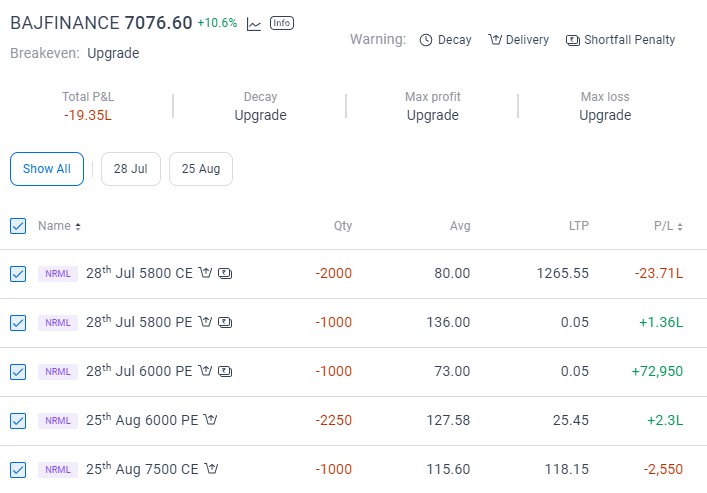

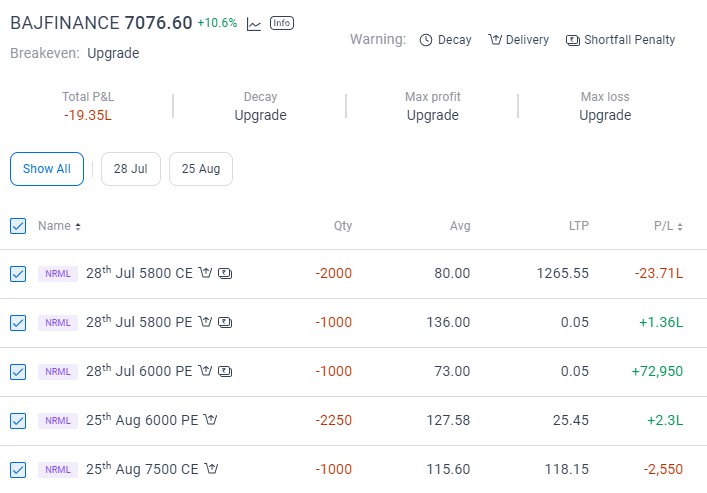

Last post by Michael Gonsalves - Jul 28, 2022, 08:03 PMLast month, the stock markets were in such a bad shape, that a Put of 2000 shares that I had sold of the Bajaj Finance 5800 strike price had devolved upon me and I was forced to take delivery. The stock was sinking fast and so I hurried to sell a Call at the same strike price of 5800.

Unfortunately, in the meantime, the markets have turned from aggressively Bearish to aggressively Bullish. Bajaj Finance shot up an incredible 10.6% today to close at Rs. 7076.

As today is the expiry, no adjustments are possible and I have no option but to give delivery at the strike price of Rs. 5800.

I suffered a (opportunity) loss of Rs. Rs. 23.71 lakhs. The loss is reduced to Rs. 19.35 lakh because I had sold some Puts to salvage the Calls.

Unfortunately, in the meantime, the markets have turned from aggressively Bearish to aggressively Bullish. Bajaj Finance shot up an incredible 10.6% today to close at Rs. 7076.

As today is the expiry, no adjustments are possible and I have no option but to give delivery at the strike price of Rs. 5800.

I suffered a (opportunity) loss of Rs. Rs. 23.71 lakhs. The loss is reduced to Rs. 19.35 lakh because I had sold some Puts to salvage the Calls.

#63

Best stocks to buy now / Buy Dolly Khanna’s portfolio s...

Last post by Michael Gonsalves - Jul 28, 2022, 07:55 PMEdelweiss and other noted experts like Antique Broking, Prabhudas Lilladher have recoommended a buy of Sharda Cropchem for a target price of Rs. 958.

"We continue to believe that SCC will witness market share gain and margin improvement in subsequent quarters. We retain 'BUY' with a revised target of Rs 958 from Rs 916 earlier, as we roll forward to Q2FY24E," Edelweiss said in the research report.

Sharda Cropchem is presently out of favour because of its poor June quarter results. There is a 41 per cent year-on-year (YoY) reduction in the company's profits.

This was mainly because of the adverse currency movement and forex losses.

Dolly Khanna holds 1,081,526 shares (1.2 per cent) in Sharda Cropchem.

The management of Sharda Cropchem is confident of achieving an 18-20 per cent growth in FY23E. t will take corrective measures with regard to the adverse efeect of currency. It is also focusing on new product registrations and scale-up of existing molecules which will improve the Ebitda margins to 18-20 per cent.

Antique Stock Broking has also recommended a buy of Sharda Cropchem for the target price of Rs 760.

"We continue to believe that SCC will witness market share gain and margin improvement in subsequent quarters. We retain 'BUY' with a revised target of Rs 958 from Rs 916 earlier, as we roll forward to Q2FY24E," Edelweiss said in the research report.

Sharda Cropchem is presently out of favour because of its poor June quarter results. There is a 41 per cent year-on-year (YoY) reduction in the company's profits.

This was mainly because of the adverse currency movement and forex losses.

Dolly Khanna holds 1,081,526 shares (1.2 per cent) in Sharda Cropchem.

The management of Sharda Cropchem is confident of achieving an 18-20 per cent growth in FY23E. t will take corrective measures with regard to the adverse efeect of currency. It is also focusing on new product registrations and scale-up of existing molecules which will improve the Ebitda margins to 18-20 per cent.

Antique Stock Broking has also recommended a buy of Sharda Cropchem for the target price of Rs 760.

#64

Best stocks to buy now / Dolly Khanna has added Chennai...

Last post by Michael Gonsalves - Jul 27, 2022, 07:05 PMDolly Khanna has added Chennai Petroleum, Monte Carlo Fashion, Manali Petrochemicals, National Oxygen, Zuari Industries and Suryoday Small Finance Bank to the portfolio.

A detailed description of the six new stocks is as follows:

It is not known why Dolly Khanna bought 12.27 lakh shares of Suryoday Small Finance Bank when it is a poor performer. Possibly she is hoping there will be a turnaround.

Chennai Petroleum is a multibagger with more than 200% gain. As the name suggests, it produces petroleum products are its refineries wihich produce liquefied petroleum gas (LPG), motor spirit, superior kerosene, aviation turbine fuel, high-speed diesel, etc.

Dolly Khanna bought 3.69 lakh shares of Monte Carlo Fashion in the June quarter. This stock i also a multibagger. The Company is engaged in the textile business and sells branded garments like cotton wear, woolens, kids wear and home furnishings.

Manali Petro is a smallcap stock that added 26 percent in the last 1 year. Khanna bought 18.78 lakh shares of the firm worth ₹19.5 crore in the June quarter. The Company is engaged in the manufacture and sale of petrochemical products. Its products are used as applications in various industries, such as appliances and thermoware; automotive; bedding and furniture; construction, etc. The stock has lost around 4.5 percent in 2022 so far.

National Oxygen manufactures industrial gases, such as Oxygen and Nitrogen. It is also engaged in wind energy generation. It is a supplier of industrial gases both in liquid and gaseous forms. Dolly Khanna holds 51,784 shares.

Zuari Industries is a diversified compny with interests in agriculture, heavy engineering, infrastructure, lifestyle, and services businesses. Dolly holds 3.48 lakh shares.

A detailed description of the six new stocks is as follows:

It is not known why Dolly Khanna bought 12.27 lakh shares of Suryoday Small Finance Bank when it is a poor performer. Possibly she is hoping there will be a turnaround.

Chennai Petroleum is a multibagger with more than 200% gain. As the name suggests, it produces petroleum products are its refineries wihich produce liquefied petroleum gas (LPG), motor spirit, superior kerosene, aviation turbine fuel, high-speed diesel, etc.

Dolly Khanna bought 3.69 lakh shares of Monte Carlo Fashion in the June quarter. This stock i also a multibagger. The Company is engaged in the textile business and sells branded garments like cotton wear, woolens, kids wear and home furnishings.

Manali Petro is a smallcap stock that added 26 percent in the last 1 year. Khanna bought 18.78 lakh shares of the firm worth ₹19.5 crore in the June quarter. The Company is engaged in the manufacture and sale of petrochemical products. Its products are used as applications in various industries, such as appliances and thermoware; automotive; bedding and furniture; construction, etc. The stock has lost around 4.5 percent in 2022 so far.

National Oxygen manufactures industrial gases, such as Oxygen and Nitrogen. It is also engaged in wind energy generation. It is a supplier of industrial gases both in liquid and gaseous forms. Dolly Khanna holds 51,784 shares.

Zuari Industries is a diversified compny with interests in agriculture, heavy engineering, infrastructure, lifestyle, and services businesses. Dolly holds 3.48 lakh shares.

#65

Best stocks to buy now / Zuari Global is Dolly Khanna's...

Last post by Michael Gonsalves - Jul 26, 2022, 07:48 PMZuari Global, a sugar and ethanol company, is the latest stock to be added to the portfolio of Dolly Khanna. She holds 1.17% stake in the company or 348,622 shares in total.

Sugar and ethanol stocks are in favour because of the benign policy of the government.

Larger caps like Dwarikesh, Bannari Amman, etc are also multibaggers.

Zuari Global has ambitions to expand the ethanol business.

It is developing a distillery to produce ethanol in India and supply it to the state-owned oil marketing companies to meet their blending requirements as specified in the biofuel policy.

The company has strong future prospects and expects to grow the business to achieve a total capacity of 1,000 kilo liters per day of ethanol.

Sugar and ethanol stocks are in favour because of the benign policy of the government.

Larger caps like Dwarikesh, Bannari Amman, etc are also multibaggers.

Zuari Global has ambitions to expand the ethanol business.

It is developing a distillery to produce ethanol in India and supply it to the state-owned oil marketing companies to meet their blending requirements as specified in the biofuel policy.

The company has strong future prospects and expects to grow the business to achieve a total capacity of 1,000 kilo liters per day of ethanol.

#66

Best stocks to buy now / Suryoday Small Finance Bank in...

Last post by Michael Gonsalves - Jul 26, 2022, 07:35 PMDolly Khanna has bought 12,27,986 equity shares or a 1.16 per cent stake in Suryoday Small Finance Bank. Her investment is worth Rs 9.8 crore.

Not much is known about Suryoday Small Finance Bank. It recorded a 21 per cent rise in total deposits to Rs 4,020 crore on a yearly basis, during the first quarter of the fiscal year 2022-23.

Not much is known about Suryoday Small Finance Bank. It recorded a 21 per cent rise in total deposits to Rs 4,020 crore on a yearly basis, during the first quarter of the fiscal year 2022-23.

#67

Best stocks to buy now / Vijay Kedia and Dolly Khanna a...

Last post by Michael Gonsalves - Jul 25, 2022, 07:48 PMVijay Kedia and Dolly Khanna are bullish about Talbros Automotive Components. Vijay Kedia holds 2,80,000 shares (2.27 per cent). Dolly Khanna holds 1,35,215 shares (1.10 per cent). Vijay Kedia's investment is worth Rs 14 crore. Dolly Khanna's investment is worth Rs 6.8 crore. The stock is a steady compounder with 30 per cent year-to-date (YTD) gain. It gave 64 per cent on a YoY basis.

Talbros Automotive Components is an auto component stock. It makes gaskets, forged and machined parts and rubber hoses for two-wheelers; powertrain heat shields, underbody heat shields, suspension parts, exhaust hangers and suspension bushes for four-wheelers ad similar parts for agri machinery and light and heavy commercial vehicles.

Talbros Automotive Components is an auto component stock. It makes gaskets, forged and machined parts and rubber hoses for two-wheelers; powertrain heat shields, underbody heat shields, suspension parts, exhaust hangers and suspension bushes for four-wheelers ad similar parts for agri machinery and light and heavy commercial vehicles.

#68

Guides & Tutorials / Asit Baran Pati Reports profit...

Last post by Michael Gonsalves - May 31, 2022, 12:38 AMAsit Baran Pati has disclosed his profits and gains from options buying. The profit run into several lakhs and crores in various accounts. Have made more than 7-8 times return on 8 figures. Screenshots are 25% of what I have done for today, he said.

https://twitter.com/asitbaran/status/1531174890870829056

https://twitter.com/asitbaran/status/1531174890870829056

#69

Guides & Tutorials / Asit Baran Pati startes mentor...

Last post by Michael Gonsalves - May 22, 2022, 11:23 AMAsit Baran Pati has announced the start of a mentoring session where he will share his intraday and positional trade setups based on Ranking System. This involves giving Buy calls on the stock and Index options. The subscription fee is ₹5,499 for 1 month (inclusive of 18% GST).

https://twitter.com/asitbaran/status/1522483486011293696

https://twitter.com/asitbaran/status/1522483486011293696

#70

Guides & Tutorials / P R Sundar suffers a loss of R...

Last post by Michael Gonsalves - May 22, 2022, 11:17 AMPR Sundar revealed that on 19th May, he was carrying Bullish positions (presumably Put shorts). However, this backfired badly because the markets plunged like a stone because of relentless selling by the FIIs.This caused his to suffer a huge MTM loss of Rs. 1 crore.

"It is the worst day of my trading career," he said in a mournful tone.

He also stated that the huge loss had occurred because he had not paid attention to the position sizing and had made many silly mistakes.

"Even after so many years of experience, have gone wrong in position sizing and made few other silly mistakes, markets have chosen to teach me expensive lesson," he stated.

https://twitter.com/PRSundar64/status/1527452789177085953

"It is the worst day of my trading career," he said in a mournful tone.

He also stated that the huge loss had occurred because he had not paid attention to the position sizing and had made many silly mistakes.

"Even after so many years of experience, have gone wrong in position sizing and made few other silly mistakes, markets have chosen to teach me expensive lesson," he stated.

https://twitter.com/PRSundar64/status/1527452789177085953